Www Ncdor Gov Media 11655North Carolina Department of Revenue Third Party Ncdor Gov 2020

Understanding the d407 nc Form

The d407 nc form, also known as the d 407 k1, is a tax document used in North Carolina for reporting income from pass-through entities. This form is essential for individuals who receive income from partnerships, S corporations, or limited liability companies (LLCs). It provides detailed information about the income, deductions, and credits that must be reported on the individual’s tax return. Understanding the specifics of this form is crucial for accurate tax reporting and compliance with state regulations.

Steps to Complete the d407 nc Form

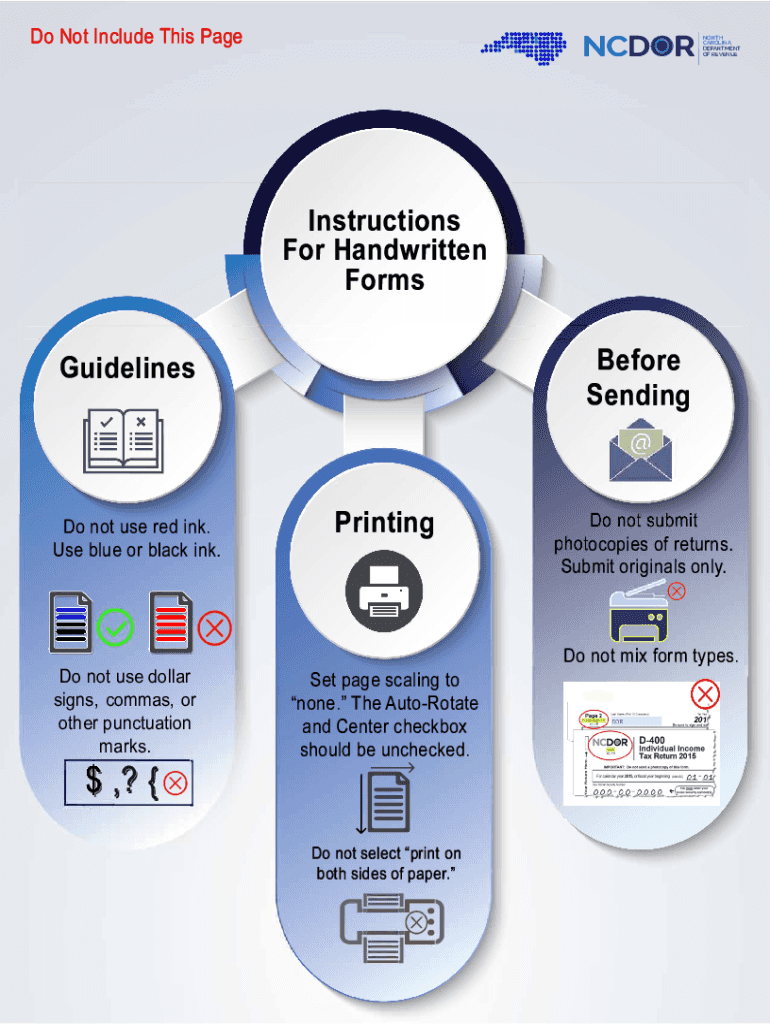

Completing the d407 nc form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including previous tax returns and income statements from pass-through entities. Next, fill out the form by providing your personal information, including your Social Security number and the details of the income received. Be sure to accurately report any deductions or credits applicable to your situation. After completing the form, review it for any errors before submission. Finally, submit the form either electronically or by mail, following the guidelines provided by the North Carolina Department of Revenue.

Legal Use of the d407 nc Form

The d407 nc form is legally binding and must be completed in accordance with North Carolina tax laws. It is essential that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. The form must be signed and dated, confirming that the information is correct to the best of your knowledge. Additionally, electronic signatures are accepted, provided that they comply with the legal standards set forth by the state. Understanding the legal implications of this form can help ensure that you remain compliant with tax regulations.

Filing Deadlines for the d407 nc Form

Filing deadlines for the d407 nc form are crucial for taxpayers to adhere to in order to avoid penalties. Generally, the form must be submitted by the same deadline as your individual income tax return, which is typically April fifteenth. If you require additional time, you may file for an extension; however, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these deadlines can help ensure a smooth filing process.

Form Submission Methods

The d407 nc form can be submitted through various methods, providing flexibility for taxpayers. You may choose to file electronically using the North Carolina Department of Revenue’s online portal, which offers a streamlined process and faster processing times. Alternatively, you can mail a paper copy of the form to the appropriate address provided by the state. In-person submissions are also an option, although they may be less common. Understanding these submission methods can help you select the most convenient option for your needs.

Required Documents for the d407 nc Form

To complete the d407 nc form accurately, certain documents are required. These include income statements from partnerships, S corporations, or LLCs, as well as any relevant tax documents from previous years. It may also be helpful to have documentation of deductions or credits you plan to claim. Gathering these documents in advance can simplify the process and ensure that all necessary information is included when filing.

Penalties for Non-Compliance

Failing to comply with the requirements of the d407 nc form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the North Carolina Department of Revenue. It is important to file the form accurately and on time to avoid these consequences. Understanding the risks associated with non-compliance can motivate taxpayers to ensure their filings are correct and timely.

Quick guide on how to complete wwwncdorgov media 11655north carolina department of revenue third party ncdorgov

Prepare Www ncdor gov Media 11655North Carolina Department Of Revenue Third Party Ncdor gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage Www ncdor gov Media 11655North Carolina Department Of Revenue Third Party Ncdor gov on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Www ncdor gov Media 11655North Carolina Department Of Revenue Third Party Ncdor gov without hassle

- Find Www ncdor gov Media 11655North Carolina Department Of Revenue Third Party Ncdor gov and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and press the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Www ncdor gov Media 11655North Carolina Department Of Revenue Third Party Ncdor gov while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwncdorgov media 11655north carolina department of revenue third party ncdorgov

Create this form in 5 minutes!

How to create an eSignature for the wwwncdorgov media 11655north carolina department of revenue third party ncdorgov

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an e-signature for a PDF file on Android

People also ask

-

What is d407 nc and how does it relate to airSlate SignNow?

d407 nc refers to a specific document or form utilized in various business processes. airSlate SignNow offers seamless solutions to send, receive, and eSign documents like d407 nc efficiently, ensuring compliance and enhancing workflow.

-

How much does airSlate SignNow cost for processing d407 nc documents?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those that require the signing of d407 nc documents. You can choose from monthly or yearly subscriptions, with the ability to scale as your business grows.

-

What features does airSlate SignNow provide for managing d407 nc documents?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage, making it ideal for managing d407 nc documents. These features enhance productivity and ensure that your document management process is streamlined.

-

Can airSlate SignNow integrate with other software for handling d407 nc forms?

Yes, airSlate SignNow supports numerous integrations with popular software like Salesforce, Google Drive, and Microsoft Office, simplifying the process of managing d407 nc forms within your existing workflows. This connectivity enhances efficiency and data synchronization.

-

What benefits do businesses gain from using airSlate SignNow for d407 nc documents?

Using airSlate SignNow for d407 nc documents allows businesses to reduce turnaround times, minimize errors, and improve overall document security. This eSigning solution fosters better collaboration among teams and enhances customer satisfaction.

-

Is it easy to create and send d407 nc documents with airSlate SignNow?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing users to quickly create and send d407 nc documents with just a few clicks. Its intuitive interface means that even those with limited technical skills can easily navigate the platform.

-

How does airSlate SignNow ensure the security of d407 nc documents?

airSlate SignNow incorporates top-notch security measures, including encryption and multi-factor authentication, to protect your d407 nc documents. This commitment to security ensures that your sensitive information remains confidential during the signing process.

Get more for Www ncdor gov Media 11655North Carolina Department Of Revenue Third Party Ncdor gov

- Living trust for husband and wife with one child delaware form

- Living trust for husband and wife with minor and or adult children delaware form

- Amendment to living trust delaware form

- Living trust property record delaware form

- Financial account transfer to living trust delaware form

- Assignment to living trust delaware form

- Notice of assignment to living trust delaware form

- Letter to lienholder to notify of trust delaware form

Find out other Www ncdor gov Media 11655North Carolina Department Of Revenue Third Party Ncdor gov

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast