Schedule or TSE AP, Oregon Transit Self Employment Tax Apportionment, 150 500 051 2022-2026

What is the Schedule OR TSE AP?

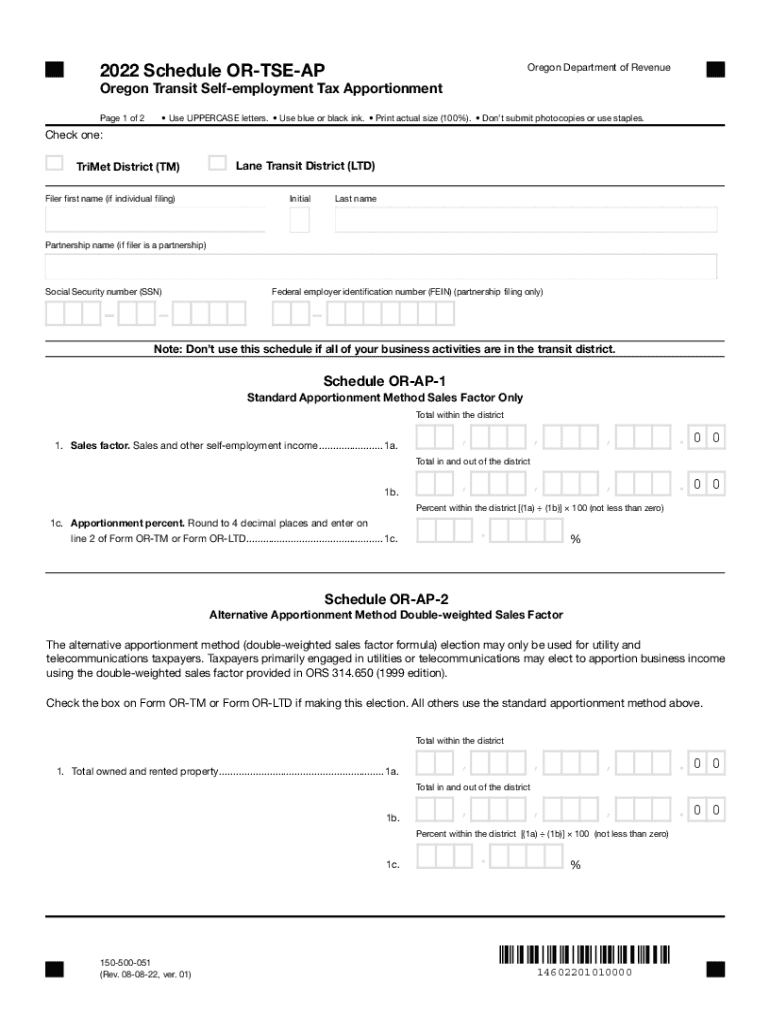

The Schedule OR TSE AP, also known as the Oregon Transit Self-Employment Tax Apportionment, is a specific tax form used by self-employed individuals in Oregon. This form is essential for reporting income generated from self-employment activities, particularly for those who operate within transit districts. The purpose of the form is to calculate the amount of self-employment tax owed based on income earned in various transit districts across the state. Understanding this form is crucial for compliance with Oregon tax regulations.

How to use the Schedule OR TSE AP

Using the Schedule OR TSE AP involves several steps to ensure accurate reporting of self-employment income. First, gather all relevant financial documents, including income statements and expense records. Next, fill out the form by providing your total self-employment income and any applicable deductions. It's important to apportion your income correctly based on the transit districts where you conducted business. Finally, submit the completed form along with your Oregon tax return to ensure compliance with state tax laws.

Steps to complete the Schedule OR TSE AP

Completing the Schedule OR TSE AP requires careful attention to detail. Start by entering your personal information, including your name and Social Security number. Then, report your total self-employment income from all sources. Next, identify the transit districts where you earned this income and apportion it accordingly. Be sure to include any deductions that apply to your situation. After filling out the necessary sections, review the form for accuracy before submission. This thorough approach helps prevent errors that could lead to penalties.

Key elements of the Schedule OR TSE AP

The Schedule OR TSE AP includes several key elements that are vital for accurate tax reporting. These elements consist of personal identification information, total self-employment income, and detailed sections for apportioning income by transit district. Additionally, the form requires the inclusion of any deductions that may apply to your self-employment income. Understanding these components is essential for ensuring that you report your taxes correctly and comply with Oregon's tax requirements.

State-specific rules for the Schedule OR TSE AP

Oregon has specific rules governing the use of the Schedule OR TSE AP. These rules dictate how self-employment income should be reported and apportioned based on the transit districts in which the income was earned. It is important to be aware of these regulations, as they can affect the amount of tax owed. Additionally, staying informed about any changes to state tax laws can help ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule OR TSE AP align with Oregon's tax return deadlines. Typically, self-employed individuals must file their state tax returns by April fifteenth of each year. However, if you require an extension, it is crucial to file the necessary paperwork to avoid late penalties. Keeping track of these important dates helps ensure that your tax obligations are met in a timely manner.

Quick guide on how to complete schedule or tse ap oregon transit self employment tax apportionment 150 500 051

Complete Schedule OR TSE AP, Oregon Transit Self employment Tax Apportionment, 150 500 051 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Schedule OR TSE AP, Oregon Transit Self employment Tax Apportionment, 150 500 051 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Schedule OR TSE AP, Oregon Transit Self employment Tax Apportionment, 150 500 051 effortlessly

- Find Schedule OR TSE AP, Oregon Transit Self employment Tax Apportionment, 150 500 051 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Edit and eSign Schedule OR TSE AP, Oregon Transit Self employment Tax Apportionment, 150 500 051 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule or tse ap oregon transit self employment tax apportionment 150 500 051

Create this form in 5 minutes!

How to create an eSignature for the schedule or tse ap oregon transit self employment tax apportionment 150 500 051

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to or tse ap?

airSlate SignNow is a robust digital solution that allows businesses to send, sign, and manage documents electronically. With or tse ap, users can streamline their document workflows, ensuring efficient processing and reducing turnaround times signNowly.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and varies based on the chosen plan. All pricing plans are designed to cater to businesses of any size looking for an or tse ap solution that fits within their budget while providing essential features.

-

What features does airSlate SignNow offer?

airSlate SignNow comes packed with features such as document templates, team collaboration, and real-time tracking. The platform is built around enhancing your or tse ap experience, making it easier to manage document signing and approvals.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage solutions. This feature ensures that your or tse ap processes remain interconnected, enhancing productivity and data flow.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures such as encryption and compliance with industry standards to protect your sensitive documents. This commitment to security is vital for businesses relying on or tse ap to handle confidential information.

-

How does airSlate SignNow improve productivity for businesses?

By automating document workflows, airSlate SignNow signNowly reduces the time spent on manual tasks. This efficiency allows teams to focus on core activities, enhancing productivity while using the or tse ap platform for document management.

-

Is there a trial version of airSlate SignNow available?

Yes, airSlate SignNow offers a free trial for new users to explore its features and capabilities without any commitments. This is an excellent opportunity to see how or tse ap can transform your document management practices.

Get more for Schedule OR TSE AP, Oregon Transit Self employment Tax Apportionment, 150 500 051

Find out other Schedule OR TSE AP, Oregon Transit Self employment Tax Apportionment, 150 500 051

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors