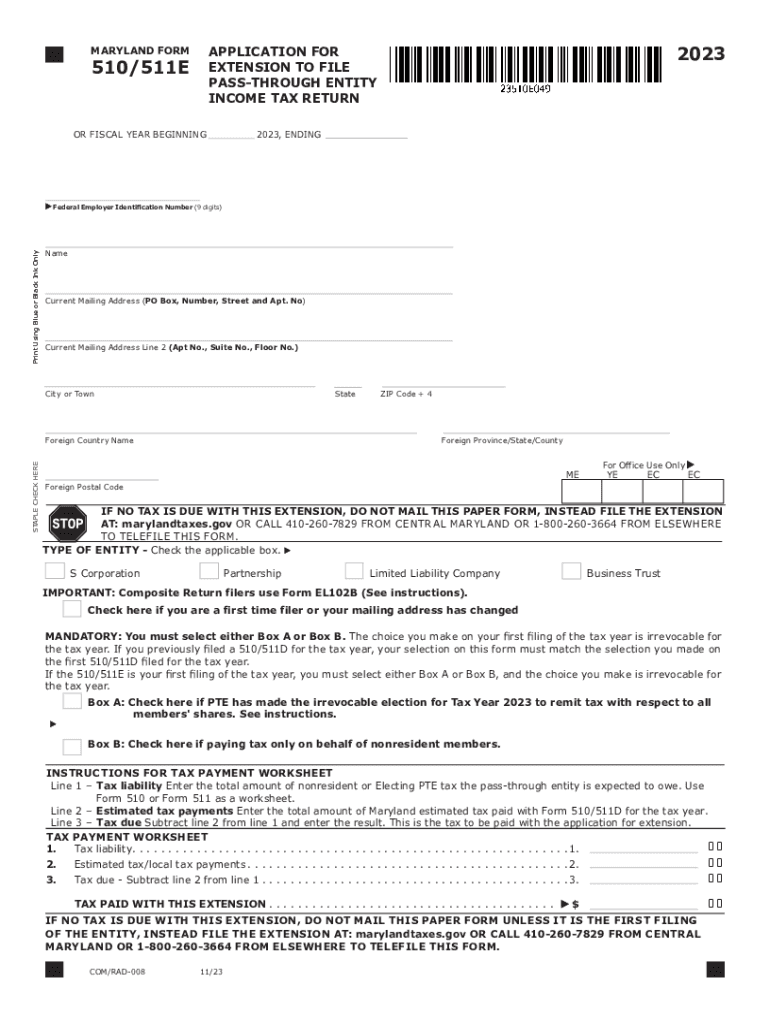

Tax Year Form 510511E Application for Extension to File Pass through Entity Income Tax Return 510511E Application for Extension 2023

Understanding the Maryland Income Tax Return

The Maryland income tax return is a crucial document for residents and businesses in Maryland, used to report income and calculate tax obligations. This form is essential for individuals and entities to comply with state tax laws. It includes various sections to detail income sources, deductions, and credits applicable to the taxpayer's situation. Understanding the purpose and requirements of this form is vital for accurate filing and to avoid penalties.

Steps to Complete the Maryland Income Tax Return

Completing the Maryland income tax return involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any records of deductions.

- Choose the correct version of the form based on your filing status and income type.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring accuracy to avoid discrepancies.

- Claim applicable deductions and credits to reduce your taxable income.

- Review the completed form for errors before submission.

- Submit the form by the deadline, either electronically or by mail.

Filing Deadlines for the Maryland Income Tax Return

Filing deadlines for the Maryland income tax return are typically aligned with federal tax deadlines. Generally, individual returns are due by April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, allowing additional time to file without penalties.

Required Documents for Filing

To successfully file a Maryland income tax return, several documents are required:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any tax-deductible expenses

- Proof of any tax credits claimed

- Last year's tax return for reference

Form Submission Methods

Taxpayers can submit their Maryland income tax return through various methods:

- Electronically via approved e-filing software

- By mail, sending the completed form to the appropriate state address

- In-person at designated tax offices, if applicable

Penalties for Non-Compliance

Failure to file the Maryland income tax return on time can result in penalties. These may include late fees, interest on unpaid taxes, and potential legal action for severe violations. It is essential for taxpayers to understand these consequences and ensure timely and accurate filing to avoid complications.

Quick guide on how to complete tax year form 510511e application for extension to file pass through entity income tax return 510511e application for extension

Complete Tax Year Form 510511E Application For Extension To File Pass Through Entity Income Tax Return 510511E Application For Extension effortlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Year Form 510511E Application For Extension To File Pass Through Entity Income Tax Return 510511E Application For Extension on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The optimal method to modify and eSign Tax Year Form 510511E Application For Extension To File Pass Through Entity Income Tax Return 510511E Application For Extension with ease

- Find Tax Year Form 510511E Application For Extension To File Pass Through Entity Income Tax Return 510511E Application For Extension and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign Tax Year Form 510511E Application For Extension To File Pass Through Entity Income Tax Return 510511E Application For Extension while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year form 510511e application for extension to file pass through entity income tax return 510511e application for extension

Create this form in 5 minutes!

How to create an eSignature for the tax year form 510511e application for extension to file pass through entity income tax return 510511e application for extension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Maryland income tax return using airSlate SignNow?

Filing a Maryland income tax return with airSlate SignNow is straightforward. You can easily upload your tax documents, eSign them, and send them directly to the Maryland tax authorities. Our platform ensures that your documents are securely handled and compliant with state regulations.

-

How does airSlate SignNow help in reducing the cost of filing a Maryland income tax return?

airSlate SignNow offers a cost-effective solution for managing your Maryland income tax return. By streamlining the document signing process, you can save on printing and mailing costs. Additionally, our subscription plans are designed to fit various budgets, making it accessible for everyone.

-

What features does airSlate SignNow offer for managing Maryland income tax returns?

Our platform provides a range of features tailored for Maryland income tax returns, including document templates, eSignature capabilities, and secure cloud storage. You can track the status of your documents in real-time, ensuring that your tax return is filed promptly and accurately.

-

Can I integrate airSlate SignNow with other accounting software for my Maryland income tax return?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your Maryland income tax return. This integration allows you to import data directly from your accounting system, reducing manual entry and minimizing errors.

-

Is airSlate SignNow secure for filing sensitive documents like a Maryland income tax return?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents, including your Maryland income tax return. You can trust that your information is safe and secure throughout the filing process.

-

What are the benefits of using airSlate SignNow for my Maryland income tax return?

Using airSlate SignNow for your Maryland income tax return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our user-friendly interface allows you to complete your tax return quickly, ensuring you meet deadlines without hassle.

-

How can I get support if I have questions about my Maryland income tax return?

airSlate SignNow provides excellent customer support for any questions regarding your Maryland income tax return. You can signNow our support team via chat, email, or phone, and we also offer a comprehensive knowledge base to help you find answers quickly.

Get more for Tax Year Form 510511E Application For Extension To File Pass Through Entity Income Tax Return 510511E Application For Extension

Find out other Tax Year Form 510511E Application For Extension To File Pass Through Entity Income Tax Return 510511E Application For Extension

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure