Form EF Oklahoma Income Tax Declaration for Electronic Filing 2023

What is the Form EF Oklahoma Income Tax Declaration For Electronic Filing

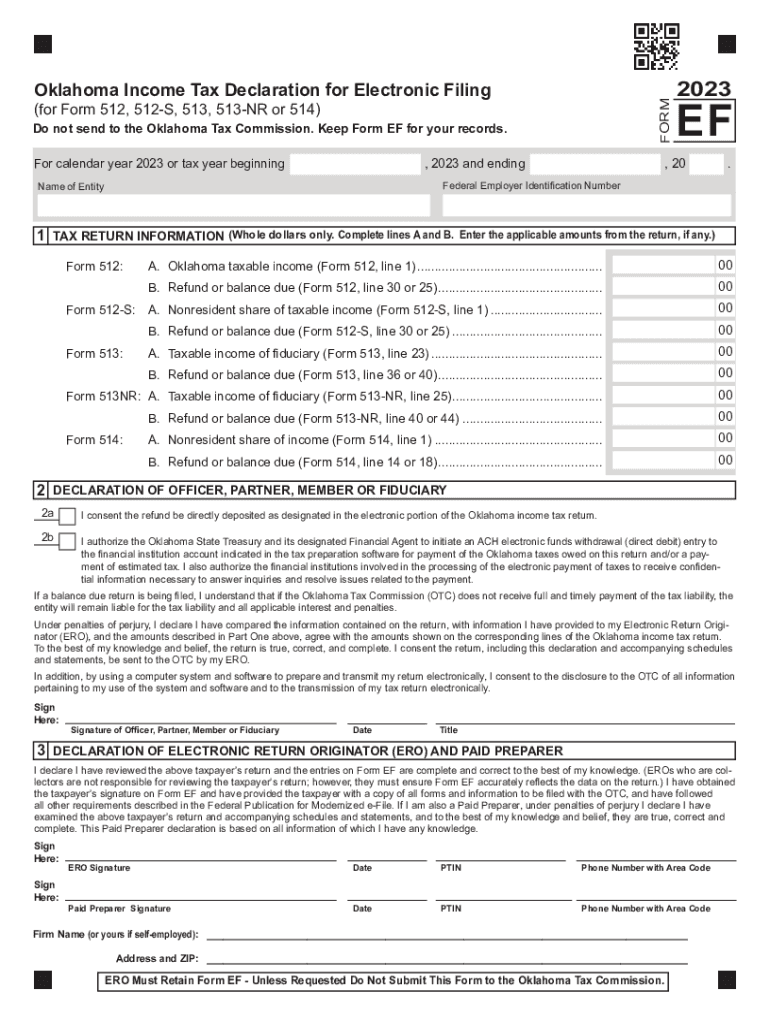

The Form EF Oklahoma Income Tax Declaration for Electronic Filing is a crucial document for taxpayers in Oklahoma who are filing their income tax returns electronically. This form serves as a declaration of the taxpayer's intent to file electronically and provides necessary information to the Oklahoma Tax Commission. It ensures that the submitted electronic return is valid and that the taxpayer acknowledges their responsibility for the accuracy of the information provided.

Steps to complete the Form EF Oklahoma Income Tax Declaration For Electronic Filing

Completing the Form EF requires several steps to ensure accuracy and compliance with Oklahoma tax laws. First, gather all necessary financial documents, including W-2s, 1099s, and any other income-related documentation. Next, enter personal information such as your name, address, and Social Security number. Then, indicate your filing status and report your total income. After filling out the required sections, review the form for accuracy before electronically submitting it alongside your tax return.

Required Documents

To complete the Form EF Oklahoma Income Tax Declaration, several documents are needed to support your income and deductions. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Documentation for deductions, such as mortgage interest statements

- Any other relevant financial records that substantiate your tax return

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form EF is essential to avoid penalties. Typically, the deadline for filing your Oklahoma income tax return is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any updates or changes to these deadlines each tax year.

Legal use of the Form EF Oklahoma Income Tax Declaration For Electronic Filing

The Form EF is legally binding and must be completed accurately to comply with Oklahoma tax regulations. By signing this form, taxpayers affirm that the information provided is true and correct to the best of their knowledge. Misrepresentation or failure to file can lead to penalties, including fines and interest on unpaid taxes.

Key elements of the Form EF Oklahoma Income Tax Declaration For Electronic Filing

Key elements of the Form EF include personal identification information, filing status, total income, and signature fields. Each section is designed to capture essential information that the Oklahoma Tax Commission requires for processing electronic returns. Ensuring that all fields are filled out correctly is critical for the acceptance of your return.

Quick guide on how to complete form ef oklahoma income tax declaration for electronic filing

Complete Form EF Oklahoma Income Tax Declaration For Electronic Filing effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Form EF Oklahoma Income Tax Declaration For Electronic Filing on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Form EF Oklahoma Income Tax Declaration For Electronic Filing without hassle

- Locate Form EF Oklahoma Income Tax Declaration For Electronic Filing and click on Obtain Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Finish button to store your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form EF Oklahoma Income Tax Declaration For Electronic Filing and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ef oklahoma income tax declaration for electronic filing

Create this form in 5 minutes!

How to create an eSignature for the form ef oklahoma income tax declaration for electronic filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration sample, and why is it important?

A tax declaration sample is a template that outlines the necessary information for filing taxes. It's crucial for ensuring accuracy in reporting income and deductions, which can help prevent errors that may lead to audits or penalties.

-

How can airSlate SignNow assist with tax declaration samples?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign tax declaration samples. This streamlines the process, enabling users to efficiently manage their tax documentation with legally binding signatures.

-

Are there any costs associated with using tax declaration samples on airSlate SignNow?

While airSlate SignNow offers a range of plans, many users find the features associated with tax declaration samples to be cost-effective for their business needs. Pricing varies based on features, and you can choose a plan that suits your budget.

-

What features do you offer for managing tax declaration samples?

airSlate SignNow includes a variety of features such as customizable templates, secure eSignature options, and easy document tracking. These features work together to simplify the management of tax declaration samples and enhance user efficiency.

-

Is there a way to integrate airSlate SignNow with other tax software?

Yes, airSlate SignNow supports integration with popular tax software, making it easier to import and export tax declaration samples. This integration streamlines workflows and helps keep your processes organized.

-

What are the benefits of eSigning a tax declaration sample through airSlate SignNow?

eSigning a tax declaration sample through airSlate SignNow ensures that your documents are legally binding and secure. The platform also saves time by allowing you to complete transactions electronically without the need for printing or mailing.

-

Can I customize a tax declaration sample on airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize tax declaration samples to meet their specific needs, adding or removing fields as necessary. This flexibility helps ensure your documents are tailored to your unique requirements.

Get more for Form EF Oklahoma Income Tax Declaration For Electronic Filing

- Fill online line form

- Color wheel harmonydoc form

- Statement of compliance sa form

- Cannacauses form

- Fijian holdings unit trust 446801181 form

- Vp form 820a consent to check and release national

- This notice is for those who did not homeschool in maine during the previous school year maine form

- Independent sale contractor agreement template form

Find out other Form EF Oklahoma Income Tax Declaration For Electronic Filing

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors