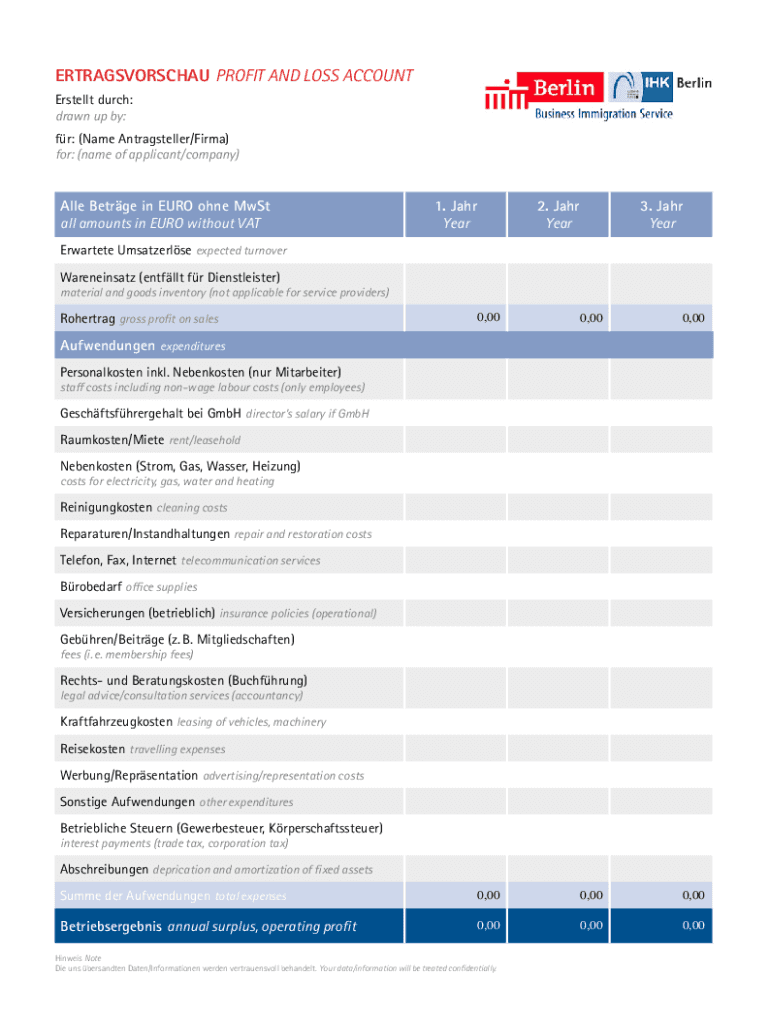

ERTRAGSVORSCHAU PROFIT and LOSS ACCOUNT Form

What is the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

The ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT is a financial document that outlines a company's projected income and expenses over a specific period. This account serves as a crucial tool for businesses to estimate profitability and make informed financial decisions. It typically includes various revenue streams, operating costs, and other financial metrics that help stakeholders understand the expected financial performance. By analyzing this account, businesses can identify potential areas for growth and manage their resources effectively.

Key elements of the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

Understanding the key elements of the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT is essential for accurate financial forecasting. The main components include:

- Revenue: Expected income from sales or services offered.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Operating Expenses: Ongoing costs for running the business, including rent, utilities, and salaries.

- Net Profit: The final profit after deducting all expenses from total revenue.

Each of these elements plays a vital role in determining the overall financial health of a business.

How to use the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

Using the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT involves several steps to ensure accurate projections. First, gather historical financial data to inform your estimates. Next, identify all potential revenue sources and forecast sales based on market trends and business strategies. After estimating revenues, calculate the cost of goods sold and operating expenses. Finally, compile these figures into the profit and loss account format to visualize expected profitability. Regularly updating this account can help businesses adapt to changing market conditions.

Steps to complete the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

Completing the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT requires a systematic approach:

- Collect historical financial data.

- Estimate future sales based on market analysis.

- Calculate the cost of goods sold.

- Determine operating expenses.

- Compile all data into a structured format.

- Review and adjust projections as necessary.

Following these steps ensures a comprehensive understanding of expected financial performance.

Legal use of the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

The ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT must be prepared in compliance with applicable financial regulations. Businesses should ensure that their projections are based on realistic assumptions and documented thoroughly. This account may be required for various legal and financial purposes, such as securing loans or attracting investors. Adhering to legal standards not only fosters trust but also helps avoid potential disputes regarding financial reporting.

Examples of using the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

Practical examples of using the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT can illustrate its value. For instance, a startup may use this account to present projected earnings to investors, demonstrating potential growth and sustainability. Similarly, an established business might utilize it to assess the viability of launching a new product line. By providing clear financial forecasts, businesses can make strategic decisions that align with their goals.

Quick guide on how to complete ertragsvorschau profit and loss account

Complete ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT without any hassle

- Obtain ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your PC.

Forget about lost or mislaid files, tedious document searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ertragsvorschau profit and loss account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT?

The ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT is a comprehensive financial statement that provides a detailed view of a company's revenues and expenses over a specific period. This overview helps businesses make informed decisions regarding budgeting and forecasting. Understanding this account is crucial for effective financial management.

-

How can airSlate SignNow streamline my ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT process?

airSlate SignNow simplifies the creation and management of your ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT by allowing you to easily send, eSign, and store documents securely. With its user-friendly interface, you can automate your document workflows, ensuring accuracy and saving valuable time. This means staying organized and focused on your business goals.

-

What pricing plans does airSlate SignNow offer for ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT services?

airSlate SignNow provides various pricing plans designed to cater to businesses of all sizes needing to manage their ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT. From basic packages for startups to advanced solutions for larger enterprises, our transparent pricing ensures that you only pay for what fits your needs. Each plan includes access to essential features that make document handling effective.

-

Can I integrate airSlate SignNow with my accounting software for ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT?

Yes, airSlate SignNow offers seamless integration with popular accounting software, facilitating the efficient management of your ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT. This integration allows for automatic updates of transactions and financial statements, enhancing accuracy and reducing manual entry. It simplifies financial reviews and planning processes signNowly.

-

What features does airSlate SignNow provide for managing ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT?

airSlate SignNow includes robust features such as customizable templates, in-built compliance tracking, and secure document storage, which are essential for managing your ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT. You can initiate signing workflows and ensure document integrity easily. These features help maintain professionalism while ensuring efficiency.

-

How does airSlate SignNow enhance collaboration on the ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT?

AirSlate SignNow enhances collaboration on your ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT by allowing multiple stakeholders to access and review documents in real-time. The commenting and tracking features enable teams to work together seamlessly, regardless of location. This improves communication and ensures that everyone is aligned towards financial goals.

-

What are the key benefits of using airSlate SignNow for ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT?

Utilizing airSlate SignNow for your ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT brings key benefits such as speed, efficiency, and enhanced compliance. The platform enables quick document turnaround, ensuring that financial information is always up-to-date. Additionally, it helps mitigate risks associated with manual processes while improving overall productivity.

Get more for ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

- Daycare staff meeting topics form

- Clinical chemistry request form sheffield childrens hospital sheffieldchildrens nhs

- Use of facilities application form trinity lutheran church

- Potomac case management referral form

- Mail this form and donation to wounded warrior project p

- Photography business plan template download form

- Da form 2590

- Lease commercial property agreement template form

Find out other ERTRAGSVORSCHAU PROFIT AND LOSS ACCOUNT

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy