Healthcare Line of Credit Form

What is the Healthcare Line Of Credit

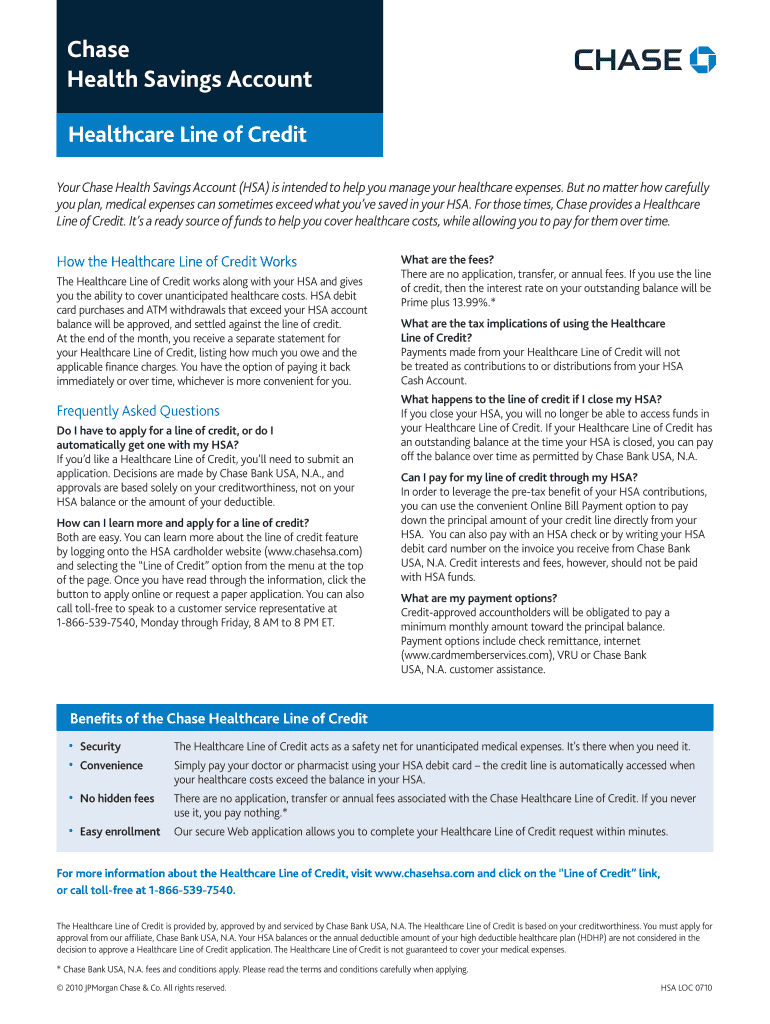

The Healthcare Line of Credit is a financial product designed specifically for healthcare providers and businesses. It allows them to access funds quickly to cover operational expenses, unexpected costs, or to invest in growth opportunities. This type of credit line offers flexibility, enabling healthcare entities to draw from it as needed, similar to a credit card, but typically with lower interest rates. It is particularly beneficial for managing cash flow, especially during periods of fluctuating patient volumes or delayed reimbursements from insurance companies.

How to Obtain the Healthcare Line Of Credit

To obtain a Healthcare Line of Credit, businesses typically follow a structured application process. First, they should assess their financial needs and determine the amount of credit required. Next, they gather necessary documentation, which may include financial statements, tax returns, and business plans. After that, they can approach lenders, such as banks or credit unions, that offer specialized healthcare financing. The application will involve a review of the business's creditworthiness, financial health, and operational history. Approval times can vary based on the lender and the completeness of the application.

Key Elements of the Healthcare Line Of Credit

Several key elements define the Healthcare Line of Credit. These include:

- Credit Limit: This is the maximum amount that can be borrowed, determined by the lender based on the business's financial profile.

- Interest Rates: Typically lower than traditional loans, interest rates can vary based on the lender and the applicant's creditworthiness.

- Repayment Terms: These terms outline how and when the borrowed amount must be repaid, often including flexible payment options.

- Draw Period: This is the time frame during which the business can withdraw funds from the line of credit.

- Fees: Some lenders may charge maintenance fees or transaction fees for accessing funds.

Steps to Complete the Healthcare Line Of Credit

Completing the process for a Healthcare Line of Credit involves several steps:

- Evaluate Financial Needs: Determine how much credit is necessary based on operational costs and potential investments.

- Research Lenders: Identify banks or financial institutions that specialize in healthcare financing.

- Prepare Documentation: Gather all required documents, including financial statements and business plans.

- Submit Application: Complete and submit the application to the chosen lender.

- Review Terms: Carefully review the terms and conditions of the line of credit before acceptance.

- Access Funds: Once approved, businesses can begin drawing funds as needed.

Eligibility Criteria

Eligibility for a Healthcare Line of Credit often depends on several factors. Lenders typically look for:

- Credit Score: A strong credit score can improve chances of approval and favorable terms.

- Business Revenue: Consistent revenue streams demonstrate the ability to repay borrowed funds.

- Time in Business: Established businesses with a proven track record may have better access to credit.

- Financial Health: Lenders assess financial statements to evaluate overall business health.

Examples of Using the Healthcare Line Of Credit

Healthcare businesses can utilize a line of credit in various ways, including:

- Covering Operational Costs: Use funds to pay for day-to-day expenses, such as payroll and utilities, especially during slow periods.

- Investing in Equipment: Acquire new medical equipment or technology to enhance services without straining cash flow.

- Managing Cash Flow: Bridge gaps in cash flow caused by delayed insurance reimbursements.

- Expanding Services: Fund marketing campaigns or new service offerings to attract more patients.

Quick guide on how to complete healthcare line of credit

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among enterprises and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any delays. Manage [SKS] across any platform using the airSlate SignNow Android or iOS applications, and streamline any document-related task today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Healthcare Line Of Credit

Create this form in 5 minutes!

How to create an eSignature for the healthcare line of credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Healthcare Line Of Credit?

A Healthcare Line Of Credit is a financial product designed specifically for healthcare providers to access funds for various operational needs. This line of credit allows businesses to cover expenses such as equipment purchases, staffing, and unexpected costs. Utilizing a Healthcare Line Of Credit can help ensure smooth cash flow in a dynamic industry.

-

How does the Healthcare Line Of Credit benefit my healthcare business?

The primary benefit of a Healthcare Line Of Credit is improved financial flexibility, enabling your practice to manage expenses more effectively. It provides immediate access to funds to address urgent needs without interrupting operations. Additionally, it can enhance your ability to invest in growth opportunities, ultimately benefiting your patients and staff.

-

What costs are associated with a Healthcare Line Of Credit?

The costs of a Healthcare Line Of Credit typically include interest rates and any applicable fees for maintaining the line. While interest rates can vary based on your creditworthiness and market conditions, you can plan for manageable payments with clear terms. It's essential to review the agreement to understand all potential costs involved.

-

Are there specific eligibility requirements for a Healthcare Line Of Credit?

Eligibility for a Healthcare Line Of Credit often depends on factors like your business credit score, annual revenue, and the type of healthcare service you provide. Lenders usually look for a stable financial history and a clear plan for using the credit line. Be prepared to provide documentation regarding your business operations and financials.

-

Can I use a Healthcare Line Of Credit for equipment purchases?

Yes, a Healthcare Line Of Credit can be used to purchase necessary equipment for your healthcare practice. This financial tool allows you to invest in high-quality equipment without draining your operational cash flow. Make sure to calculate the return on investment (ROI) of the equipment you plan to buy to ensure it positively impacts your practice's bottom line.

-

How quickly can I access my Healthcare Line Of Credit?

The speed of access to funds from a Healthcare Line Of Credit can vary based on the lender's process. Generally, once approved, you can draw funds quickly, often within a few days. This prompt access is crucial for managing urgent financial needs in a healthcare setting, making it a valuable resource for busy practitioners.

-

Is there a limit to how much I can borrow with a Healthcare Line Of Credit?

Yes, there is typically a credit limit set by the lender based on your business's financial profile and creditworthiness. This limit dictates the maximum amount you can withdraw at any given time. It's essential to communicate your expected funding needs with the lender to tailor the line of credit to your practice's requirements.

Get more for Healthcare Line Of Credit

Find out other Healthcare Line Of Credit

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile