Fidelity 529 Plan Rollover Form

What is the Fidelity 529 Plan Rollover Form

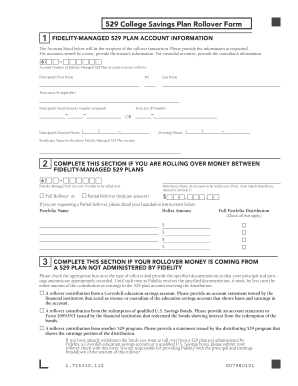

The Fidelity 529 Plan Rollover Form is a document used to transfer funds from one 529 college savings plan to another. This form allows account holders to move their investments without incurring tax penalties, provided that the funds are used for qualified education expenses. The rollover process is essential for individuals looking to optimize their savings strategy or switch to a plan that better suits their needs. Understanding the purpose of this form is crucial for effective financial planning for education.

How to use the Fidelity 529 Plan Rollover Form

Using the Fidelity 529 Plan Rollover Form involves several key steps. First, ensure you have the correct form, which can typically be obtained from Fidelity's website or customer service. Next, fill out the required information, including your personal details and the specifics of both the current and new 529 plans. It is important to verify that all information is accurate to avoid delays in processing. Finally, submit the completed form according to the instructions provided, either online or by mail, to initiate the rollover process.

Steps to complete the Fidelity 529 Plan Rollover Form

Completing the Fidelity 529 Plan Rollover Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary information about your current and new 529 plans, including account numbers and plan details.

- Access the Fidelity 529 Plan Rollover Form from the official Fidelity website or through their customer service.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the existing 529 plan, including the account number and the name of the financial institution.

- Indicate the new 529 plan details where the funds will be transferred.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, ensuring you retain a copy for your records.

Legal use of the Fidelity 529 Plan Rollover Form

The legal use of the Fidelity 529 Plan Rollover Form is governed by specific regulations that ensure the transfer of funds is compliant with tax laws. To be considered valid, the rollover must occur within a specified timeframe, typically within sixty days of withdrawal from the original plan. Additionally, the rollover must be executed for qualified education expenses to avoid tax penalties. Understanding these legal requirements helps account holders make informed decisions regarding their educational savings.

Required Documents

When completing the Fidelity 529 Plan Rollover Form, certain documents may be required to facilitate the process. These typically include:

- A copy of the current 529 plan statement.

- Identification documents, such as a driver's license or Social Security card.

- Any additional forms required by the new 529 plan provider.

Having these documents ready can expedite the rollover process and ensure compliance with all necessary regulations.

Form Submission Methods

The Fidelity 529 Plan Rollover Form can be submitted through various methods, providing flexibility for account holders. Common submission methods include:

- Online submission through the Fidelity website, which may require creating an account or logging in.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at a Fidelity branch, if available, for those who prefer direct assistance.

Choosing the appropriate submission method can depend on personal preference and the urgency of the rollover.

Quick guide on how to complete fidelity 529 plan rollover form

Prepare [SKS] effortlessly on any device

Online document handling has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searching, and errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Fidelity 529 Plan Rollover Form

Create this form in 5 minutes!

How to create an eSignature for the fidelity 529 plan rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fidelity 529 Plan Rollover Form?

The Fidelity 529 Plan Rollover Form is a document used to transfer assets from one 529 college savings plan to another. This form streamlines the process, ensuring that your funds are transferred efficiently and securely. It's ideal for those looking to change providers while maximizing their educational savings.

-

How do I complete the Fidelity 529 Plan Rollover Form?

To complete the Fidelity 529 Plan Rollover Form, you need to provide details about your current plan and the new plan you wish to roll over to. Ensure that you have all necessary account information at hand. Once filled out, submit the form as directed, typically to the new plan provider.

-

Is there a fee associated with the Fidelity 529 Plan Rollover Form?

While the Fidelity 529 Plan Rollover Form itself may not have a direct fee, it's essential to check with both your current and new 529 plan providers for any potential charges. Some plans may have account maintenance fees or penalties for transferring funds. Always verify before initiating a rollover.

-

What are the benefits of using the Fidelity 529 Plan Rollover Form?

Utilizing the Fidelity 529 Plan Rollover Form allows you to consolidate your educational savings under a plan that may offer better investment options or lower fees. It simplifies the process of transferring funds, ensuring continued growth of your savings. Additionally, it helps you maintain flexibility in your college savings strategy.

-

How long does the Fidelity 529 Plan Rollover process take?

The duration of the Fidelity 529 Plan Rollover process can vary but typically takes 2-4 weeks. This timeframe allows for processing, verifying your information, and transferring funds between plans. It's important to follow up with both providers to ensure timely completion.

-

Can I roll over a Fidelity 529 Plan to another 529 plan?

Yes, you can roll over a Fidelity 529 Plan to another 529 plan using the Fidelity 529 Plan Rollover Form. This process allows you to move your funds into a plan that may better suit your educational savings goals. Just make sure you follow the guidelines to avoid any tax penalties.

-

Does airSlate SignNow support the digital completion of the Fidelity 529 Plan Rollover Form?

Yes, airSlate SignNow offers a platform that allows you to electronically sign and complete the Fidelity 529 Plan Rollover Form with ease. With its user-friendly interface, you can streamline your submission process while ensuring that all your documents are securely stored. This feature enhances convenience for busy parents managing their college savings.

Get more for Fidelity 529 Plan Rollover Form

Find out other Fidelity 529 Plan Rollover Form

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure