D 407 NC K 1 Web 7 22 for Use Only Beneficia 2022

What is the D-407 NC K-1 Form?

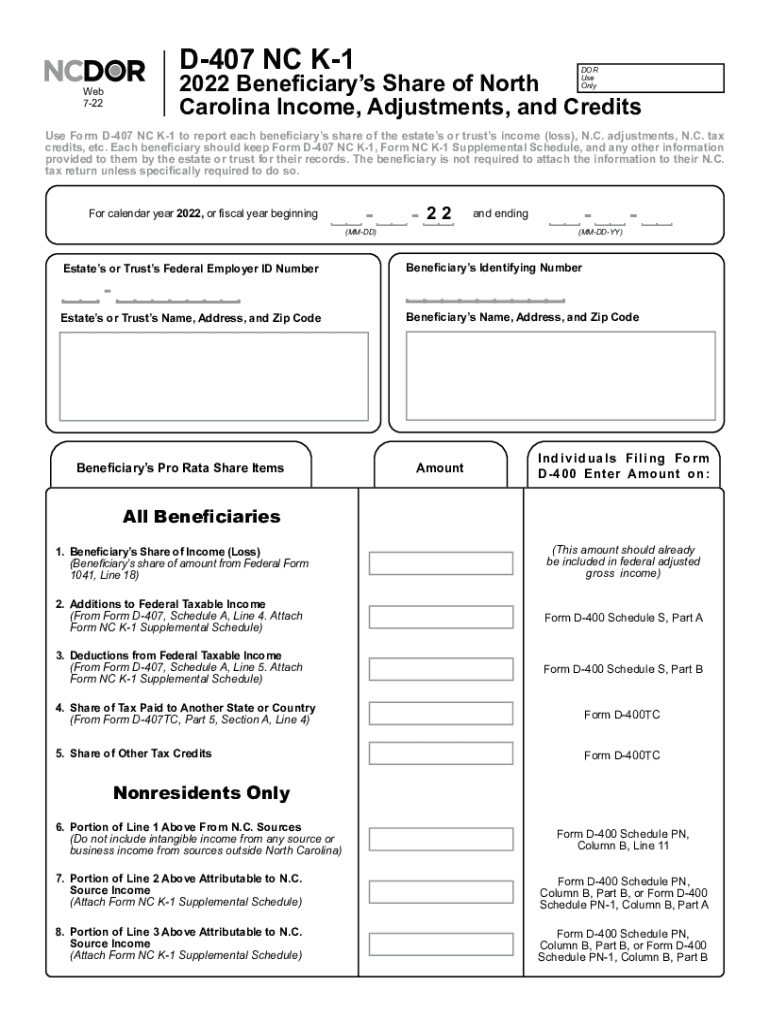

The D-407 NC K-1 form is a tax document used in North Carolina to report income, deductions, and credits for beneficiaries of pass-through entities such as partnerships and S corporations. This form is essential for individuals who receive income from these entities, as it provides the necessary information to accurately report their share of the entity's income on their personal tax returns. The D-407 NC K-1 includes details such as the beneficiary's share of income, losses, and other tax attributes, ensuring compliance with state tax regulations.

How to Complete the D-407 NC K-1 Form

Completing the D-407 NC K-1 form involves several key steps:

- Gather all relevant financial information from the pass-through entity, including income statements and any deductions applicable to your share.

- Fill out the beneficiary's information, such as name, address, and Social Security number, ensuring accuracy to avoid delays.

- Report your share of income, losses, and other tax attributes as provided by the entity, ensuring that all figures are correctly calculated.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines for the D-407 NC K-1 Form

It is crucial to be aware of the filing deadlines associated with the D-407 NC K-1 form. Generally, the form must be filed by the same deadline as the entity's tax return. For most partnerships and S corporations, this is March 15 of the following year. If an extension is filed for the entity, the K-1 form must also be submitted by the extended deadline. Beneficiaries should ensure they receive their K-1 in a timely manner to meet their personal tax filing obligations.

Legal Use of the D-407 NC K-1 Form

The D-407 NC K-1 form is legally required for beneficiaries of pass-through entities to accurately report their income to the North Carolina Department of Revenue. Failure to file this form can result in penalties and interest on unpaid taxes. It is important for beneficiaries to understand their obligations under state tax law and to use the form correctly to avoid any legal complications.

Required Documents for the D-407 NC K-1 Form

To complete the D-407 NC K-1 form, beneficiaries should have the following documents on hand:

- Financial statements from the pass-through entity, detailing income and deductions.

- Previous year’s tax return, which may provide useful information for reporting.

- Any additional documentation related to deductions or credits that may apply to the beneficiary's share of income.

Examples of Using the D-407 NC K-1 Form

Beneficiaries can utilize the D-407 NC K-1 form in various scenarios, such as:

- Receiving income from a partnership where they are a limited partner, allowing them to report their share of profits and losses.

- Being a shareholder in an S corporation, where the K-1 provides necessary details for personal tax reporting.

- Claiming deductions related to business expenses as reported on the K-1, which can help reduce overall taxable income.

Quick guide on how to complete d 407 nc k 1 web 7 22 for use only beneficia

Fulfill D 407 NC K 1 Web 7 22 FOR Use Only Beneficia seamlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can acquire the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources required to create, amend, and eSign your files quickly without hold-ups. Handle D 407 NC K 1 Web 7 22 FOR Use Only Beneficia on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign D 407 NC K 1 Web 7 22 FOR Use Only Beneficia effortlessly

- Locate D 407 NC K 1 Web 7 22 FOR Use Only Beneficia and then click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your amendments.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign D 407 NC K 1 Web 7 22 FOR Use Only Beneficia and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 407 nc k 1 web 7 22 for use only beneficia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ncdor d 407nc form?

The ncdor d 407nc is used for reporting certain tax exemptions in North Carolina. This form allows businesses to claim deductions for their purchases, ensuring compliance with state tax regulations. By utilizing the ncdor d 407nc, you can streamline your tax processes efficiently.

-

How can airSlate SignNow assist with completing the ncdor d 407nc?

airSlate SignNow simplifies the process of completing the ncdor d 407nc form by providing easy-to-use eSignature features. You can fill out, sign, and send the form securely, ensuring that all your tax documentation is handled properly. This minimizes errors and saves time when dealing with tax submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet the needs of different businesses. Each plan provides access to essential features, including support for the ncdor d 407nc form. You can choose a plan that aligns with your budget while ensuring compliance with tax documentation requirements.

-

What are the key features of airSlate SignNow for handling tax forms like ncdor d 407nc?

Key features of airSlate SignNow that benefit users managing forms like the ncdor d 407nc include eSignature capabilities, document collaboration tools, and secure cloud storage. These features enhance efficiency and reduce the risk of errors when preparing and submitting your tax documents.

-

Can I integrate airSlate SignNow with other software for managing ncdor d 407nc?

Yes, airSlate SignNow integrates seamlessly with various business applications to enhance your workflow for managing documents like the ncdor d 407nc. These integrations can help streamline your document management processes and improve overall productivity. You can easily connect with tools you already use.

-

What are the benefits of using airSlate SignNow for eSigning the ncdor d 407nc?

Using airSlate SignNow for eSigning the ncdor d 407nc offers convenience, speed, and security. You can sign documents from any device, reducing turnaround time and increasing compliance. This is particularly beneficial for businesses that need to meet deadlines for tax submissions.

-

Is airSlate SignNow secure for handling sensitive tax documents like ncdor d 407nc?

Absolutely, airSlate SignNow prioritizes security, utilizing encryption and secure servers to protect sensitive information such as the ncdor d 407nc. It complies with industry standards to ensure your documents are safe. This security bolsters your confidence in sending critical tax forms electronically.

Get more for D 407 NC K 1 Web 7 22 FOR Use Only Beneficia

- Composite transfer grant form pdf

- Sample powered industrial truck operator permits form

- Fie checklist form

- Dhs form 9014

- The process of sealing or expunging a criminal record in form

- Parent39s worksheet for child support amount pinal county clerk of form

- Earn money driving your pickup truck cargo van box truck form

- Zoning application permit fees wantage township new jersey form

Find out other D 407 NC K 1 Web 7 22 FOR Use Only Beneficia

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe