Underwriting Checklist Template 2014

What is the Underwriting Checklist Template

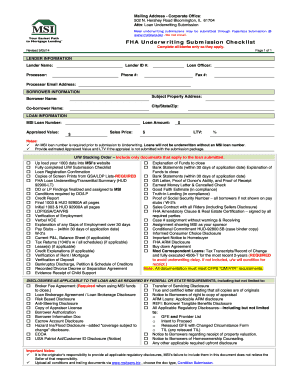

The underwriting checklist template is a structured document used in the mortgage underwriting process. It serves as a comprehensive guide for underwriters to evaluate a borrower's financial profile and determine their eligibility for a loan. This template typically includes sections for documenting essential information such as income verification, credit history, debt-to-income ratio, and asset assessment. By utilizing this template, lenders can ensure they consider all necessary factors before making a lending decision.

How to use the Underwriting Checklist Template

Using the underwriting checklist template involves several straightforward steps. First, gather all relevant financial documents from the borrower, including pay stubs, tax returns, and bank statements. Next, systematically fill out the checklist, ensuring each section is completed with accurate and up-to-date information. After completing the template, review it to confirm that all required documents are attached and that the information aligns with the lender's guidelines. This organized approach helps streamline the underwriting process and reduces the likelihood of errors.

Steps to complete the Underwriting Checklist Template

Completing the underwriting checklist template requires careful attention to detail. Here are the key steps:

- Collect necessary documents from the borrower.

- Fill in personal information, including name, address, and Social Security number.

- Document income sources and amounts, ensuring to include all relevant pay stubs and tax documents.

- Assess the borrower’s credit history by obtaining a credit report.

- Calculate the debt-to-income ratio using the provided formula.

- List all assets, including savings accounts, investments, and property.

- Review the completed checklist for accuracy and completeness.

Legal use of the Underwriting Checklist Template

The legal use of the underwriting checklist template is crucial for ensuring compliance with federal and state regulations. When completed correctly, this template can serve as a valid record of the underwriting process. It is essential that all information is accurate and that the borrower has consented to the use of their financial data. Additionally, lenders must adhere to privacy laws and regulations, such as the Fair Credit Reporting Act, when handling sensitive information. Proper legal use helps protect both the lender and the borrower throughout the mortgage process.

Key elements of the Underwriting Checklist Template

Several key elements are integral to the underwriting checklist template. These include:

- Borrower Information: Personal details such as name, address, and contact information.

- Income Verification: Documentation of all income sources, including employment and additional earnings.

- Credit History: A summary of the borrower’s credit report and score.

- Debt-to-Income Ratio: A calculation that compares the borrower’s monthly debt payments to their gross monthly income.

- Asset Assessment: A detailed list of the borrower’s assets, including cash reserves and property holdings.

Examples of using the Underwriting Checklist Template

Examples of using the underwriting checklist template can illustrate its practical application in various scenarios. For instance, a first-time homebuyer may use the template to organize their financial documents before applying for a mortgage. Alternatively, a lender might use the checklist to ensure that all required information is collected before submitting a loan application for approval. These examples highlight the template’s versatility in facilitating efficient and thorough underwriting processes.

Quick guide on how to complete underwriting checklist template

Effortlessly prepare Underwriting Checklist Template on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly option to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Manage Underwriting Checklist Template on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and electronically sign Underwriting Checklist Template with ease

- Find Underwriting Checklist Template and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or mask sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Underwriting Checklist Template and ensure effective communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct underwriting checklist template

Create this form in 5 minutes!

How to create an eSignature for the underwriting checklist template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the three C's of traditional home mortgage underwriting?

Traditional home mortgage underwriting is said to rest on three elements: the three C's, which are character, capacity, and collateral. These components help lenders evaluate a borrower's creditworthiness and ability to repay the loan. Understanding these elements is key for anyone seeking a mortgage.

-

What elements are not included in the three C's of mortgage underwriting?

The three C's of traditional home mortgage underwriting include character, capacity, and collateral. Any factors outside these elements, such as credit score or lender policies, do not form part of this foundational approach. Thus, traditional home mortgage underwriting is said to rest on three elements the three C's, the three C's include all of the following except external factors.

-

How does airSlate SignNow simplify the document signing process for mortgage applications?

airSlate SignNow streamlines the document signing process by allowing users to easily send, eSign, and manage documents online. This efficient solution reduces the turnaround time for mortgage applications. By facilitating seamless communication and documentation, airSlate SignNow enhances the mortgage underwriting experience.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs and budgets. From basic document signing features to advanced integrations, you can find a plan suited for your specific requirements. This cost-effective solution ensures that businesses can manage their documentation efficiently without breaking the bank.

-

Which integrations does airSlate SignNow support?

airSlate SignNow supports a wide range of integrations with popular business tools and platforms, enhancing its versatility. You can connect it with CRM systems, cloud storage, and productivity tools to streamline your workflow. These integrations can signNowly benefit companies in the mortgage sector where collaboration is essential.

-

What benefits does airSlate SignNow provide for mortgage professionals?

airSlate SignNow offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Mortgage professionals can quickly send and receive signed documents, minimizing delays in the underwriting process. This improved workflow ultimately leads to better customer satisfaction and faster loan approvals.

-

Is airSlate SignNow secure for handling sensitive mortgage documents?

Yes, airSlate SignNow prioritizes security by implementing advanced encryption and compliance features. This ensures that sensitive mortgage documents are protected throughout the signing process. Users can have peace of mind knowing that their information is safeguarded while leveraging traditional home mortgage underwriting practices.

Get more for Underwriting Checklist Template

- Application for crime victim compensation state of iowa iowa form

- Openup iowa form

- Office of state examiner of the louisiana municipal ose louisiana form

- Michigan department of state out of state resident duplicate michigan form

- Eagle feather request form 2010

- 3 200 3 form

- Ci sammamish wa usfilesdocument7444 pdf the form

- Service provider list sample form

Find out other Underwriting Checklist Template

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free