Form W 2c Rev August Corrected Wage and Tax Statement 2023-2026

What is the Form W-2c Rev August Corrected Wage And Tax Statement

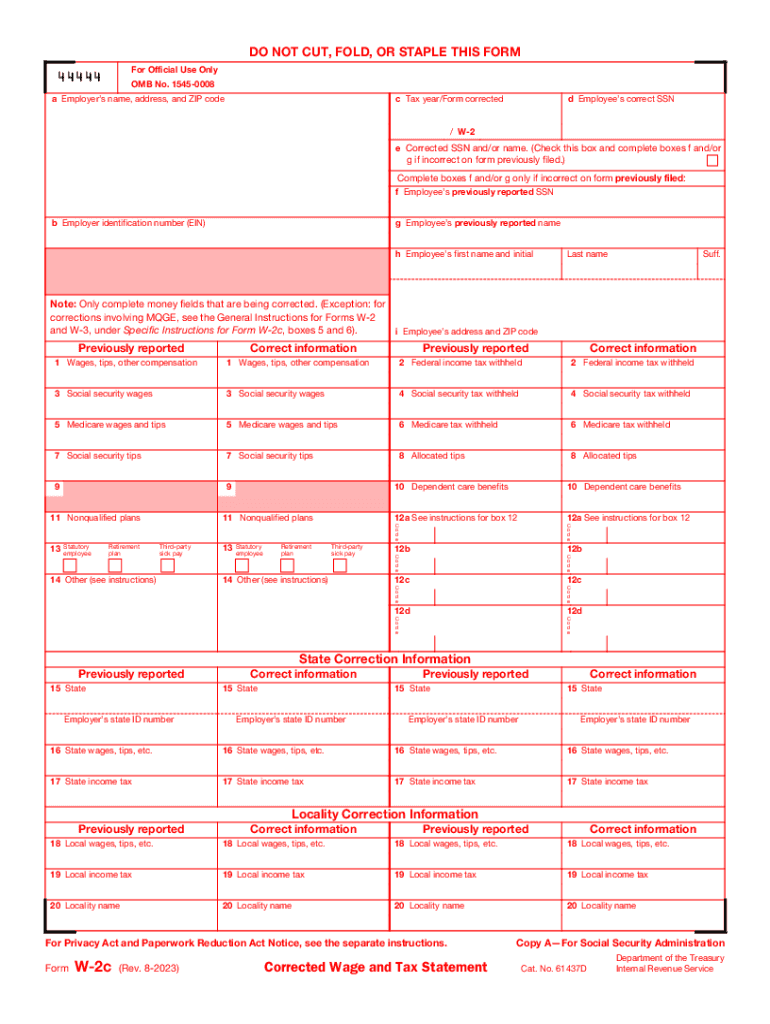

The Form W-2c, officially known as the Corrected Wage and Tax Statement, is utilized to correct errors on a previously issued Form W-2. This form is essential for both employers and employees, as it ensures that the correct wage and tax information is reported to the Internal Revenue Service (IRS). The W-2c includes details such as corrected wages, tips, and other compensation, along with the corrected amounts of federal, state, and local taxes withheld. It is crucial for maintaining accurate tax records and ensuring compliance with tax regulations.

How to use the Form W-2c Rev August Corrected Wage And Tax Statement

Using the Form W-2c involves several steps to ensure that the corrections are accurately reflected. First, obtain the W-2c form from the IRS website or through your employer. Fill in the required fields, including the employee's name, Social Security number, and the corrected amounts. Once completed, submit the W-2c to the IRS and provide a copy to the employee. It is important to keep a copy for your records. The form can be filed electronically or via mail, depending on the preference and the volume of corrections being made.

Steps to complete the Form W-2c Rev August Corrected Wage And Tax Statement

Completing the Form W-2c requires attention to detail. Follow these steps:

- Obtain the correct version of the W-2c form.

- Fill in the employee's details, including name and Social Security number.

- Enter the corrected amounts in the appropriate boxes, ensuring accuracy.

- Indicate the reason for the correction in the designated section.

- Review the form for any errors before submission.

- Submit the form to the IRS and provide a copy to the employee.

Legal use of the Form W-2c Rev August Corrected Wage And Tax Statement

The legal use of the Form W-2c is governed by IRS regulations. It is used to rectify discrepancies in wage and tax reporting, which is essential for compliance with federal tax laws. Employers must issue a W-2c when they discover errors in previously submitted W-2 forms, ensuring that employees have accurate information for their tax filings. Failure to issue a W-2c when necessary can lead to penalties for both the employer and the employee, highlighting the importance of timely and accurate corrections.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-2c are critical for ensuring compliance with IRS regulations. Generally, the W-2c must be filed as soon as an error is discovered, but it is recommended to do so before the tax filing deadline to avoid complications. For the tax year 2023, the deadline for submitting corrections is typically January 31 of the following year. Employers should also be aware of any state-specific deadlines that may apply.

Examples of using the Form W-2c Rev August Corrected Wage And Tax Statement

There are several scenarios where the Form W-2c may be necessary:

- If an employee's wages were reported incorrectly due to a clerical error.

- When an employee's name or Social Security number was misreported.

- If there were mistakes in the amount of federal or state taxes withheld.

In each case, issuing a W-2c helps to correct the record and ensures that the employee's tax return accurately reflects their earnings and tax liabilities.

Quick guide on how to complete form w 2c rev august corrected wage and tax statement

Complete Form W 2c Rev August Corrected Wage And Tax Statement effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Form W 2c Rev August Corrected Wage And Tax Statement on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign Form W 2c Rev August Corrected Wage And Tax Statement with ease

- Find Form W 2c Rev August Corrected Wage And Tax Statement and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device of your choice. Modify and electronically sign Form W 2c Rev August Corrected Wage And Tax Statement and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 2c rev august corrected wage and tax statement

Create this form in 5 minutes!

How to create an eSignature for the form w 2c rev august corrected wage and tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mium w2candw3c, and how does it work?

Mium w2candw3c refers to the digital forms used for W-2 and W-3 tax reporting. With airSlate SignNow, you can easily create, send, and eSign these forms, ensuring a smooth and compliant filing process. This platform simplifies document management, making it accessible for businesses of all sizes.

-

How can airSlate SignNow improve my mium w2candw3c workflow?

AirSlate SignNow streamlines your mium w2candw3c workflow by automating the document creation and signing processes. You can send forms directly to employees or contractors for eSignature, reducing turnaround time and enhancing efficiency. Additionally, its user-friendly interface helps minimize training time.

-

What are the pricing options for using airSlate SignNow for mium w2candw3c?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, including options for organizations processing mium w2candw3c forms. You can choose from monthly or annual subscriptions, which include various features, such as unlimited document uploads and eSignatures. This ensures you get the best value for your investment.

-

Are there any key features in airSlate SignNow for mium w2candw3c?

Yes, airSlate SignNow provides essential features for managing mium w2candw3c documents, including customizable templates, automated workflows, and real-time tracking of document status. Its collaboration tools enable multiple users to work on forms simultaneously, enhancing productivity and teamwork.

-

What integrations does airSlate SignNow offer for mium w2candw3c?

AirSlate SignNow integrates seamlessly with various business applications, enhancing the management of mium w2candw3c forms. You can connect it with tools like Google Drive, Dropbox, and CRM systems, ensuring your documents are easily accessible and shareable. This integration capability simplifies your workflows signNowly.

-

How secure is airSlate SignNow for handling mium w2candw3c?

Security is a priority for airSlate SignNow when managing mium w2candw3c forms. The platform ensures that all documents are encrypted during transmission and storage, complying with industry standards for data protection. Additionally, user authentication features help safeguard sensitive information.

-

Can airSlate SignNow assist with compliance regarding mium w2candw3c?

Absolutely, airSlate SignNow helps businesses maintain compliance with IRS regulations related to mium w2candw3c forms. The platform provides guidance and templates that are aligned with current tax laws, making it easier to ensure that your documentation meets required standards. This reduces the risk of errors during tax season.

Get more for Form W 2c Rev August Corrected Wage And Tax Statement

Find out other Form W 2c Rev August Corrected Wage And Tax Statement

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter