Form it 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT for START UP NY Tax Year 2022

What is the Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

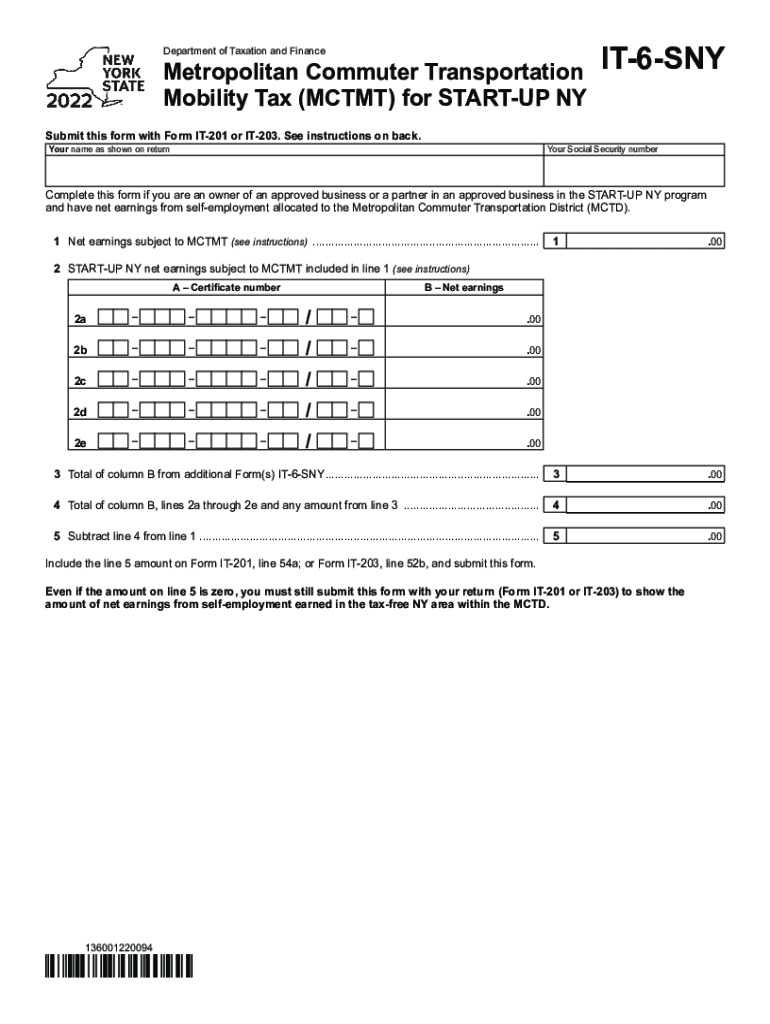

The Form IT 6 SNY is a tax form used in New York State for the Metropolitan Commuter Transportation Mobility Tax (MCTMT). This form is specifically designed for businesses participating in the START-UP NY program, which aims to promote economic growth by providing tax benefits to new businesses. The MCTMT applies to employers and self-employed individuals who engage in business activities within the Metropolitan Commuter Transportation District, which includes New York City and surrounding counties. Understanding the purpose of this form is crucial for compliance and to take advantage of the tax incentives offered under the START-UP NY initiative.

Steps to complete the Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

Completing the Form IT 6 SNY involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, employee information, and any relevant financial data. Next, fill out the form by providing accurate figures for your gross payroll and any applicable deductions. It is essential to review the form carefully to avoid errors that could lead to penalties. After completing the form, sign it electronically or in print, depending on your submission method. Finally, submit the form by the specified deadline to ensure compliance with New York State tax regulations.

Legal use of the Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

The legal use of the Form IT 6 SNY is governed by New York State tax laws. To be considered valid, the form must be completed accurately and submitted by the required deadlines. Electronic signatures are legally binding under the ESIGN Act, provided that the signer intends to sign the document and the signature meets the necessary legal standards. It is important to maintain a record of the submitted form and any supporting documentation, as this may be required for audits or inquiries by tax authorities.

How to obtain the Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

The Form IT 6 SNY can be obtained directly from the New York State Department of Taxation and Finance website. It is available in both digital and printable formats, allowing users to choose the method that best suits their needs. Additionally, tax professionals and accountants may provide the form as part of their services. Ensure that you are using the most current version of the form to comply with any recent updates or changes in tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 6 SNY are critical to avoid penalties and interest charges. Typically, the form must be submitted annually, with specific due dates depending on your business's tax year. For most businesses, the deadline aligns with the annual tax return due date. It is advisable to check the New York State Department of Taxation and Finance for any updates or changes to filing deadlines, as well as to confirm any quarterly payment requirements that may apply to your business.

Key elements of the Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

The Form IT 6 SNY includes several key elements that must be completed for proper filing. These elements typically include the business name, employer identification number (EIN), total gross payroll, and any applicable deductions. Additionally, the form may require information about the business's location and the number of employees. Accurate reporting of these elements is essential for determining the correct tax liability and ensuring compliance with New York State tax laws.

Quick guide on how to complete form it 6 sny metropolitan commuter transportation mobility tax mctmt for start up ny tax year

Complete Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year effortlessly

- Obtain Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 6 sny metropolitan commuter transportation mobility tax mctmt for start up ny tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 6 sny metropolitan commuter transportation mobility tax mctmt for start up ny tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT for START UP NY Tax Year?

Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT for START UP NY Tax Year is a form used by certain businesses to report their liability under the MCTMT. This tax applies to employers in the Metropolitan Commuter Transportation District and is crucial for compliance with state tax regulations. Understanding and filing this form correctly can help businesses avoid penalties and ensure they benefit from their START UP NY status.

-

How can airSlate SignNow help with Form IT 6 SNY MCTMT filings?

airSlate SignNow simplifies the process of preparing and filing Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year. Our platform allows users to upload relevant documents, eSign them electronically, and send them directly to tax authorities, reducing paperwork and ensuring accuracy. This can save time and help ensure compliance with tax obligations.

-

What features does airSlate SignNow offer for managing Form IT 6 SNY MCTMT?

airSlate SignNow provides an intuitive interface that makes it easy for users to manage Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year. Key features include customizable templates, secure eSigning, document tracking, and storage capabilities. These features ensure that users can manage their documents efficiently and with confidence.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. The costs vary based on features and the number of users, but the platform remains a cost-effective solution for managing Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year. You can choose a plan that best suits your business requirements.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides your business with several benefits, including enhanced efficiency in document management and improved compliance with tax regulations. Specifically, for Form IT 6 SNY MCTMT, you can easily track the submission process and ensure timely filing. Additionally, the electronic signing feature reduces the time taken to gather signatures, streamlining your workflow.

-

Can airSlate SignNow integrate with other software for payroll and tax management?

Yes, airSlate SignNow can integrate seamlessly with various payroll and tax management software solutions. This integration facilitates the automatic transfer of necessary data when completing Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT for START UP NY Tax Year. This capability enhances efficiency and data accuracy across your business operations.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. The platform utilizes encryption, secure access controls, and compliance with data protection regulations to safeguard your sensitive documents, including Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year. You can trust that your information is protected while stored and during the eSigning process.

Get more for Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

- Reimbursement form b 2013r1 bajaj allianz

- People call me crazy form

- Calocus manual form

- Healthcare provider screening form rsa al

- Fasting contract form

- Temp event vendor app 0619 no checkboxes for pdf form docx

- Visitor confidentiality agreement template form

- Voetstoots car sale agreement template form

Find out other Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy