County Phone Number 2022

Required Documents for Alabama Personal Property Return

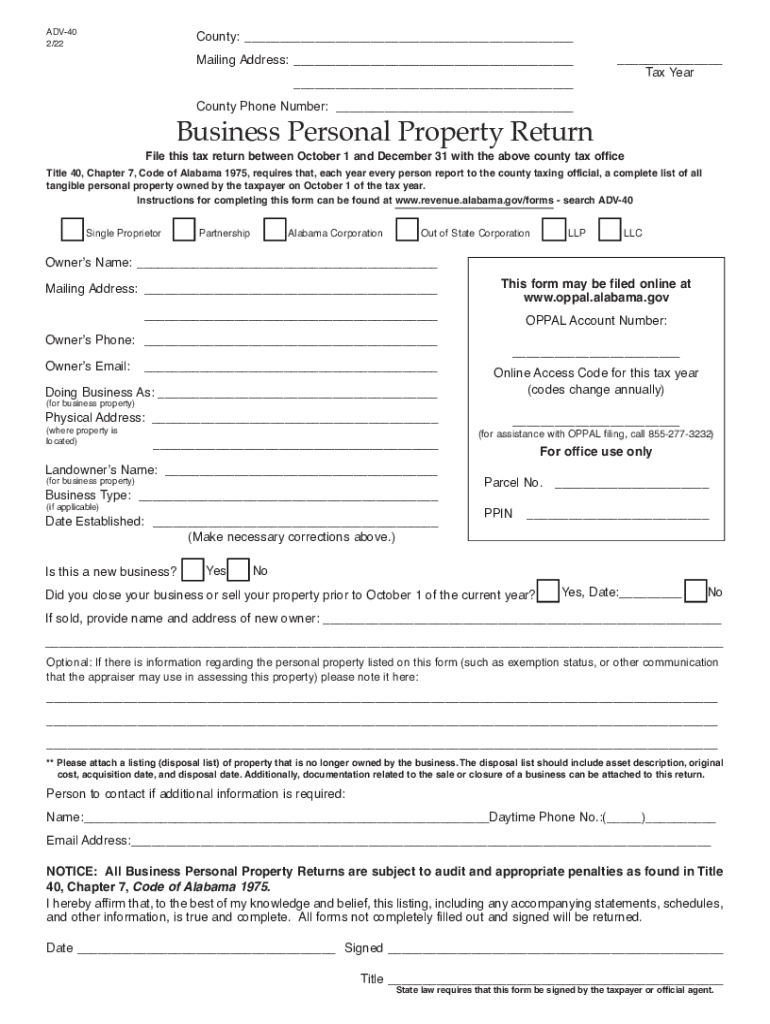

To complete the Alabama personal property return, specific documents are necessary to ensure accurate reporting. These documents typically include:

- Proof of ownership for all personal property, such as purchase receipts or titles.

- Previous year’s personal property return, if applicable, to provide a basis for comparison.

- Inventory lists detailing the types and values of personal property owned.

- Any relevant business documents, if the property is associated with a business entity.

Gathering these documents beforehand can streamline the filing process and help avoid potential issues with compliance.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the Alabama personal property return is crucial for compliance. The typical deadline for submitting the return is April 1 of each year. Late submissions may incur penalties. It is advisable to check with local county offices for any specific dates that may vary based on jurisdiction.

Additionally, some counties may offer extensions under certain circumstances, but these must be formally requested. Staying informed about these dates helps ensure timely and accurate filing.

Form Submission Methods

The Alabama personal property return can be submitted through various methods, providing flexibility for filers. The available submission methods include:

- Online: Many counties offer online filing options through their official websites, allowing for quick and efficient submission.

- Mail: Filers can print the completed form and send it via postal mail to the appropriate county office.

- In-Person: Submissions can also be made in person at the local county tax assessor’s office.

Selecting the most convenient method can help ensure that the return is filed correctly and on time.

Penalties for Non-Compliance

Failure to file the Alabama personal property return by the deadline can result in penalties. The penalties may include:

- Late fees, which can accumulate over time.

- Potential assessment of property taxes based on estimated values, which may be higher than actual values.

- Legal repercussions, including liens against property for continued non-compliance.

Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary costs.

Eligibility Criteria

Eligibility to file the Alabama personal property return typically includes individuals and businesses that own tangible personal property within the state. This includes:

- Individuals who own personal property such as vehicles, boats, or equipment.

- Businesses, including sole proprietorships, partnerships, and corporations, that possess personal property used in their operations.

It is essential to review local regulations, as specific criteria may vary by county.

Who Issues the Form

The Alabama personal property return form is issued by the local county tax assessor's office. Each county may have its own version of the form, so it is important to obtain the correct form specific to your county. This ensures that all local requirements are met and that the form is properly processed.

Quick guide on how to complete county phone number

Complete County Phone Number effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage County Phone Number on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to edit and eSign County Phone Number with minimal effort

- Obtain County Phone Number and select Get Form to begin.

- Use the tools available to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign County Phone Number and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct county phone number

Create this form in 5 minutes!

How to create an eSignature for the county phone number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Alabama personal property return?

An Alabama personal property return is a document that individuals and businesses in Alabama submit to report their personal property for tax purposes. This return helps local governments assess property taxes accurately. Understanding this process is essential for compliance and to avoid penalties.

-

How can airSlate SignNow help with Alabama personal property returns?

airSlate SignNow streamlines the process of completing and submitting Alabama personal property returns by allowing users to eSign and send documents efficiently. Our platform enhances accuracy and minimizes delays, ensuring that your returns are submitted on time. This can save you time and reduce the hassle associated with traditional paperwork.

-

Are there any fees associated with filing an Alabama personal property return using airSlate SignNow?

While airSlate SignNow offers various pricing plans, there are no additional fees specifically for filing an Alabama personal property return. Users can select a plan that fits their needs, ensuring they have access to essential features at a cost-effective rate. Be sure to check out our pricing page for detailed information on our packages.

-

What features does airSlate SignNow offer for managing documents related to Alabama personal property returns?

airSlate SignNow provides a variety of features, such as customizable templates, secure eSigning, and document tracking, which are invaluable for managing Alabama personal property returns. These tools ensure that your documentation is organized and easily accessible throughout the filing process. This power helps simplify compliance with state requirements.

-

Can I integrate airSlate SignNow with other software for my Alabama personal property return needs?

Yes, airSlate SignNow integrates seamlessly with various software solutions, allowing you to manage your Alabama personal property return alongside other business processes. This integration can improve your workflow efficiency and data accuracy. Popular integrations include cloud storage services and accounting software.

-

Is airSlate SignNow secure for processing Alabama personal property returns?

Absolutely! airSlate SignNow is committed to data security, implementing advanced encryption protocols to safeguard sensitive information related to your Alabama personal property returns. Users can have confidence that their data is protected throughout the signing and submission process.

-

What benefits can I expect from using airSlate SignNow for Alabama personal property returns?

By using airSlate SignNow for your Alabama personal property returns, you can expect increased efficiency, reduced paperwork, and improved accuracy. Our cloud-based platform facilitates remote access, enabling users to manage returns from anywhere. Additionally, the electronic signature feature speeds up the approval process and helps maintain compliance.

Get more for County Phone Number

Find out other County Phone Number

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free