SECTION V FOREIGN for PROFIT CORPORATIONS a in Form

Understanding the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

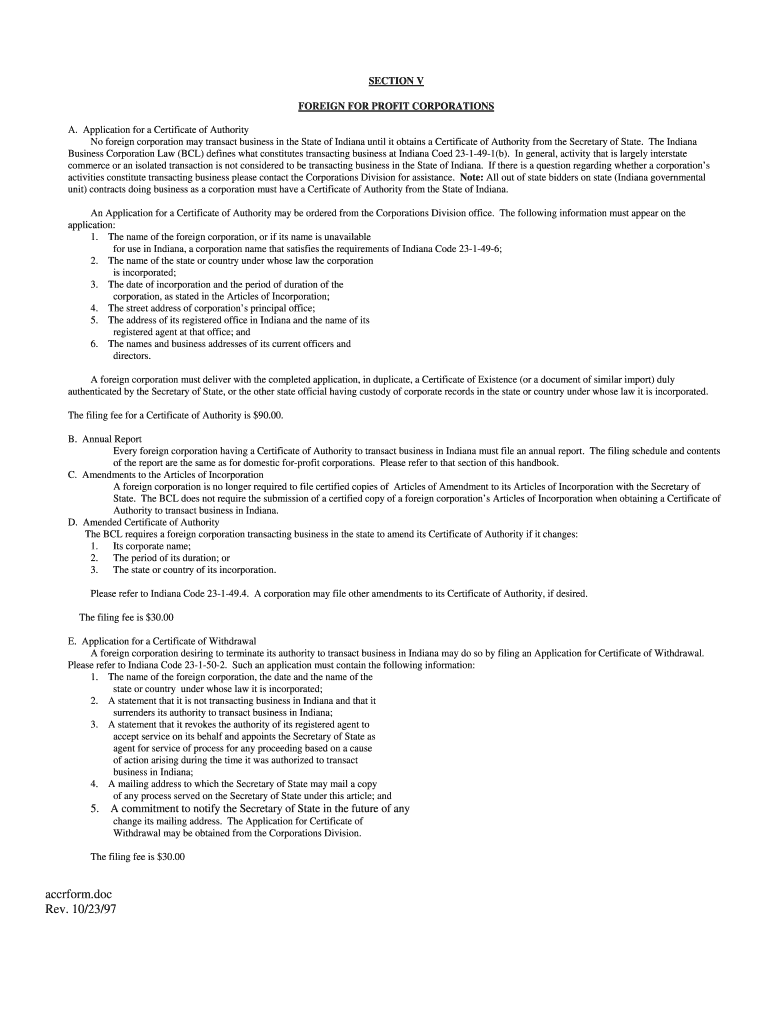

The SECTION V FOREIGN FOR PROFIT CORPORATIONS A In is a crucial document for businesses operating in the United States that are incorporated outside the country. This form is essential for foreign corporations that wish to conduct business legally within the U.S. It outlines the necessary information about the corporation, including its legal status, business activities, and compliance with state regulations. Understanding this form is vital for ensuring that foreign entities meet all legal requirements and avoid potential penalties.

Steps to Complete the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

Completing the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In involves several key steps:

- Gather necessary documentation, including the corporation's formation documents, proof of good standing, and any relevant business licenses.

- Provide detailed information about the corporation, including its name, principal office address, and the names of its officers and directors.

- Indicate the nature of the business activities the corporation will engage in while operating in the U.S.

- Submit the completed form to the appropriate state authority, ensuring that all information is accurate and up to date.

Legal Use of the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

The legal use of the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In is primarily to ensure that foreign corporations comply with U.S. business laws. This form serves as a declaration of the corporation's intent to operate within the country and helps establish its legal standing. By filing this document, foreign entities can protect themselves from legal challenges and ensure they are recognized as legitimate businesses in their respective states.

Required Documents for the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

When preparing to submit the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In, certain documents are typically required:

- Certificate of good standing from the corporation's home jurisdiction.

- Copy of the corporation's formation documents, such as articles of incorporation.

- Identification of the corporation's registered agent in the state where it will operate.

- Any additional state-specific forms or documentation that may be required.

Filing Deadlines for the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

Filing deadlines for the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In can vary by state. It is important for corporations to be aware of these deadlines to avoid penalties. Typically, the form should be filed before the corporation begins any business activities in the U.S. Some states may have specific annual renewal requirements, so staying informed about these dates is crucial for compliance.

Examples of Using the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

Examples of situations where the SECTION V FOREIGN FOR PROFIT CORPORATIONS A In is utilized include:

- A foreign corporation expanding its operations into the U.S. market and needing to establish a legal presence.

- A company incorporated in Canada that wishes to sell products in the United States.

- A European technology firm looking to open a subsidiary in a U.S. state.

Quick guide on how to complete section v foreign for profit corporations a in

Effortlessly prepare [SKS] on any device

Digital document management has gained immense traction among companies and individuals alike. It offers a perfect sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to craft, modify, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device utilizing airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest method to modify and electronically sign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Edit and electronically sign [SKS] and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

Create this form in 5 minutes!

How to create an eSignature for the section v foreign for profit corporations a in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SECTION V FOREIGN FOR PROFIT CORPORATIONS A In?

SECTION V FOREIGN FOR PROFIT CORPORATIONS A In refers to the regulatory framework governing foreign corporations operating in specific jurisdictions. Understanding these regulations is essential for businesses to ensure compliance while utilizing e-signatures with airSlate SignNow.

-

How can airSlate SignNow assist with SECTION V FOREIGN FOR PROFIT CORPORATIONS A In compliance?

airSlate SignNow helps businesses streamline their document signing process, ensuring that all e-signatures are compliant with SECTION V FOREIGN FOR PROFIT CORPORATIONS A In requirements. Our solution includes built-in compliance features that make it easier for foreign corporations to meet legal standards.

-

What features does airSlate SignNow offer for SECTION V FOREIGN FOR PROFIT CORPORATIONS A In?

Our platform provides features that address the complexities of SECTION V FOREIGN FOR PROFIT CORPORATIONS A In, such as customizable templates, audit trails, and secure cloud storage. These tools simplify document management for foreign for-profit entities.

-

Is airSlate SignNow cost-effective for businesses dealing with SECTION V FOREIGN FOR PROFIT CORPORATIONS A In?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses navigating SECTION V FOREIGN FOR PROFIT CORPORATIONS A In. Our pricing plans are competitive, allowing companies to efficiently manage their signing processes without breaking the bank.

-

Can airSlate SignNow integrate with other systems for SECTION V FOREIGN FOR PROFIT CORPORATIONS A In?

Absolutely! airSlate SignNow offers seamless integrations with various business tools and systems to enhance the efficiency of managing SECTION V FOREIGN FOR PROFIT CORPORATIONS A In documentation. From CRM platforms to project management tools, we ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for SECTION V FOREIGN FOR PROFIT CORPORATIONS A In?

Using airSlate SignNow for SECTION V FOREIGN FOR PROFIT CORPORATIONS A In allows businesses to reduce paperwork, save time, and ensure compliance with legal requirements. Our intuitive platform empowers teams to manage e-signatures efficiently.

-

How secure is airSlate SignNow for documents related to SECTION V FOREIGN FOR PROFIT CORPORATIONS A In?

Security is a top priority at airSlate SignNow. Our platform is built with enterprise-level security features to protect documents related to SECTION V FOREIGN FOR PROFIT CORPORATIONS A In, including data encryption and multi-factor authentication.

Get more for SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

Find out other SECTION V FOREIGN FOR PROFIT CORPORATIONS A In

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online