Alabama Form Adv 40 2019

What is the Alabama Form Adv 40

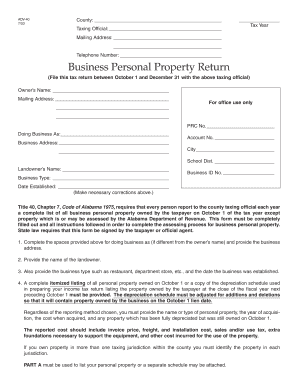

The Alabama Form Adv 40 is a tax form used by businesses in Alabama to report and pay their business privilege tax. This form is essential for maintaining compliance with state tax regulations. It is designed for various business entities, including corporations, limited liability companies (LLCs), and partnerships. The form provides a structured way for businesses to disclose their taxable income and calculate the amount owed to the state.

How to use the Alabama Form Adv 40

To effectively use the Alabama Form Adv 40, businesses must first gather all necessary financial information, including revenue figures and any applicable deductions. The form requires details about the entity, such as its name, address, and federal identification number. Once the relevant information is collected, businesses can fill out the form accurately, ensuring that all figures are correct to avoid penalties. After completing the form, it should be submitted to the appropriate state department for processing.

Steps to complete the Alabama Form Adv 40

Completing the Alabama Form Adv 40 involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Provide the business's legal name, address, and federal identification number.

- Calculate the total revenue and any allowable deductions.

- Fill in the form accurately, ensuring all calculations are correct.

- Review the form for completeness and accuracy.

- Submit the completed form to the Alabama Department of Revenue by the deadline.

Legal use of the Alabama Form Adv 40

The Alabama Form Adv 40 is legally binding when completed and submitted in accordance with state regulations. For the form to be valid, it must be signed by an authorized representative of the business. Additionally, the information provided must be truthful and accurate, as any discrepancies could lead to penalties or legal issues. Utilizing a reliable eSignature solution can ensure that the submission process meets legal requirements for electronic documents.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Form Adv 40 are crucial for compliance. Typically, businesses must file the form annually, with the due date often set for April 15 of each year. However, specific deadlines may vary based on the business's fiscal year. It is important for businesses to stay informed about any changes to these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Alabama Form Adv 40 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Alabama Department of Revenue's website, which allows for quick processing.

- Mailing the completed form to the designated address provided by the state.

- In-person submission at local tax offices for those who prefer direct interaction.

Who Issues the Form

The Alabama Department of Revenue is the official body responsible for issuing the Alabama Form Adv 40. This department oversees the collection of business privilege taxes and ensures that businesses comply with state tax laws. They provide guidance and resources to assist businesses in understanding their tax obligations and completing the form accurately.

Quick guide on how to complete alabama form adv 40

Complete Alabama Form Adv 40 effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and safely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Alabama Form Adv 40 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign Alabama Form Adv 40 without any hassle

- Find Alabama Form Adv 40 and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you prefer to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Adjust and eSign Alabama Form Adv 40 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama form adv 40

Create this form in 5 minutes!

How to create an eSignature for the alabama form adv 40

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is adv 40 and how does it relate to airSlate SignNow?

Adv 40 refers to advanced features offered by airSlate SignNow that enhance electronic signatures and document management. These features are designed to help businesses streamline their workflows, ensuring that users can easily send, sign, and manage documents efficiently.

-

How much does airSlate SignNow cost for users interested in adv 40 features?

Pricing for airSlate SignNow, including the adv 40 features, varies based on the subscription plan you choose. We offer flexible pricing tiers that cater to different business sizes and needs, allowing you to select the plan that provides the best value for your organization.

-

What key features are included in the adv 40 package?

The adv 40 package includes essential features like templates, real-time tracking, customizable workflows, and robust security measures. These features empower businesses to enhance their eSigning processes and improve overall productivity.

-

What are the benefits of using airSlate SignNow’s adv 40 for my business?

Using airSlate SignNow’s adv 40 can lead to signNow time savings and increased efficiency in document handling. By automating workflows and simplifying the signing process, organizations can reduce operational costs and improve customer satisfaction.

-

Can airSlate SignNow with adv 40 integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enabling users to incorporate adv 40 features into their existing systems. This facilitates smoother data transfer and enhances overall workflow automation across platforms.

-

Is there a free trial available for the adv 40 features of airSlate SignNow?

Absolutely! airSlate SignNow offers a free trial that allows prospective users to explore the adv 40 features. This trial provides a risk-free way to evaluate how these capabilities can benefit your business before making a commitment.

-

How secure is the document signing process using airSlate SignNow adv 40?

The document signing process with airSlate SignNow’s adv 40 features is highly secure, adhering to industry standards for data protection. Our encryption protocols and authentication methods ensure that all transactions are safe and your information remains confidential.

Get more for Alabama Form Adv 40

- Warfighter refractive surgery information briefing sheet afsc

- Mississippinew voter registration form

- Terminix receipt form

- Petfinder application form

- Job shadow verification broyalb middle school royal wednet form

- Mesacan form

- Commission agreement for sale of a horse pdfpdf form

- Williamson law book form

Find out other Alabama Form Adv 40

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template