Form it 6 SNY 2016

What is the Form IT 6 SNY

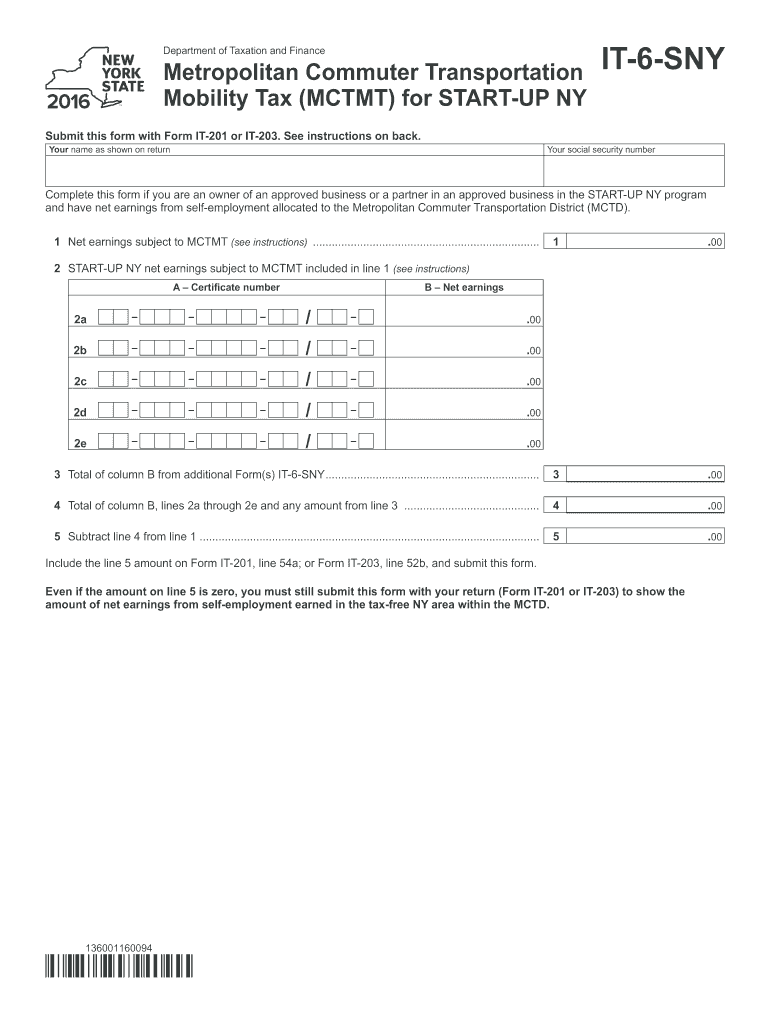

The Form IT 6 SNY is a specific tax form used primarily for reporting income and claiming deductions related to self-employment in the United States. This form is essential for individuals who earn income through freelance work, contract jobs, or other self-employed activities. It allows taxpayers to accurately report their net earnings and calculate the appropriate self-employment tax owed to the Internal Revenue Service (IRS).

Steps to complete the Form IT 6 SNY

Completing the Form IT 6 SNY involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all relevant financial documents, including income statements and records of allowable deductions. Next, fill out the personal information section, including your name, address, and Social Security number. After that, report your total income from self-employment and list any allowable deductions, such as business expenses. Finally, calculate your net earnings and the self-employment tax, ensuring to double-check your entries for accuracy before submission.

Legal use of the Form IT 6 SNY

The legal use of the Form IT 6 SNY hinges on compliance with IRS guidelines and regulations. To be valid, the form must be completed accurately and submitted by the designated deadlines. The information provided on the form must reflect true and correct financial data, as any discrepancies may lead to penalties or audits. Additionally, the form must be signed and dated to affirm its authenticity, ensuring that it meets the legal requirements for tax documentation.

IRS Guidelines

IRS guidelines for the Form IT 6 SNY outline the requirements for proper completion and submission. Taxpayers must adhere to the specific instructions provided by the IRS, which detail how to report income, claim deductions, and calculate taxes owed. It is crucial to stay updated on any changes to tax laws or regulations that may affect the filing process. Following these guidelines helps ensure that the form is legally binding and accepted by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 6 SNY are critical for compliance and avoiding penalties. Typically, the form must be submitted by April fifteenth of the tax year, though extensions may be available under certain circumstances. It is important to keep track of any changes to these deadlines, as they can vary based on specific tax situations or legislative updates. Marking these dates on a calendar can help ensure timely submission.

Required Documents

When completing the Form IT 6 SNY, several documents are required to support the information reported. These may include income statements, such as 1099 forms from clients, receipts for business expenses, and records of any allowable deductions. Having these documents organized and accessible will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete form it 6 sny

Complete Form IT 6 SNY effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely retain it online. airSlate SignNow equips you with all the necessary resources to create, modify, and electronically sign your documents promptly without delays. Manage Form IT 6 SNY on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest method to modify and eSign Form IT 6 SNY seamlessly

- Find Form IT 6 SNY and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that task.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow addresses all your requirements in document management within just a few clicks from any device you prefer. Edit and eSign Form IT 6 SNY and ensure effective communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 6 sny

Create this form in 5 minutes!

People also ask

-

What is the form tmt and how does it work?

The form tmt is a powerful document automation tool that allows users to create, send, and eSign documents effortlessly. By leveraging airSlate SignNow's intuitive platform, you can streamline your workflow, ensuring that forms are completed quickly and accurately.

-

Are there any costs associated with using the form tmt?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The form tmt is included in these plans, which are designed to be cost-effective while providing users with comprehensive features and benefits.

-

What features does the form tmt offer?

The form tmt offers numerous features, including customizable templates, automated workflows, and secure eSignature capabilities. These features enhance user experience by simplifying the document management process and ensuring compliance.

-

How can the form tmt benefit my business?

By implementing the form tmt, your business can signNowly improve efficiency and reduce turnaround times on document signing. The streamlined processes allow for quicker decision-making and enhanced productivity, ultimately benefiting your bottom line.

-

Can I integrate the form tmt with other applications?

Absolutely! The form tmt seamlessly integrates with a variety of third-party applications such as CRM systems, cloud storage platforms, and productivity tools. This integration capability empowers you to maintain a cohesive workflow across different tools your team uses.

-

Is the form tmt suitable for all types of businesses?

Yes, the form tmt is versatile and can be utilized by businesses of all sizes and industries. Whether you're a startup or a large enterprise, airSlate SignNow’s solution can be tailored to meet your specific document handling needs.

-

How secure is the form tmt for sensitive documents?

The form tmt prioritizes security with advanced encryption protocols and compliance with major regulations. This ensures that your sensitive documents are protected throughout the eSignature process, giving you peace of mind.

Get more for Form IT 6 SNY

- Inbetriebsetzungsauftrag westnetz form

- Formwork inspection checklist pdf

- Papa nicholas points form

- Coach evaluation form

- Sports vocabulary word search puzzle form

- Hot work template form

- Jiit medical certificate form

- Home building notice of registration of equivalent occupation use this form to register for mutual recognition in home building

Find out other Form IT 6 SNY

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form