or Tse Ap 2015

What is the Or Tse Ap

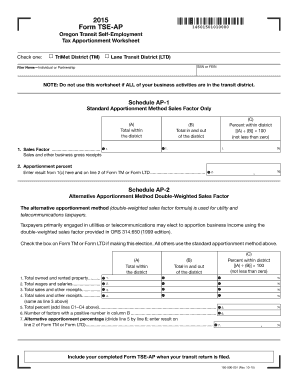

The Or Tse Ap, also known as the Schedule OR-TSE AP, is a tax form used by individuals and businesses in the United States to report specific income and expenses related to their operations. This form is particularly relevant for those who need to disclose details about their tax obligations and ensure compliance with IRS regulations. It serves as a crucial tool for accurately calculating tax liabilities and reporting income from various sources.

How to use the Or Tse Ap

Using the Or Tse Ap involves filling out the form with accurate financial information. Taxpayers should gather all necessary documents, including income statements, expense receipts, and any other relevant financial records. Once the information is compiled, individuals can complete the form by entering data in the designated sections. It is essential to review the form for accuracy before submission to avoid potential penalties or delays in processing.

Steps to complete the Or Tse Ap

Completing the Or Tse Ap requires a systematic approach:

- Gather all necessary financial documents, including income and expense records.

- Download the Or Tse Ap form from the IRS website or obtain a physical copy.

- Fill in your personal and business information as required.

- Report all applicable income and expenses in the designated sections.

- Review the completed form for accuracy and completeness.

- Submit the form by the appropriate deadline, whether electronically or by mail.

Legal use of the Or Tse Ap

The Or Tse Ap is legally recognized by the IRS and must be used in accordance with federal tax laws. Accurate reporting on this form is essential to comply with tax regulations and avoid legal repercussions. Taxpayers should ensure that all information provided is truthful and complete, as inaccuracies can lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Or Tse Ap typically align with the general tax filing deadlines in the United States. Taxpayers should be aware of these key dates:

- April 15: Standard deadline for individual tax returns.

- October 15: Extended deadline for filing, if an extension has been requested.

It is important to file on time to avoid late fees and interest on unpaid taxes.

Required Documents

To complete the Or Tse Ap accurately, taxpayers need to gather several key documents:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Bank statements and financial records related to income.

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete or tse ap

Effortlessly Prepare Or Tse Ap on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Or Tse Ap on any device with airSlate SignNow’s Android or iOS applications and simplify any document-focused process today.

How to Edit and eSign Or Tse Ap with Ease

- Find Or Tse Ap and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Or Tse Ap and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct or tse ap

Create this form in 5 minutes!

How to create an eSignature for the or tse ap

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to schedule or tse ap with airSlate SignNow?

To schedule or tse ap with airSlate SignNow, simply log into your account and navigate to the scheduling feature. You can set up reminders and notifications to ensure that all parties are aware of the signing timeline. This streamlined process helps you manage your documents efficiently.

-

How much does it cost to schedule or tse ap using airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that allows you to schedule or tse ap without breaking the bank. Each plan includes features that enhance your document management experience.

-

What features does airSlate SignNow offer for scheduling or tse ap?

airSlate SignNow provides a range of features for scheduling or tse ap, including customizable templates, automated reminders, and real-time tracking. These features ensure that your documents are signed promptly and securely. You can also integrate with other tools to enhance your workflow.

-

Can I integrate airSlate SignNow with other applications to schedule or tse ap?

Yes, airSlate SignNow supports integration with various applications, allowing you to schedule or tse ap seamlessly. You can connect it with CRM systems, cloud storage, and other productivity tools. This integration helps streamline your document management process.

-

What are the benefits of using airSlate SignNow to schedule or tse ap?

Using airSlate SignNow to schedule or tse ap offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform is user-friendly, making it easy for all parties to sign documents electronically. This can signNowly improve your business operations.

-

Is airSlate SignNow secure for scheduling or tse ap?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents when you schedule or tse ap. This includes encryption, secure access controls, and compliance with industry standards. You can trust that your sensitive information is safe.

-

How can I get support for scheduling or tse ap with airSlate SignNow?

If you need support for scheduling or tse ap with airSlate SignNow, you can access a variety of resources. The platform offers a comprehensive help center, live chat, and email support. Our team is dedicated to assisting you with any questions or issues you may encounter.

Get more for Or Tse Ap

- Missouri standardized credentialling form state legal forms

- Attachment j6 small business subcontracting plan hanford site hanford form

- Complaint for divorce tennessee bar association tba form

- Application for term conversion liberty national life form

- Axis bank kyc formpdffillercom

- Form 14 expense voucher score score

- Content form 33159258

- Decisions regarding assessment participation and designated supports form

Find out other Or Tse Ap

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document