Form 14568 E Model VCP Compliance Statement 2023-2026

What is the Form 14568 E Model VCP Compliance Statement

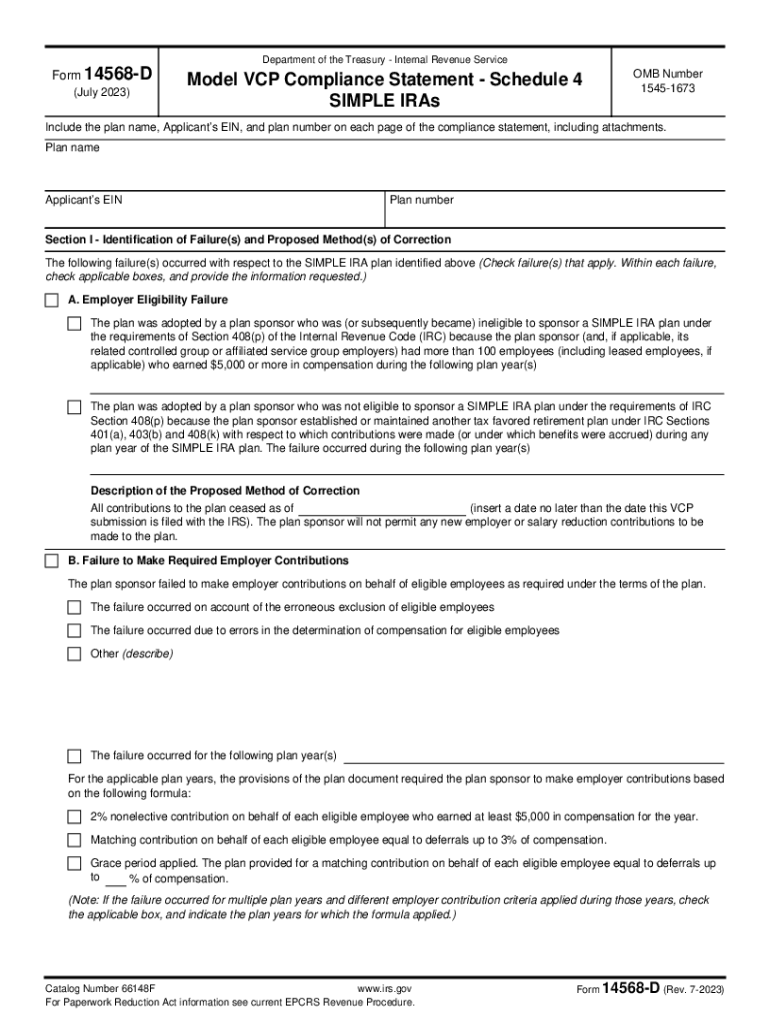

The Form 14568 E Model VCP Compliance Statement is a crucial document for organizations seeking to correct retirement plan compliance failures under the IRS's Voluntary Compliance Program (VCP). This form allows plan sponsors to disclose issues and outline their corrective actions, ensuring that they remain compliant with federal regulations. By utilizing this form, organizations can mitigate potential penalties and maintain the tax-qualified status of their retirement plans.

Steps to complete the Form 14568 E Model VCP Compliance Statement

Completing the Form 14568 E Model VCP Compliance Statement involves several key steps:

- Gather necessary information about the retirement plan, including plan documents and participant data.

- Clearly identify the compliance failures that have occurred, providing detailed explanations for each issue.

- Outline the corrective actions taken or proposed to resolve these failures, ensuring they align with IRS guidelines.

- Review the completed form for accuracy and completeness before submission.

- Submit the form along with any required fees to the IRS for review.

Legal use of the Form 14568 E Model VCP Compliance Statement

The legal use of the Form 14568 E Model VCP Compliance Statement is essential for organizations aiming to rectify compliance issues with their retirement plans. By submitting this form, plan sponsors demonstrate their commitment to adhering to IRS regulations. The form serves as a formal declaration of the compliance failures and the steps taken to correct them, which can be critical in avoiding penalties and maintaining the plan's tax-qualified status.

Filing Deadlines / Important Dates

Timely filing of the Form 14568 E Model VCP Compliance Statement is vital to ensure compliance with IRS regulations. The submission must be made within the specified time frame outlined by the IRS, which typically includes deadlines based on the nature of the compliance issue. Organizations should consult the latest IRS guidelines to confirm current deadlines and ensure their submissions are made promptly to avoid additional penalties.

Examples of using the Form 14568 E Model VCP Compliance Statement

Organizations may utilize the Form 14568 E Model VCP Compliance Statement in various scenarios, such as:

- When a retirement plan fails to operate in accordance with its written terms.

- If there are discrepancies in contribution calculations or eligibility requirements.

- When late contributions are made to the plan, impacting compliance.

In each case, the form allows the organization to disclose the issue and outline corrective measures taken to rectify the situation.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 14568 E Model VCP Compliance Statement. These guidelines include instructions on how to properly disclose compliance failures, the types of corrective actions that are acceptable, and the necessary documentation to accompany the submission. Adhering to these guidelines is crucial for ensuring that the submission is accepted and that the organization can benefit from the VCP.

Quick guide on how to complete form 14568 e model vcp compliance statement

Complete Form 14568 E Model VCP Compliance Statement effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and without delays. Handle Form 14568 E Model VCP Compliance Statement on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 14568 E Model VCP Compliance Statement with ease

- Locate Form 14568 E Model VCP Compliance Statement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 14568 E Model VCP Compliance Statement while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14568 e model vcp compliance statement

Create this form in 5 minutes!

How to create an eSignature for the form 14568 e model vcp compliance statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is d schedule 4 in airSlate SignNow?

d schedule 4 refers to the document management features available in airSlate SignNow that allow users to easily send and eSign important documents. This feature streamlines the signing process, making it more efficient and secure for all parties involved.

-

How does airSlate SignNow enhance the d schedule 4 process?

airSlate SignNow enhances the d schedule 4 process by providing a user-friendly interface that simplifies document preparation and signing. Users can easily customize templates, track document statuses, and utilize advanced security features to ensure compliance.

-

What pricing plans are available for d schedule 4 in airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs concerning d schedule 4. These plans are designed to be cost-effective, providing powerful features that help businesses optimize their document workflows without breaking the bank.

-

Can I integrate d schedule 4 with other software?

Yes, airSlate SignNow allows seamless integration of d schedule 4 with a variety of other software tools and platforms. This enables users to automate workflows and enhance productivity by linking their existing systems with the eSignature solution.

-

What are the benefits of using d schedule 4 in airSlate SignNow?

Using d schedule 4 in airSlate SignNow offers numerous benefits, including improved efficiency, reduced turnaround times, and increased security for sensitive documents. Businesses can streamline their operations and save valuable time by utilizing the platform's intuitive features.

-

Is airSlate SignNow suitable for all types of businesses using d schedule 4?

Absolutely! airSlate SignNow is designed to be flexible and scalable, making it suitable for businesses of all sizes that require document eSigning with d schedule 4. Whether you're a small startup or a large organization, the platform adapts to your unique needs.

-

How secure is the d schedule 4 feature in airSlate SignNow?

The d schedule 4 feature in airSlate SignNow is equipped with robust security measures, including encryption and compliance with industry standards. This ensures that all documents remain confidential and secure throughout the signing process.

Get more for Form 14568 E Model VCP Compliance Statement

- Rbl bank ad code form

- Dr 501t pasco county property appraiser pascogovcom form

- Print tax forms 1040

- United healthcare community plan nj prior authorization form

- Pre employment health declaration form nsw

- Aimsweb number identification benchmark assessment 1 kindergarten fall form

- Fax 404 378 5054 form

- Month to month tenancy agreement template form

Find out other Form 14568 E Model VCP Compliance Statement

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free