File This Tax Return between October 1 and December 31 with the above County Tax Office 2023

Understanding the Alabama Business Personal Property Return

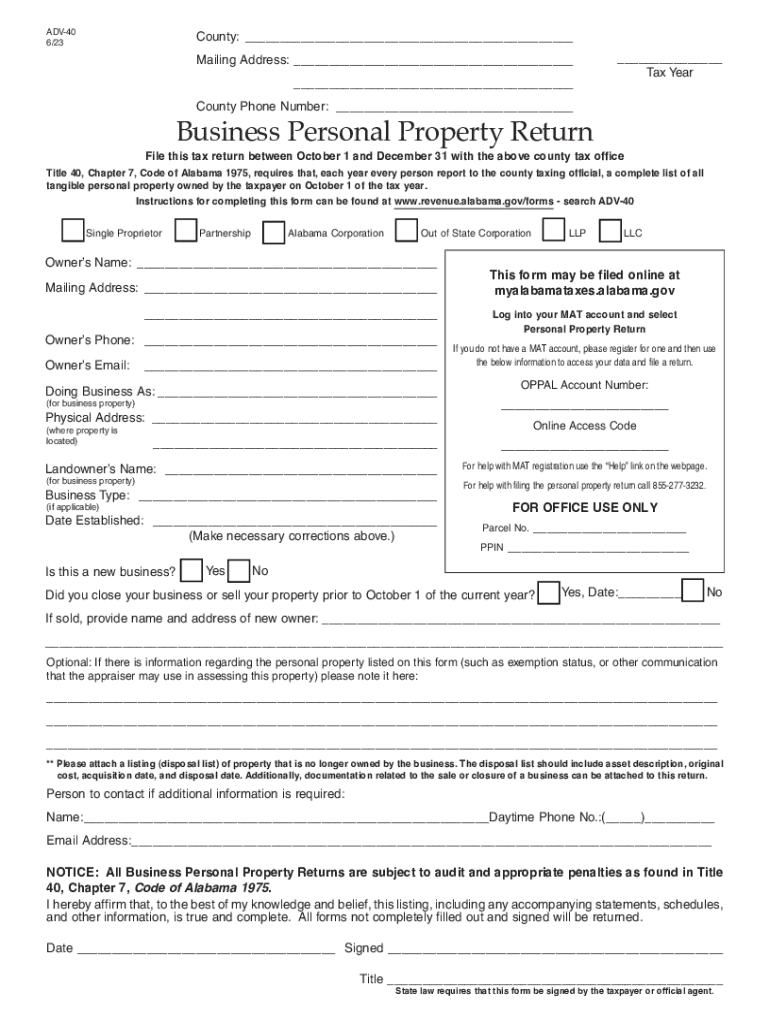

The Alabama business personal property return, commonly referred to as the ADV40, is a crucial document for businesses operating in Alabama. This form is used to report the value of personal property owned by a business to the local tax authorities. It is essential for ensuring compliance with state tax laws and for the accurate assessment of property taxes. The ADV40 must be filed annually, typically between October 1 and December 31, to avoid penalties.

Eligibility Criteria for Filing the ADV40

To be eligible to file the ADV40, businesses must own personal property that is subject to taxation in Alabama. This includes items such as machinery, equipment, furniture, and fixtures used in the course of business operations. Businesses must also ensure they are registered with the appropriate local tax office and have an established physical presence in Alabama. Understanding these criteria is vital for accurate reporting and compliance.

Steps to Complete the ADV40

Completing the ADV40 involves several key steps:

- Gather necessary documentation, including purchase invoices and previous tax returns.

- Accurately assess the value of all personal property owned by the business.

- Fill out the ADV40 form, providing detailed information about the property and its value.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate county tax office by the deadline.

Following these steps helps ensure that the filing process is smooth and compliant with state regulations.

Filing Deadlines for the ADV40

The ADV40 must be filed annually between October 1 and December 31. It is important for businesses to mark these dates on their calendars to avoid late filings. Missing the deadline can result in penalties and interest charges, which can add to the overall tax liability. Therefore, timely submission is crucial for maintaining compliance.

Penalties for Non-Compliance with the ADV40

Failure to file the ADV40 on time can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from local tax authorities. Non-compliance can also affect the business's ability to operate legally within the state. Understanding these consequences emphasizes the importance of adhering to filing requirements.

Form Submission Methods for the ADV40

Businesses have several options for submitting the ADV40 form. The form can be filed online through the appropriate county tax office website, mailed directly to the tax office, or submitted in person. Each method has its own advantages, such as convenience for online submissions or the ability to receive immediate confirmation when filing in person. Choosing the right method can streamline the filing process.

Quick guide on how to complete file this tax return between october 1 and december 31 with the above county tax office

Effortlessly Prepare File This Tax Return Between October 1 And December 31 With The Above County Tax Office on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the right format and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle File This Tax Return Between October 1 And December 31 With The Above County Tax Office on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign File This Tax Return Between October 1 And December 31 With The Above County Tax Office seamlessly

- Acquire File This Tax Return Between October 1 And December 31 With The Above County Tax Office and click on Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your document, whether by email, text (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign File This Tax Return Between October 1 And December 31 With The Above County Tax Office and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct file this tax return between october 1 and december 31 with the above county tax office

Create this form in 5 minutes!

How to create an eSignature for the file this tax return between october 1 and december 31 with the above county tax office

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is adv40 and how does it relate to airSlate SignNow?

Adv40 is a unique identifier used to denote specific features and benefits of the airSlate SignNow platform. This designation helps users to easily find relevant information regarding the software's capabilities and advantages, particularly in handling document e-signatures and workflows.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow starts at a competitive rate, making it an affordable choice for businesses of all sizes. You can discover the various subscription tiers and their associated features, ensuring you select the best plan that meets your needs in relation to adv40 specifics.

-

What are the key features of airSlate SignNow?

AirSlate SignNow offers an array of powerful features, including e-signatures, document templates, and collaborative editing. The platform is designed to enhance productivity with features that address the unique challenges businesses face, embodying the adv40 standard of excellence in digital document management.

-

How can I benefit from using airSlate SignNow?

Using airSlate SignNow can signNowly streamline your document workflows, ensuring quicker turnaround times and improved accuracy. The adv40 capabilities allow you to reduce paper usage and administrative overhead, providing a more eco-friendly and efficient solution for your business.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integration capabilities with various third-party applications, including CRM and project management tools. This interoperability aligns with the adv40 framework, empowering businesses to seamlessly connect their existing systems for enhanced efficiency.

-

Is there a mobile app for airSlate SignNow?

AirSlate SignNow provides a mobile application that enables users to manage documents on the go. This ensures that the advantages of the adv40 system are accessible anytime, anywhere, allowing for real-time collaboration and e-signing from mobile devices.

-

What types of documents can I sign with airSlate SignNow?

With airSlate SignNow, you can sign various document types, including contracts, agreements, and forms. This versatility is a key component of the adv40 designation, as it caters to the diverse needs of businesses looking to simplify their document handling processes.

Get more for File This Tax Return Between October 1 And December 31 With The Above County Tax Office

- Loyalty oath form oklahoma secretary of state state of oklahoma sos ok

- 740 ez kentucky fillable form

- Staff exiting procedures checklist curtin university form

- Level 2 reading task answer booklet and mark scheme ocr marjon ac form

- Fidelitycomgotoddnumber form

- How do i reset a form social msdn microsoft com

- Residential lease contract template form

- Room lease contract template form

Find out other File This Tax Return Between October 1 And December 31 With The Above County Tax Office

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template