Business IncentivesOklahoma Department of Commerce Form

Understanding Oklahoma Sales Tax Exemption

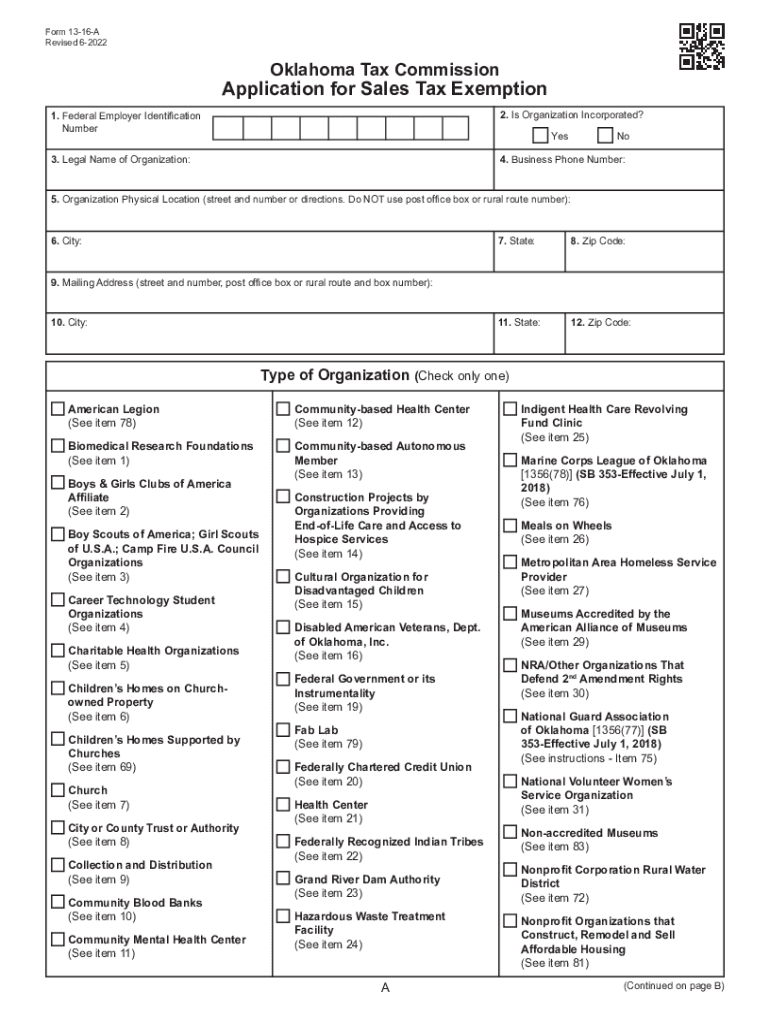

The Oklahoma sales tax exemption allows certain businesses and organizations to purchase goods and services without paying sales tax. This exemption is typically available to non-profit organizations, government entities, and specific types of businesses that meet certain criteria. Understanding the eligibility requirements and the application process is essential for businesses looking to take advantage of this exemption.

Eligibility Criteria for Oklahoma Sales Tax Exemption

To qualify for the Oklahoma sales tax exemption, applicants must meet specific criteria. Generally, the following entities may be eligible:

- Non-profit organizations recognized by the IRS

- Government agencies

- Certain educational institutions

- Religious organizations

Each category may have additional requirements, so it is important to review the specific regulations that apply to your organization.

Required Documents for Application

When applying for the Oklahoma sales tax exemption, certain documents are necessary to support your application. Typically, you will need:

- A completed Oklahoma sales tax exemption form

- Proof of your organization’s non-profit status, such as a 501(c)(3) determination letter

- Identification information, including the Federal Employer Identification Number (FEIN)

Gathering these documents in advance can streamline the application process.

Steps to Complete the Oklahoma Sales Tax Exemption Application

Completing the application for the Oklahoma sales tax exemption involves several key steps:

- Obtain the appropriate exemption form, which can often be found in PDF format from the Oklahoma Tax Commission.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach the necessary documentation to support your application.

- Submit the application either online, by mail, or in person at the designated office.

Following these steps carefully can help ensure your application is processed efficiently.

Form Submission Methods

There are several methods for submitting the Oklahoma sales tax exemption application. Applicants can choose from:

- Online submission through the Oklahoma Tax Commission’s website

- Mailing the completed form and documents to the appropriate office

- Delivering the application in person to a local tax office

Selecting the method that best suits your organization’s needs can facilitate a smoother application process.

Legal Use of the Oklahoma Sales Tax Exemption

It is crucial to understand the legal implications of using the sales tax exemption. The exemption is intended for eligible purchases directly related to the exempt organization’s mission. Misuse of the exemption, such as using it for personal purchases or non-qualifying items, can lead to penalties. Organizations should maintain accurate records of exempt purchases to ensure compliance with state regulations.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Oklahoma sales tax exemption can result in significant penalties. Organizations found to have misused the exemption may face:

- Fines imposed by the Oklahoma Tax Commission

- Repayment of the sales tax that should have been collected

- Potential loss of exemption status

Understanding these penalties highlights the importance of adhering to the guidelines set forth by the state.

Quick guide on how to complete business incentivesoklahoma department of commerce

Complete Business IncentivesOklahoma Department Of Commerce effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Business IncentivesOklahoma Department Of Commerce on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Business IncentivesOklahoma Department Of Commerce with ease

- Obtain Business IncentivesOklahoma Department Of Commerce and select Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, lengthy form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Business IncentivesOklahoma Department Of Commerce and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business incentivesoklahoma department of commerce

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma sales tax exemption process?

The Oklahoma sales tax exemption process allows qualifying businesses to avoid paying sales tax on certain purchases. To benefit from this exemption, businesses must apply for and obtain an exemption certificate from the Oklahoma Tax Commission. Once approved, you can use this certificate to ensure your purchases are exempt from sales tax.

-

How can airSlate SignNow help with Oklahoma sales tax exemption documentation?

airSlate SignNow provides a seamless way to manage and sign Oklahoma sales tax exemption documents electronically. By using our eSignature solution, businesses can quickly create, send, and store exemption certificates, ensuring compliance and streamlined processes. This efficiency is especially beneficial for businesses dealing with multiple transactions requiring documentation.

-

Are there any fees associated with obtaining an Oklahoma sales tax exemption certificate?

Typically, there are no fees for obtaining an Oklahoma sales tax exemption certificate; however, businesses should verify this with the Oklahoma Tax Commission. airSlate SignNow offers affordable pricing plans to help businesses manage their documentation processes without additional costs. Our solution can help eliminate expenses related to paper and postal services.

-

Can airSlate SignNow integrate with accounting software for Oklahoma sales tax exemption?

Yes, airSlate SignNow easily integrates with a variety of accounting software, which helps manage the documentation related to the Oklahoma sales tax exemption. By syncing your eSignature documents with your accounting system, you ensure accurate tracking and reporting of exempt purchases. This integration saves time and reduces the likelihood of errors.

-

What features does airSlate SignNow offer to support businesses navigating Oklahoma sales tax exemption?

airSlate SignNow offers features such as customizable templates, secure eSignatures, and automated workflows specifically designed to facilitate the Oklahoma sales tax exemption process. These tools allow businesses to efficiently manage exemption requests and ensure all documentation is easily accessible. Our platform is built to enhance productivity while maintaining compliance with state tax laws.

-

Is it possible to manage multiple Oklahoma sales tax exemptions with airSlate SignNow?

Absolutely! With airSlate SignNow, businesses can manage multiple Oklahoma sales tax exemptions by creating distinct templates for each exemption type. This organization allows for efficient tracking, easy access, and streamlined processing of all exemption requests. Our solution simplifies the complexity of handling multiple sales tax exemptions.

-

How does airSlate SignNow ensure the security of Oklahoma sales tax exemption documents?

airSlate SignNow takes security seriously, implementing robust encryption and security measures to protect all Oklahoma sales tax exemption documents. Our platform complies with industry standards, ensuring that your sensitive information is secure during the signing process. Businesses can trust airSlate SignNow to keep their documentation safe and confidential.

Get more for Business IncentivesOklahoma Department Of Commerce

- How to file vsp claim messa messa form

- Madaptap form

- Certificate of medical education l2 the medical board of california mbc ca form

- Wi 1a online fillable tax form

- Pet applicationregistration form walnutknollaptcom

- Contact unit verification formeducatorlicensed p

- Pool rental agreement form

- Independent contractor service agreement template form

Find out other Business IncentivesOklahoma Department Of Commerce

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form