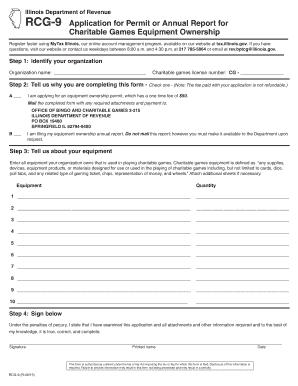

RCG 9 Application or Annual Report for Charitable Game Tax Illinois Form

What is the RCG 9 Application or Annual Report for Charitable Game Tax Illinois

The RCG 9 Application or Annual Report for Charitable Game Tax in Illinois is a crucial document for organizations that conduct charitable gaming activities. This form is used to report the financial details of charitable games, including bingo, raffles, and other gaming events. It ensures compliance with state regulations and provides transparency regarding the funds raised through these activities. Charitable organizations must submit this report annually to maintain their eligibility for conducting gaming and to fulfill tax obligations.

Steps to Complete the RCG 9 Application or Annual Report for Charitable Game Tax Illinois

Completing the RCG 9 form involves several key steps. First, gather all necessary financial records related to your charitable gaming activities for the reporting period. This includes income from games, expenses incurred, and any distributions made. Next, accurately fill out each section of the form, ensuring that all figures are correct and reflect the actual financial situation. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline to the appropriate state agency, either online or by mail.

Required Documents for the RCG 9 Application or Annual Report for Charitable Game Tax Illinois

To successfully complete the RCG 9 Application or Annual Report, certain documents are essential. These typically include:

- Financial statements detailing income and expenses from gaming activities

- Records of any prizes awarded during the gaming events

- Proof of any licenses or permits obtained for conducting charitable games

- Documentation of distributions made to charitable causes from gaming proceeds

Having these documents ready will streamline the completion of the form and ensure compliance with state regulations.

Filing Deadlines for the RCG 9 Application or Annual Report for Charitable Game Tax Illinois

Filing deadlines for the RCG 9 form are critical to avoid penalties. Generally, the report must be submitted annually by a specific date, often aligned with the end of the organization's fiscal year. It is important to check the Illinois Department of Revenue's guidelines for the exact due date, as it can vary based on the organization's reporting period. Late submissions may result in fines or other penalties, so timely filing is essential.

Legal Use of the RCG 9 Application or Annual Report for Charitable Game Tax Illinois

The RCG 9 form serves a legal purpose by ensuring that charitable organizations comply with Illinois gaming laws. By accurately reporting financial activities related to charitable gaming, organizations demonstrate transparency and accountability. This legal compliance is crucial for maintaining the right to operate gaming events and for protecting the organization’s tax-exempt status. Failure to submit this report can lead to legal repercussions, including fines and loss of gaming privileges.

Who Issues the RCG 9 Application or Annual Report for Charitable Game Tax Illinois

The Illinois Department of Revenue is responsible for issuing the RCG 9 Application or Annual Report. This state agency oversees the regulation of charitable gaming activities and ensures that organizations comply with applicable laws. The Department provides guidance on the completion of the form, filing procedures, and any updates to the regulations governing charitable gaming in Illinois.

Quick guide on how to complete rcg 9 application or annual report for charitable game tax illinois

Effortlessly Complete [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications, and streamline any document-related processes today.

Edit and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all details and click the Done button to store your changes.

- Select how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to RCG 9 Application Or Annual Report For Charitable Game Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the rcg 9 application or annual report for charitable game tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois?

The RCG 9 Application Or Annual Report For Charitable Game Tax Illinois is a state-required document for organizations conducting charitable gaming activities in Illinois. It outlines all gaming activities and reporting necessary to comply with state tax regulations. Submitting this report ensures transparency and legal compliance for your charitable organization.

-

How can airSlate SignNow help with the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois?

airSlate SignNow streamlines the process of completing the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois by providing an easy-to-use platform for eSigning and sharing documents. This simplifies gathering signatures from board members and stakeholders, making the submission process more efficient. Users benefit from tracking capabilities that ensure submissions are completed on time.

-

What features does airSlate SignNow offer for handling the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois?

AirSlate SignNow offers features such as customizable templates, eSigning, and secure document storage, specifically designed to simplify the management of the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois. Additionally, the platform provides reminders and notifications to keep users informed about deadlines. These features save time and reduce the risk of errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois?

Yes, airSlate SignNow offers various pricing plans to accommodate organizations of all sizes, making it a cost-effective solution for managing the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois. Each plan includes essential features designed to enhance the document signing process. Potential users can choose the plan that best fits their company's needs and budget.

-

Can airSlate SignNow integrate with other software for managing the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois?

Absolutely! airSlate SignNow integrates seamlessly with various CRM systems, cloud storage services, and productivity tools. This feature allows users to easily import data required for the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois. Integration enhances workflow efficiency and reduces redundancy in data entry.

-

What benefits does airSlate SignNow provide for submitting the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois?

By using airSlate SignNow to submit the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois, organizations benefit from enhanced accuracy, time savings, and improved compliance with state regulations. The platform's intuitive interface ensures that all necessary information is filled out correctly before submission. Additionally, eSigning capabilities expediate the entire process, avoiding delays.

-

Is my information secure when using airSlate SignNow for the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois?

Yes, airSlate SignNow prioritizes the security of user information with industry-standard encryption and secure data storage protocols. When submitting the RCG 9 Application Or Annual Report For Charitable Game Tax Illinois, you can be confident that your data is protected against unauthorized access. Compliance with privacy regulations is also assured.

Get more for RCG 9 Application Or Annual Report For Charitable Game Tax Illinois

- Ethiopian grade 7 information and communication technology students text book and guide pdf

- Spark form 3 pdf

- D4 form medical

- Keypass idapply for a keypass id australia post form

- Michigan estimated income tax form

- Wwwcourseherocom117326386application formdocapplication formdoc employment application form position

- Maxicare claim reimbursement form

- Item phone number photo form

Find out other RCG 9 Application Or Annual Report For Charitable Game Tax Illinois

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer