FHA Correspondent Approval 57 Kb US Bank Form

What is the FHA Correspondent Approval 57 Kb US Bank

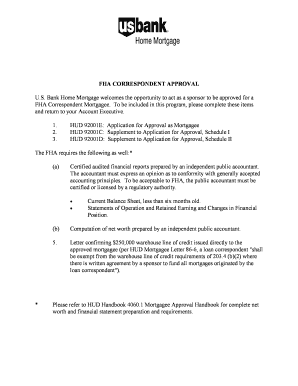

The FHA Correspondent Approval 57 Kb US Bank refers to a specific approval process for lenders who wish to originate Federal Housing Administration (FHA) loans. This approval is essential for lenders looking to participate in the FHA lending program, which aims to provide affordable housing options to low- and moderate-income borrowers. The "57 Kb" designation indicates a particular version or update of the approval document, ensuring compliance with the latest FHA guidelines. This process involves meeting specific eligibility criteria and adhering to the regulations set forth by the FHA and US Bank.

How to Obtain the FHA Correspondent Approval 57 Kb US Bank

To obtain the FHA Correspondent Approval 57 Kb US Bank, lenders must follow a structured application process. This typically includes submitting a completed application form, providing necessary documentation, and demonstrating compliance with FHA requirements. Key documents may include financial statements, proof of experience in mortgage lending, and a detailed business plan. Lenders should also ensure they meet the eligibility criteria outlined by the FHA, which may include having a certain level of capital and a history of responsible lending practices.

Steps to Complete the FHA Correspondent Approval 57 Kb US Bank

Completing the FHA Correspondent Approval 57 Kb US Bank involves several critical steps:

- Gather necessary documentation, including financial records and business plans.

- Complete the FHA correspondent lender application form accurately.

- Submit the application along with all required documents to US Bank.

- Await approval from US Bank, which may involve additional requests for information.

- Once approved, ensure ongoing compliance with FHA guidelines and reporting requirements.

Key Elements of the FHA Correspondent Approval 57 Kb US Bank

Key elements of the FHA Correspondent Approval 57 Kb US Bank include adherence to FHA guidelines, financial stability, and operational capacity. Lenders must demonstrate their ability to underwrite and close FHA loans efficiently. Additionally, they must maintain a quality control process to ensure compliance with FHA standards. The approval also requires lenders to have a clear understanding of the FHA loan products and the associated risks involved in originating these loans.

Legal Use of the FHA Correspondent Approval 57 Kb US Bank

The FHA Correspondent Approval 57 Kb US Bank is legally binding and allows approved lenders to originate FHA loans. This approval ensures that lenders operate within the framework of federal regulations, promoting fair lending practices. It is crucial for lenders to understand the legal implications of their approval, including compliance with all applicable laws and regulations related to FHA lending. Non-compliance can result in penalties or revocation of approval.

Eligibility Criteria for FHA Correspondent Approval 57 Kb US Bank

Eligibility criteria for the FHA Correspondent Approval 57 Kb US Bank typically include:

- A minimum net worth requirement, demonstrating financial stability.

- Experience in mortgage lending, particularly with FHA loans.

- Compliance with federal and state regulations governing lending practices.

- A robust quality control system to monitor loan origination and underwriting processes.

Quick guide on how to complete fha correspondent approval 57 kb us bank

Easily prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a great environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it in the cloud. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications, and streamline your document-related processes today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FHA Correspondent Approval 57 Kb US Bank

Create this form in 5 minutes!

How to create an eSignature for the fha correspondent approval 57 kb us bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FHA Correspondent Approval 57 Kb US Bank?

FHA Correspondent Approval 57 Kb US Bank refers to the approval process for correspondents to work with FHA loans. It ensures that lenders meet the guidelines set by the Federal Housing Administration. This process is crucial for maintaining loan integrity and compliance, and airSlate SignNow can help simplify and expedite this process.

-

How can airSlate SignNow assist with FHA Correspondent Approval 57 Kb US Bank?

airSlate SignNow provides an efficient platform for managing the documentation required for FHA Correspondent Approval 57 Kb US Bank. With its eSigning features and document management tools, users can streamline the approval process, allowing for quicker turnaround times and ensuring compliance with all necessary criteria.

-

What are the pricing options for using airSlate SignNow related to FHA Correspondent Approval 57 Kb US Bank?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including those focused on FHA Correspondent Approval 57 Kb US Bank. These plans are cost-effective and include features that enhance document flow and approval efficiency. It's best to review our pricing page for specific details and available discounts.

-

What features does airSlate SignNow offer for FHA Correspondent Approval 57 Kb US Bank?

airSlate SignNow includes several features tailored for the FHA Correspondent Approval 57 Kb US Bank process, such as document templates, secure eSigning capabilities, and real-time tracking. These tools help users manage their correspondence and ensure all documents are processed efficiently and securely.

-

Are there any integrations available with airSlate SignNow for FHA Correspondent Approval 57 Kb US Bank?

Yes, airSlate SignNow offers integrations with popular platforms that can further enhance the FHA Correspondent Approval 57 Kb US Bank workflow. These integrations allow users to connect their existing systems for seamless data exchange, ensuring that documents are easily accessible and workflows are optimized.

-

What are the benefits of using airSlate SignNow for FHA Correspondent Approval 57 Kb US Bank?

Using airSlate SignNow for FHA Correspondent Approval 57 Kb US Bank brings numerous benefits, including reduced processing times and increased accuracy in document management. The platform's user-friendly interface and robust security measures also enhance user experience while ensuring compliance with FHA standards.

-

Can airSlate SignNow help speed up the FHA Correspondent Approval process?

Absolutely! airSlate SignNow is designed to help streamline the FHA Correspondent Approval process. With features like automated workflows, real-time notifications, and easy document sharing, it signNowly reduces the time needed to obtain approvals and facilitates faster transactions.

Get more for FHA Correspondent Approval 57 Kb US Bank

- Emergency room discharge papers template form

- Private detective agency license application form

- Ct au 677 form

- 5 foodborne illness poster form

- Youth soccer player contract pdf form

- Form st 3 state of new jersey state nj

- Farm exemption kentucky form

- Borang permohonan jawatan kumpulan pelaksana sok bum br03 jawatan 02 form

Find out other FHA Correspondent Approval 57 Kb US Bank

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast