Valic Retirement ServiceBetter Business Bureau Profile 2022-2026

Understanding Annuity Cash

Annuity cash refers to the liquid value of an annuity contract, which can be accessed through withdrawals or cash distributions. Annuities are financial products sold by insurance companies designed to provide a steady income stream, often during retirement. The cash value can be influenced by various factors, including the type of annuity, the length of time it has been held, and any applicable fees or penalties for early withdrawal.

Eligibility Criteria for Annuity Cash Withdrawals

To access annuity cash, policyholders typically need to meet specific eligibility criteria. These may include:

- Age requirements, often set at fifty-nine and a half years or older to avoid penalties.

- Minimum holding period, which varies by contract.

- Compliance with any contractual obligations, such as maintaining the annuity for a specified duration.

It is essential to review the terms of the annuity contract to understand the specific eligibility requirements for cash withdrawals.

Required Documents for Cash Distribution

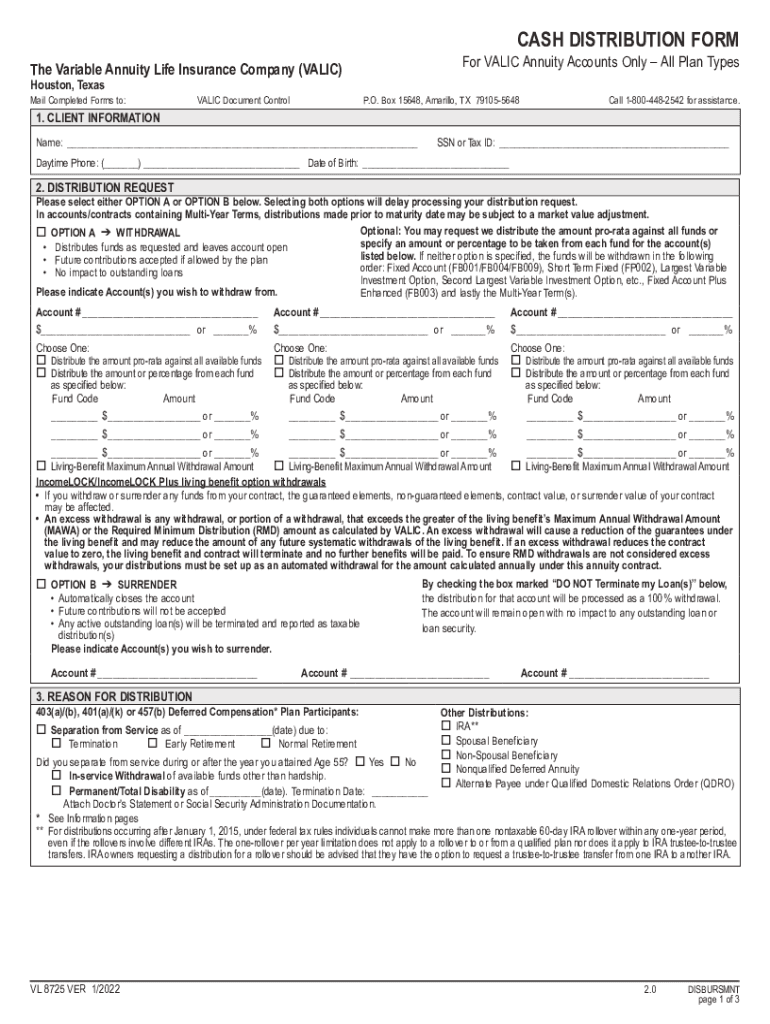

When requesting annuity cash, certain documents are typically required to process the transaction efficiently. Commonly needed documents include:

- The annuity contract or policy number.

- A completed cash distribution form, such as the Valic cash distribution form.

- Identification documents, such as a government-issued ID.

Gathering these documents in advance can help expedite the cash distribution process.

Steps to Complete the Cash Distribution Process

Accessing annuity cash generally involves a series of steps to ensure compliance and proper processing. The typical process includes:

- Reviewing your annuity contract for specific terms regarding cash distributions.

- Completing the required cash distribution form accurately.

- Submitting the form along with any required documents to the insurance company.

- Awaiting confirmation and processing of the request, which may take several business days.

Following these steps can help ensure a smooth experience when accessing your annuity cash.

IRS Guidelines on Annuity Cash Withdrawals

The Internal Revenue Service (IRS) has specific guidelines regarding the taxation of annuity cash withdrawals. Generally, any earnings withdrawn from an annuity are subject to income tax. If withdrawals occur before the age of fifty-nine and a half, an additional ten percent penalty may apply. Understanding these guidelines is crucial for effective financial planning and avoiding unexpected tax liabilities.

Penalties for Non-Compliance with Annuity Cash Rules

Failure to comply with the rules governing annuity cash withdrawals can result in significant penalties. Common penalties include:

- Early withdrawal penalties, typically ten percent for distributions taken before age fifty-nine and a half.

- Tax implications on any earnings withdrawn, which may be taxed as ordinary income.

Awareness of these potential penalties can help individuals make informed decisions regarding their annuity cash options.

Quick guide on how to complete valic retirement servicebetter business bureau profile

Complete Valic Retirement ServiceBetter Business Bureau Profile effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Valic Retirement ServiceBetter Business Bureau Profile on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Valic Retirement ServiceBetter Business Bureau Profile effortlessly

- Find Valic Retirement ServiceBetter Business Bureau Profile and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select your preferred method for delivering your form: by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require you to print new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you choose. Modify and electronically sign Valic Retirement ServiceBetter Business Bureau Profile and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct valic retirement servicebetter business bureau profile

Create this form in 5 minutes!

How to create an eSignature for the valic retirement servicebetter business bureau profile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is valic life insurance?

Valic life insurance is a type of insurance policy offered by Valic, designed to provide financial protection for your loved ones in the event of your passing. It helps ensure that your beneficiaries receive a death benefit, which can be used to cover living expenses, debts, or other financial obligations. Understanding valic life insurance is crucial for anyone looking to secure their family's future.

-

What are the different types of valic life insurance available?

Valic life insurance offers several options, including term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and cash value accumulation. Choosing the right type of valic life insurance depends on your financial goals and family needs.

-

How much does valic life insurance cost?

The cost of valic life insurance varies based on several factors, including your age, health, and the type of policy you choose. Generally, term life insurance tends to be more affordable than whole life insurance. To get an accurate quote for valic life insurance, it's best to consult with a Valic representative.

-

What are the benefits of valic life insurance?

Valic life insurance provides peace of mind, knowing that your loved ones will be financially secure if something happens to you. It can also offer tax advantages, as the death benefit is generally tax-free for beneficiaries. Additionally, some valic life insurance policies may include optional riders that enhance coverage.

-

Can I customize my valic life insurance policy?

Yes, many valic life insurance policies allow for customization, enabling you to tailor your coverage based on your specific needs. You can often add riders for additional protection, such as accidental death or disability coverage. Customization helps ensure that your policy aligns with your financial objectives.

-

How does valic life insurance integrate with other financial products?

Valic life insurance can seamlessly integrate with other financial products, such as retirement accounts and investment options. This integration allows you to create a comprehensive financial plan that supports your long-term goals. Combining valic life insurance with other products can enhance your overall financial security.

-

How do I file a claim for valic life insurance?

To file a claim for valic life insurance, beneficiaries should contact Valic's customer service or visit their website for detailed instructions. The process typically requires submitting necessary documentation, such as a death certificate and policy details. Valic aims to make the claims process as straightforward as possible for beneficiaries.

Get more for Valic Retirement ServiceBetter Business Bureau Profile

Find out other Valic Retirement ServiceBetter Business Bureau Profile

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease