Form 1099 LS Rev April 2025-2026

What is the Form 1099 LS Rev April

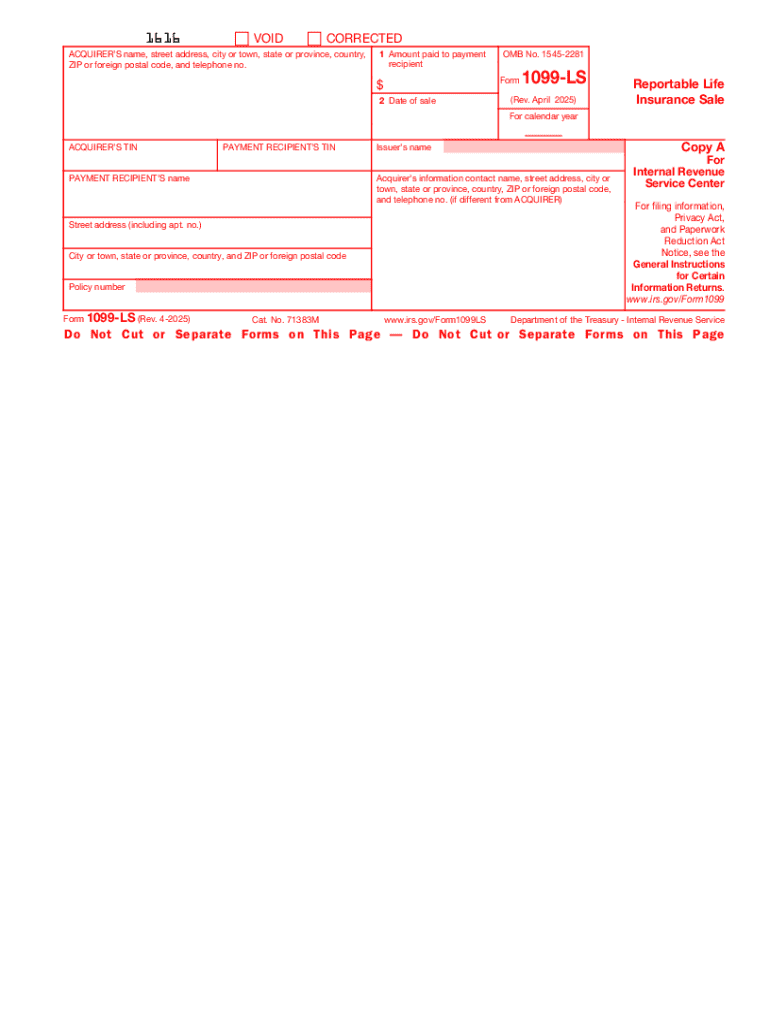

The Form 1099 LS Rev April is a tax document used in the United States to report certain transactions involving life insurance contracts. Specifically, this form is utilized when a life insurance policy is sold or transferred, and it is essential for both the seller and the buyer to accurately report these transactions to the Internal Revenue Service (IRS). This form ensures that all parties comply with tax regulations regarding the gains or losses associated with the transfer of life insurance policies.

How to use the Form 1099 LS Rev April

Using the Form 1099 LS Rev April involves several steps. First, the issuer of the form must complete it with accurate details regarding the transaction, including the names and addresses of both the seller and buyer, the policy number, and the amount involved in the sale. Once completed, the issuer sends one copy to the IRS and another to the recipient. Recipients must then use the information provided on the form when filing their taxes to ensure proper reporting of income or losses related to the life insurance transaction.

Steps to complete the Form 1099 LS Rev April

Completing the Form 1099 LS Rev April requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the names, addresses, and taxpayer identification numbers (TINs) of both parties involved in the transaction.

- Fill in the policy number and the amount received from the sale of the life insurance policy.

- Ensure all information is accurate and complete to avoid issues with the IRS.

- Submit the form to the IRS by the specified deadline, typically by the end of February for paper filings or by the end of March for electronic submissions.

- Provide a copy of the completed form to the recipient for their records.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1099 LS Rev April. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties. The form must be filed accurately, and any discrepancies can lead to audits or fines. The IRS also outlines the deadlines for submission, which vary depending on whether the form is filed electronically or by mail. Familiarizing oneself with these guidelines helps ensure a smooth filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 LS Rev April are critical to avoid penalties. Typically, the form must be submitted to the IRS by February twenty-eight if filed on paper, or by March thirty-one if filed electronically. Recipients should receive their copies by the same deadlines. It is important to keep track of these dates to ensure timely compliance with IRS regulations and to avoid any potential issues related to late filings.

Penalties for Non-Compliance

Failure to file the Form 1099 LS Rev April correctly or on time can result in significant penalties. The IRS imposes fines based on how late the form is filed, with higher penalties for forms that are filed more than thirty days late. Additionally, if the information provided is incorrect, the issuer may face penalties for each incorrect form submitted. Understanding these consequences underscores the importance of accurate and timely filing.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 ls rev april

Create this form in 5 minutes!

How to create an eSignature for the form 1099 ls rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 LS Rev April?

Form 1099 LS Rev April is a tax form used to report certain transactions involving the sale or exchange of property. It is essential for businesses to accurately complete this form to comply with IRS regulations. Using airSlate SignNow, you can easily eSign and send Form 1099 LS Rev April, ensuring a smooth filing process.

-

How does airSlate SignNow help with Form 1099 LS Rev April?

airSlate SignNow streamlines the process of preparing and signing Form 1099 LS Rev April. Our platform allows you to create, edit, and eSign documents quickly, reducing the time spent on paperwork. This efficiency helps businesses stay organized and compliant with tax regulations.

-

What are the pricing options for using airSlate SignNow for Form 1099 LS Rev April?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when handling Form 1099 LS Rev April. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Can I integrate airSlate SignNow with other software for Form 1099 LS Rev April?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Form 1099 LS Rev April alongside your existing tools. This integration enhances your workflow and ensures that all your documents are in one place. Popular integrations include CRM systems, accounting software, and cloud storage services.

-

What features does airSlate SignNow offer for managing Form 1099 LS Rev April?

airSlate SignNow provides a range of features to assist with Form 1099 LS Rev April, including customizable templates, secure eSigning, and document tracking. These features simplify the process of preparing and sending tax forms, ensuring that you can focus on your business operations. Additionally, our platform is user-friendly, making it accessible for all team members.

-

Is airSlate SignNow secure for handling Form 1099 LS Rev April?

Absolutely! airSlate SignNow prioritizes security, especially when dealing with sensitive documents like Form 1099 LS Rev April. Our platform employs advanced encryption and compliance measures to protect your data. You can trust that your information is safe while using our eSigning services.

-

How can airSlate SignNow improve the efficiency of filing Form 1099 LS Rev April?

By using airSlate SignNow, businesses can signNowly improve the efficiency of filing Form 1099 LS Rev April. Our platform automates many aspects of document management, reducing manual errors and saving time. This allows you to focus on more critical tasks while ensuring timely submissions to the IRS.

Get more for Form 1099 LS Rev April

- City of laguna niguel plumbing contract services request for form

- Garages walls floors or other structures form

- Sizeweight form

- Wiring form

- Will be taped and form

- County state of new jersey said property being described as follows type form

- If you have any questions about this notice contact an form

- Undersigned as sellers and as buyers which contract form

Find out other Form 1099 LS Rev April

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed