TY 510E PTE INCOME TAX RETURN 2021

What is the Maryland Form 510E PTE Income Tax Return?

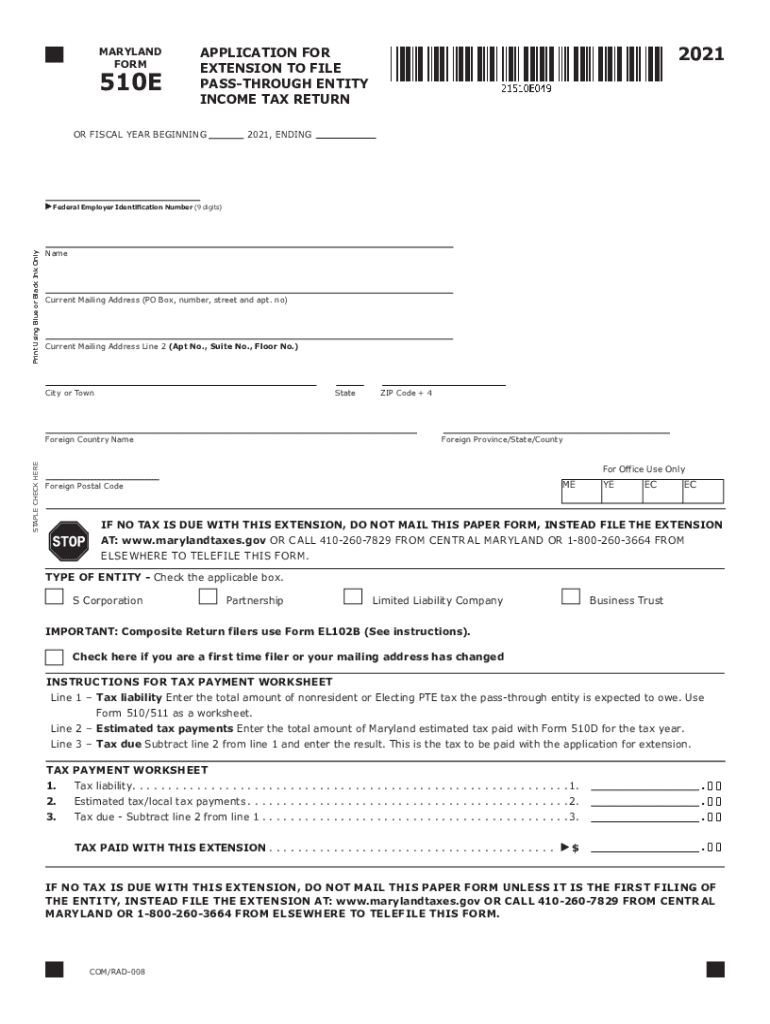

The Maryland Form 510E PTE Income Tax Return is designed for pass-through entities, such as partnerships and S corporations, to report income, deductions, and credits. This form is essential for entities that pass their income directly to their owners or shareholders, allowing them to report their share of the income on their individual tax returns. The form ensures compliance with state tax laws and helps to accurately calculate the tax liability for the entity and its members.

Steps to Complete the Maryland Form 510E PTE Income Tax Return

Completing the Maryland Form 510E requires careful attention to detail. Here are the key steps involved:

- Gather necessary financial documents, including income statements, expense reports, and prior year tax returns.

- Fill out the entity information section, including the name, address, and federal employer identification number (EIN).

- Report the total income and deductions for the entity, ensuring all calculations are accurate.

- Allocate income and deductions to each member or shareholder based on their ownership percentage.

- Complete the signature section, ensuring that an authorized person signs the return.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Maryland Form 510E is crucial for compliance. Generally, the form must be filed by the 15th day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Additionally, if an extension is needed, Form 510E can be submitted along with a request for an extension, which allows for an additional six months to file.

Required Documents

When preparing to file the Maryland Form 510E, several documents are necessary to ensure a complete and accurate submission. These include:

- Financial statements detailing income and expenses for the tax year.

- Prior year tax returns for reference.

- Ownership agreements that outline the distribution of income among members.

- Any supporting documentation for deductions claimed, such as receipts and invoices.

Form Submission Methods

The Maryland Form 510E can be submitted through various methods to accommodate different preferences. Entities can file the form online using the Maryland Comptroller's e-file system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided by the Maryland Comptroller's office. For those who prefer in-person submissions, visiting a local Comptroller office is also an option. Each method has its own processing times, so it is advisable to choose the one that best fits the entity's needs.

Penalties for Non-Compliance

Failing to file the Maryland Form 510E by the deadline can result in significant penalties. Late filing penalties may accrue at a rate of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest may be charged on any unpaid tax from the due date until the tax is paid in full. It is important for entities to be aware of these penalties to avoid unnecessary financial burdens.

Quick guide on how to complete ty 510e pte income tax return

Effortlessly Complete TY 510E PTE INCOME TAX RETURN on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage TY 510E PTE INCOME TAX RETURN on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to Update and eSign TY 510E PTE INCOME TAX RETURN with Ease

- Locate TY 510E PTE INCOME TAX RETURN and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign TY 510E PTE INCOME TAX RETURN to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 510e pte income tax return

Create this form in 5 minutes!

How to create an eSignature for the ty 510e pte income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Maryland income tax return with airSlate SignNow?

Filing your Maryland income tax return with airSlate SignNow is straightforward. You can easily prepare your documents, eSign them, and submit them electronically. The platform streamlines the entire process, ensuring that your Maryland income tax return is filed efficiently and securely.

-

Are there any fees associated with filing a Maryland income tax return using airSlate SignNow?

While airSlate SignNow offers an affordable solution for eSigning documents, the fees for filing a Maryland income tax return may vary based on the specific services you select. However, many users find that the convenience and efficiency gained far outweigh the costs involved.

-

Can I integrate airSlate SignNow with accounting software for my Maryland income tax return?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to manage your Maryland income tax return. This integration ensures that all your financial data is synchronized, simplifying the preparation and submission of your tax documents.

-

What features does airSlate SignNow offer for managing my Maryland income tax return?

AirSlate SignNow provides various features to manage your Maryland income tax return efficiently. These include templates for quick document preparation, secure eSigning capabilities, and real-time tracking of document status, making tax filing a breeze.

-

Is airSlate SignNow suitable for both individuals and businesses filing Maryland income tax returns?

Absolutely! AirSlate SignNow is designed to cater to both individuals and businesses. Whether you're filing a personal Maryland income tax return or managing tax documents for a business entity, our platform provides the tools you need for successful submissions.

-

How does airSlate SignNow ensure the security of my Maryland income tax return documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure servers to protect your Maryland income tax return documents. This commitment to security ensures that your sensitive tax information remains confidential and safe.

-

Can I track the status of my Maryland income tax return after submission?

Yes, you can easily track the status of your Maryland income tax return after submission using airSlate SignNow. Our platform provides real-time updates, allowing you to confirm when your documents are received and processed, giving you peace of mind.

Get more for TY 510E PTE INCOME TAX RETURN

- Nationsotc com bnd form

- Damage assessment form size up observations foster city cert

- Account opening form global construction services limited

- Scca 401f form

- Upmc personal representative form 100105525

- Bangladesh high commission passport renewal form

- Standard employment application one stop business amp career form

- Eit certification application after exam georgia secretary of state sos georgia form

Find out other TY 510E PTE INCOME TAX RETURN

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form