Maryland Form 510e Fill Online, Printable, Fillable, Blank 2022

What is the Maryland Form 510e

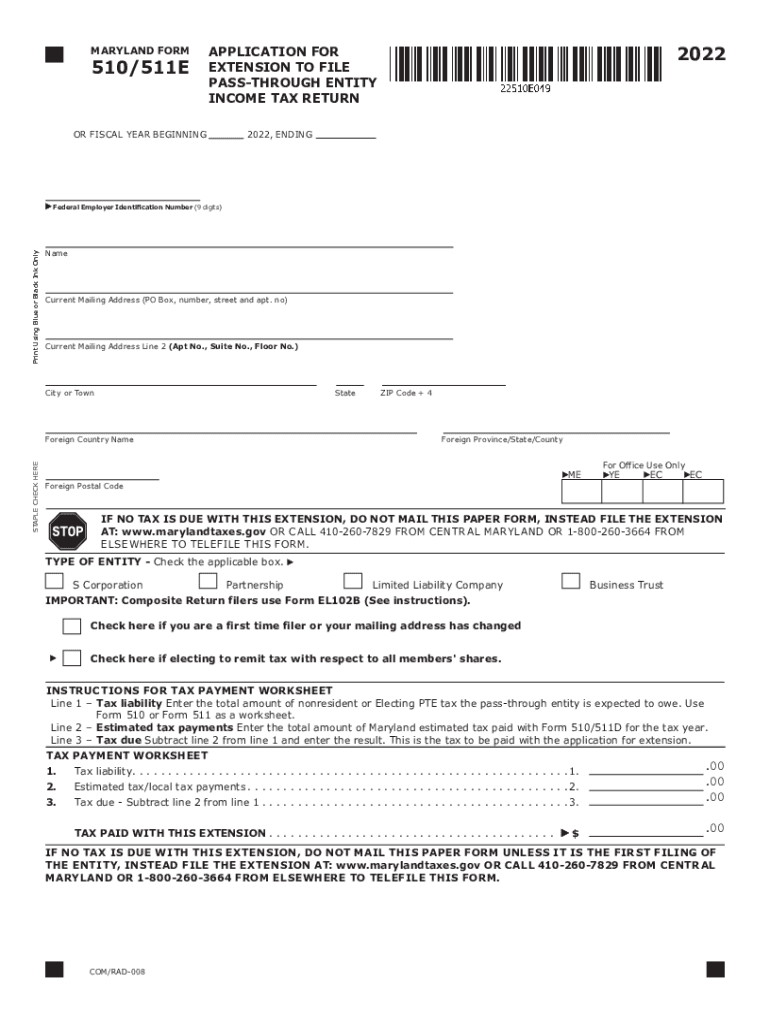

The Maryland Form 510e is a tax form used by non-resident individuals and businesses to report income earned in Maryland. This form is specifically designed for entities that do not reside in Maryland but have income sourced from the state. It helps ensure compliance with Maryland tax laws and facilitates the proper reporting of income for tax purposes.

How to use the Maryland Form 510e

To use the Maryland Form 510e effectively, individuals and businesses should first gather all necessary financial documents, including income statements and any relevant deductions. The form can be filled out online, printed, or completed as a fillable PDF. It is essential to provide accurate information to avoid delays or penalties. Once completed, the form can be submitted electronically or mailed to the appropriate Maryland tax authority.

Steps to complete the Maryland Form 510e

Completing the Maryland Form 510e involves several key steps:

- Download the form from the official Maryland tax website or access it online.

- Fill in personal information, including name, address, and Social Security number.

- Report all income earned in Maryland, ensuring that it is accurately calculated.

- Include any applicable deductions or credits that may apply to your situation.

- Review the completed form for accuracy before submission.

Legal use of the Maryland Form 510e

The Maryland Form 510e is legally required for non-residents who earn income in Maryland. Proper use of this form ensures compliance with state tax regulations. Failing to file this form when required can result in penalties or fines. It is crucial for taxpayers to understand their obligations under Maryland law to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 510e typically align with the federal tax deadlines. Generally, the form must be submitted by April 15 of the following tax year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should stay informed of any changes to these deadlines to ensure timely filing.

Form Submission Methods

The Maryland Form 510e can be submitted in various ways, including:

- Online submission through the Maryland Comptroller's website.

- Mailing a printed copy to the designated tax office.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help streamline the filing process and ensure that the form is received on time.

Quick guide on how to complete maryland form 510e fill online printable fillable blank

Prepare Maryland Form 510e Fill Online, Printable, Fillable, Blank seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Maryland Form 510e Fill Online, Printable, Fillable, Blank on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Maryland Form 510e Fill Online, Printable, Fillable, Blank effortlessly

- Obtain Maryland Form 510e Fill Online, Printable, Fillable, Blank and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obfuscate sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from a device of your preference. Alter and eSign Maryland Form 510e Fill Online, Printable, Fillable, Blank to ensure excellent communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form 510e fill online printable fillable blank

Create this form in 5 minutes!

How to create an eSignature for the maryland form 510e fill online printable fillable blank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 510e, and why would I need to fill it online?

The Maryland Form 510e is a tax document used for reporting income and claiming tax credits. Filling the Maryland Form 510e Fill Online, Printable, Fillable, Blank allows for instant access and submission, making the process more efficient and reducing errors associated with handwritten forms.

-

How can I access the Maryland Form 510e Fill Online, Printable, Fillable, Blank?

You can easily access the Maryland Form 510e Fill Online, Printable, Fillable, Blank through airSlate SignNow's user-friendly platform. Simply navigate to the relevant section, and you will find the form ready for online completion or printing.

-

Is there a cost associated with filling out the Maryland Form 510e online?

Using airSlate SignNow to fill out the Maryland Form 510e Fill Online, Printable, Fillable, Blank comes at a minimal cost. The service is designed to be cost-effective, allowing businesses and individuals to save time and money while ensuring compliance.

-

What features does airSlate SignNow offer for the Maryland Form 510e?

airSlate SignNow provides several features for the Maryland Form 510e Fill Online, Printable, Fillable, Blank, including electronic signatures, document editing, and secure cloud storage. These features enhance convenience, ensuring that your forms are completed accurately and efficiently.

-

Can I save my progress while filling the Maryland Form 510e online?

Yes, airSlate SignNow allows you to save your progress while filling out the Maryland Form 510e Fill Online, Printable, Fillable, Blank. This means you can return to your document anytime without losing your entries, helping you manage your time effectively.

-

Is the Maryland Form 510e compatible with other applications?

Absolutely! airSlate SignNow's Maryland Form 510e Fill Online, Printable, Fillable, Blank is compatible with various applications and platforms. This integration capability allows you to streamline your workflow and incorporate the form into your existing business processes.

-

How does airSlate SignNow ensure the security of my Maryland Form 510e?

airSlate SignNow prioritizes security by implementing robust encryption and data protection measures for all documents, including the Maryland Form 510e Fill Online, Printable, Fillable, Blank. You can trust that your sensitive information remains private and secure throughout the process.

Get more for Maryland Form 510e Fill Online, Printable, Fillable, Blank

- Under kansas law there is no liability for an injury to or the death of a participant in form

- Notice of intent to perform individual

- County hereinafter referred to as grantor and a duly organized form

- Agreement between contractor and owner for construction 09 form

- Free independent contractor agreement template word form

- Medical history of horse form

- Company existing under and by virtue of the laws of the state of and having form

- County hereinafter referred to as grantor and a limited liability form

Find out other Maryland Form 510e Fill Online, Printable, Fillable, Blank

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word