Michigan Estimated Income Tax 2022

What is the Michigan Estimated Income Tax

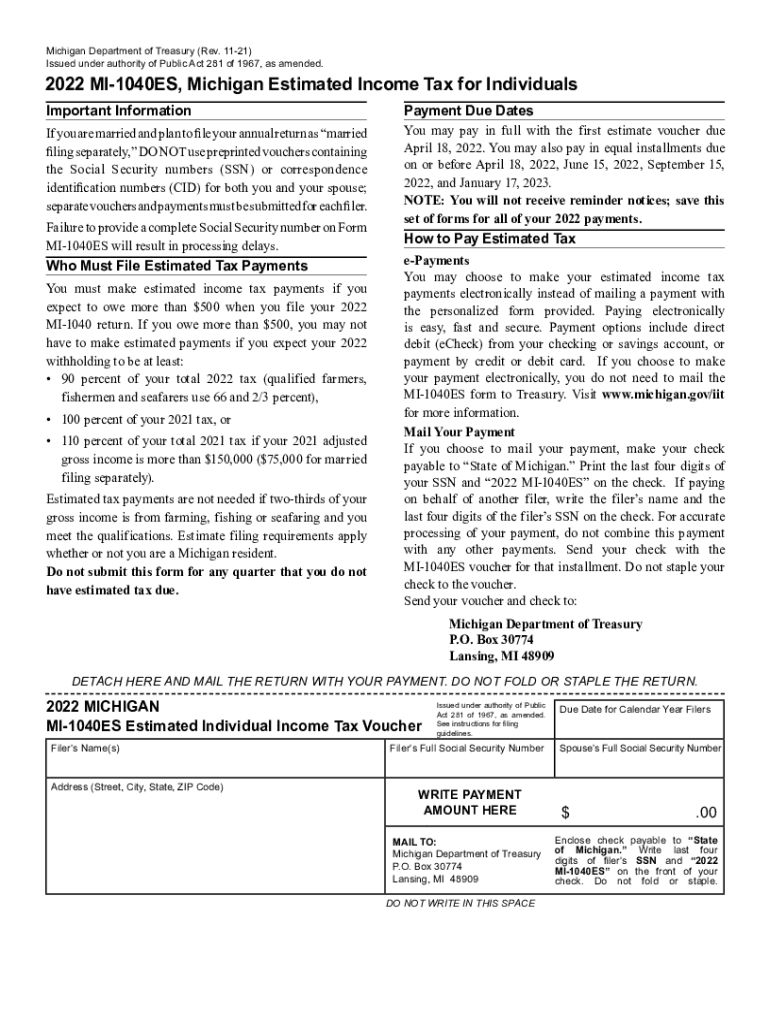

The Michigan Estimated Income Tax is a method for taxpayers in Michigan to pay their income tax in advance. This system is designed for individuals and businesses that expect to owe tax of more than $500 when filing their annual return. By making estimated payments, taxpayers can avoid penalties and interest that may arise from underpayment at the end of the tax year. This tax is calculated based on the expected income for the year, allowing taxpayers to manage their tax obligations proactively.

How to use the Michigan Estimated Income Tax

To utilize the Michigan Estimated Income Tax, taxpayers must first determine their expected tax liability for the year. This involves estimating total income, deductions, and credits. Once this figure is established, taxpayers can divide their total estimated tax liability by four, as payments are typically made quarterly. Payments can be submitted online, by mail, or in person, depending on the taxpayer’s preference. It is essential to keep accurate records of all payments made to ensure compliance and avoid any penalties.

Steps to complete the Michigan Estimated Income Tax

Completing the Michigan Estimated Income Tax involves several key steps:

- Estimate your total income for the year, including wages, self-employment income, and other sources.

- Calculate your expected deductions and credits to determine your taxable income.

- Use the Michigan tax rate to compute your estimated tax liability.

- Divide your total estimated tax by four to establish quarterly payment amounts.

- Submit your payments according to the established deadlines, ensuring you keep records of each transaction.

Filing Deadlines / Important Dates

Timely filing of the Michigan Estimated Income Tax is crucial to avoid penalties. The quarterly payment deadlines typically fall on:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should be aware that if a deadline falls on a weekend or holiday, the due date may shift to the next business day.

Required Documents

To accurately complete the Michigan Estimated Income Tax, taxpayers should gather the following documents:

- Prior year tax returns to reference income and deductions.

- Current year income statements, including W-2s and 1099s.

- Documentation of any deductions or credits that may apply.

- Records of any previous estimated tax payments made during the year.

Penalties for Non-Compliance

Failure to comply with Michigan's Estimated Income Tax requirements can result in penalties. Taxpayers who do not make the required estimated payments may face a penalty of up to 25 percent of the unpaid tax. Additionally, interest may accrue on any unpaid amounts, further increasing the total liability. It is essential for taxpayers to stay informed about their payment obligations to avoid these consequences.

Quick guide on how to complete michigan estimated income tax

Prepare Michigan Estimated Income Tax effortlessly on any gadget

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without interruptions. Handle Michigan Estimated Income Tax on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Michigan Estimated Income Tax without stress

- Obtain Michigan Estimated Income Tax and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose how you would like to send your document, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Michigan Estimated Income Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan estimated income tax

Create this form in 5 minutes!

How to create an eSignature for the michigan estimated income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing the 2023 mi 1040 using airSlate SignNow?

Filing the 2023 mi 1040 with airSlate SignNow is easy and efficient. Users can upload their tax documents, add necessary signatures, and send them securely. The platform ensures compliance and offers a straightforward interface for seamlessly managing your forms.

-

What features does airSlate SignNow offer for the 2023 mi 1040?

AirSlate SignNow provides a variety of features for the 2023 mi 1040, including customizable templates, automated workflows, and secure eSignature options. This allows users to streamline the tax filing process while ensuring that all documents are properly signed and filed. Additionally, it reduces paperwork clutter.

-

Is airSlate SignNow a cost-effective solution for handling the 2023 mi 1040?

Yes, airSlate SignNow is a cost-effective solution for managing your 2023 mi 1040. With competitive pricing plans, businesses can optimize their document signing processes without breaking the bank. This allows users to save time and resources while focusing on their core activities.

-

Can I integrate airSlate SignNow with other applications for the 2023 mi 1040?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular applications, enhancing your experience when filing the 2023 mi 1040. Whether you use CRM systems or accounting software, these integrations help streamline your document management and eSigning processes.

-

What are the advantages of using airSlate SignNow for my 2023 mi 1040?

Using airSlate SignNow for your 2023 mi 1040 offers numerous advantages, such as increased efficiency, enhanced security, and the ability to track document status in real-time. You can easily communicate with stakeholders and maintain complete control over your tax documents. This empowers businesses to enhance productivity during tax season.

-

How secure is airSlate SignNow for submitting my 2023 mi 1040?

AirSlate SignNow prioritizes the security of your sensitive information when filing the 2023 mi 1040. The platform employs advanced encryption technology to protect your documents during transit and storage. With regular security audits and compliance with industry standards, your data remains safe.

-

What customer support options are available while using airSlate SignNow for the 2023 mi 1040?

AirSlate SignNow offers robust customer support for users tackling the 2023 mi 1040. You can access a knowledge base, FAQs, and live chat assistance for any inquiries. The dedicated support team is available to address your concerns and help you navigate the platform with ease.

Get more for Michigan Estimated Income Tax

Find out other Michigan Estimated Income Tax

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word