Oklahoma Corporate Income Tax Return Form and Schedules 2021

What is the Oklahoma Corporate Income Tax Return form and Schedules

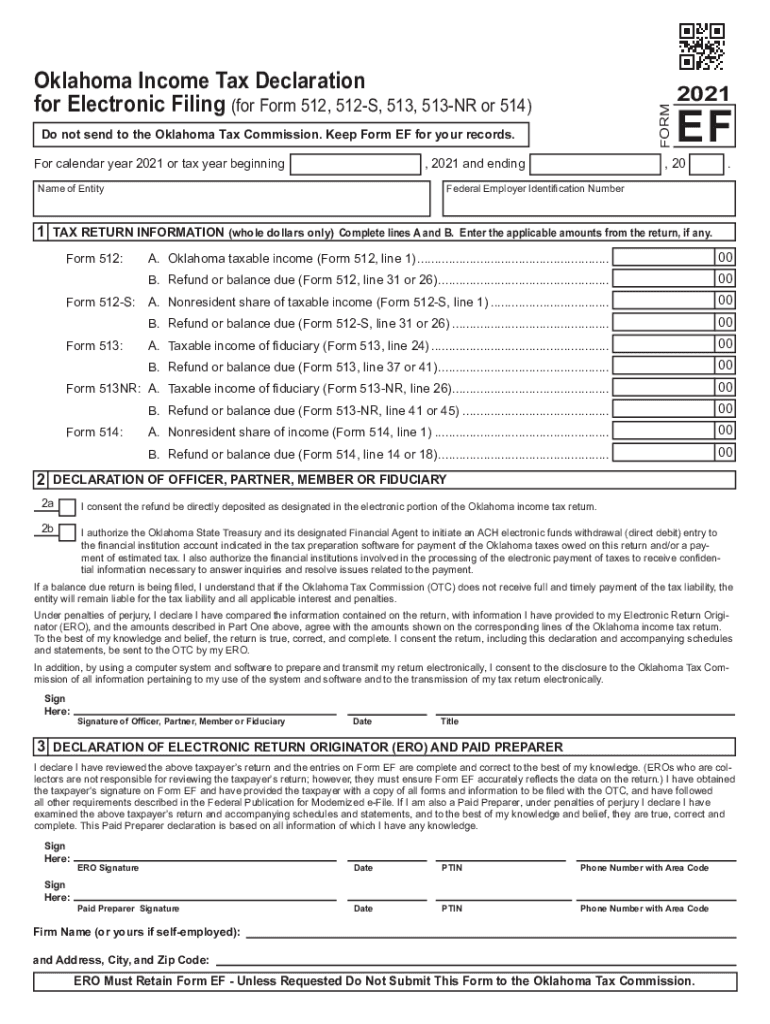

The Oklahoma Corporate Income Tax Return form and Schedules is a crucial document for corporations operating in Oklahoma. This form is used to report the income, deductions, and credits of a corporation to the Oklahoma Tax Commission. The form ensures that businesses comply with state tax regulations and accurately calculate their tax liability. It includes various schedules that provide detailed information about specific income sources, deductions, and credits applicable to the corporation.

How to use the Oklahoma Corporate Income Tax Return form and Schedules

Using the Oklahoma Corporate Income Tax Return form and Schedules involves several steps to ensure accurate completion and compliance. Corporations must first gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Once the required information is collected, businesses can fill out the form by entering their financial data into the appropriate sections. Each schedule must be completed as needed, depending on the corporation's specific tax situation. After completing the form, it is essential to review all entries for accuracy before submission.

Steps to complete the Oklahoma Corporate Income Tax Return form and Schedules

Completing the Oklahoma Corporate Income Tax Return form and Schedules requires careful attention to detail. Here are the steps to follow:

- Gather financial records: Collect all relevant documents, including income statements and balance sheets.

- Fill out the main form: Enter the corporation's income, deductions, and credits in the designated sections.

- Complete applicable schedules: Attach any necessary schedules that provide additional details about income sources or deductions.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the form: File the completed form with the Oklahoma Tax Commission by the designated deadline.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Oklahoma Corporate Income Tax Return form and Schedules. Generally, the tax return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For most corporations operating on a calendar year, this means the return is due by April 15. It is essential to be aware of these deadlines to avoid penalties and ensure timely compliance with state tax regulations.

Legal use of the Oklahoma Corporate Income Tax Return form and Schedules

The Oklahoma Corporate Income Tax Return form and Schedules must be used in accordance with state tax laws to ensure legal compliance. This includes accurately reporting all income and deductions, as well as adhering to the specific requirements outlined by the Oklahoma Tax Commission. Using this form legally involves providing truthful and complete information to avoid potential penalties or legal issues. Additionally, maintaining proper records and documentation is vital for supporting the information reported on the tax return.

Key elements of the Oklahoma Corporate Income Tax Return form and Schedules

Several key elements are essential to the Oklahoma Corporate Income Tax Return form and Schedules. These include:

- Corporate identification: Basic information about the corporation, such as name, address, and federal employer identification number (EIN).

- Income reporting: Detailed reporting of all income sources, including sales revenue and investment income.

- Deductions and credits: Information on allowable deductions and tax credits that can reduce the overall tax liability.

- Signature and verification: A section for authorized representatives to sign and verify the accuracy of the information provided.

Quick guide on how to complete oklahoma corporate income tax return form and schedules

Prepare Oklahoma Corporate Income Tax Return form And Schedules effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without any delays. Manage Oklahoma Corporate Income Tax Return form And Schedules on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign Oklahoma Corporate Income Tax Return form And Schedules without difficulty

- Locate Oklahoma Corporate Income Tax Return form And Schedules and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from your preferred device. Edit and eSign Oklahoma Corporate Income Tax Return form And Schedules and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma corporate income tax return form and schedules

Create this form in 5 minutes!

People also ask

-

What is the Oklahoma Corporate Income Tax Return form and its schedules?

The Oklahoma Corporate Income Tax Return form is a mandatory document for corporations operating in Oklahoma to report their income and tax liability. It includes several schedules that detail various aspects of the corporation's finances, allowing the state to assess the appropriate tax. Completing the Oklahoma Corporate Income Tax Return form and its schedules correctly is crucial for compliance and tax planning.

-

How can airSlate SignNow assist in completing the Oklahoma Corporate Income Tax Return form and schedules?

airSlate SignNow provides an easy-to-use platform to send and eSign documents, including the Oklahoma Corporate Income Tax Return form and schedules. With its user-friendly interface, businesses can streamline their documentation process and ensure that all forms are signed, dated, and organized. This reduces the likelihood of errors and delays in submitting your tax return.

-

What are the pricing plans for using airSlate SignNow for tax document management?

airSlate SignNow offers various pricing plans tailored to meet different business needs, starting with a free trial for new users. Its affordable plans enable businesses of all sizes to efficiently manage their documentation, including the Oklahoma Corporate Income Tax Return form and schedules, without breaking the bank. Investing in airSlate SignNow can save time and reduce the hassle associated with tax filings.

-

Can I integrate airSlate SignNow with my accounting software for the Oklahoma Corporate Income Tax Return form?

Yes, airSlate SignNow seamlessly integrates with a variety of accounting software solutions, facilitating easy access to your Oklahoma Corporate Income Tax Return form and schedules. This integration allows you to pull in data directly, reducing manual entry and improving accuracy. It ensures that you're working with the most up-to-date financial information when filing your tax return.

-

What features help ensure compliance with the Oklahoma Corporate Income Tax Return form?

airSlate SignNow includes features like templates, reminders, and tracking that help ensure compliance with the Oklahoma Corporate Income Tax Return form requirements. The platform allows you to set up automated reminders for filing deadlines and tracks document status, making the entire process efficient. This way, you can focus on your core business while staying compliant with tax obligations.

-

Are there any security measures in place for handling the Oklahoma Corporate Income Tax Return form?

Yes, airSlate SignNow prioritizes the security of your documents, including the Oklahoma Corporate Income Tax Return form and schedules. The platform employs industry-standard encryption and secure access controls to protect sensitive information from unauthorized access. You can trust that your tax documents are handled with the highest security standards.

-

How does eSigning the Oklahoma Corporate Income Tax Return form benefit my business?

eSigning the Oklahoma Corporate Income Tax Return form simplifies and accelerates the signing process for your tax documents. It eliminates the need for physical signatures, which can slow down the filing process, and allows you to gather signatures remotely. This efficiency can help ensure timely submissions and reduce the stress associated with tax deadlines.

Get more for Oklahoma Corporate Income Tax Return form And Schedules

- Mutual wills package with last wills and testaments for married couple with minor children mississippi form

- Legal last will and testament form for married person with adult children mississippi

- Legal last will and testament form for a married person with no children mississippi

- Legal last will and testament form for married person with minor children mississippi

- Mississippi codicil to will form for amending your will will changes or amendments mississippi

- Legal last will and testament form for married person with adult and minor children from prior marriage mississippi

- Legal last will and testament form for married person with adult and minor children mississippi

- Mutual wills package with last wills and testaments for married couple with adult and minor children mississippi form

Find out other Oklahoma Corporate Income Tax Return form And Schedules

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple