Oklahoma Income Tax Declaration OK Gov 2019

What is the Oklahoma Income Tax Declaration OK-512?

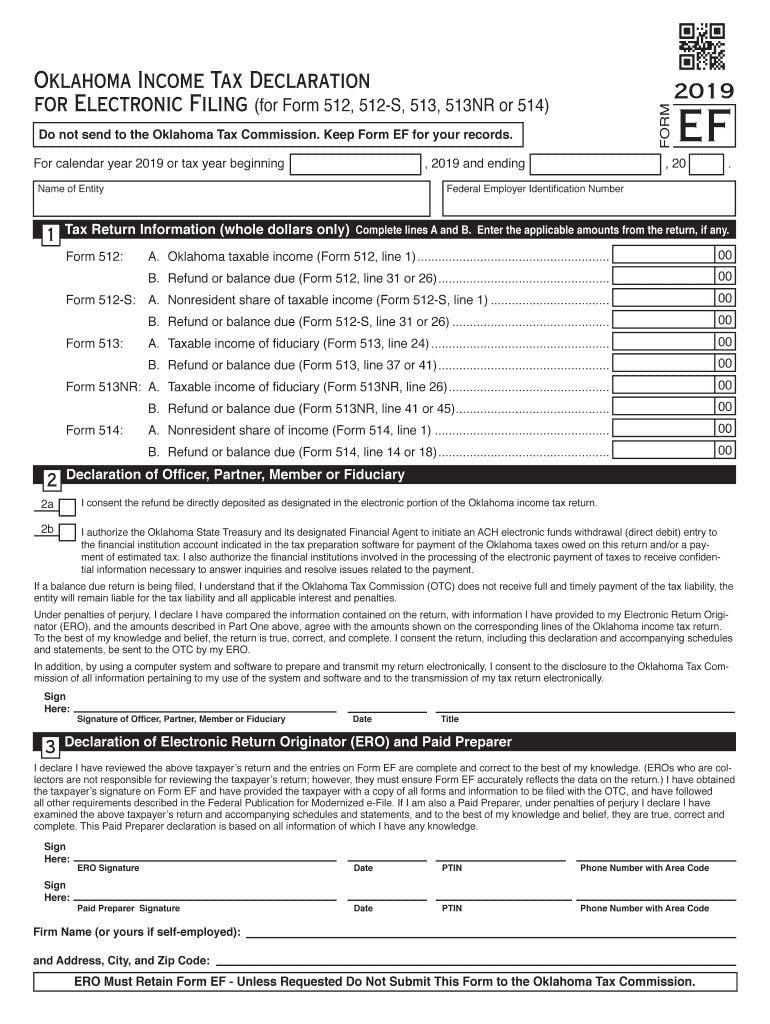

The Oklahoma Income Tax Declaration OK-512 is a form used by residents of Oklahoma to report their income and calculate their state tax liability. This document is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The form provides a structured format for taxpayers to declare their earnings, deductions, and credits, which ultimately determines the amount of tax owed or the refund due. Understanding the purpose of the OK-512 is crucial for accurate tax reporting and compliance.

Steps to Complete the Oklahoma Income Tax Declaration OK-512

Completing the Oklahoma Income Tax Declaration OK-512 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Next, carefully fill out the form, entering personal information, income details, and applicable deductions. It is important to double-check all entries for accuracy. After completing the form, sign and date it before submitting it to the appropriate state tax authority. Finally, keep a copy of the submitted form for your records.

Legal Use of the Oklahoma Income Tax Declaration OK-512

The Oklahoma Income Tax Declaration OK-512 serves as a legally binding document when properly completed and submitted. To ensure its legal standing, the form must adhere to specific guidelines set forth by the Oklahoma Tax Commission. This includes providing accurate information and signatures. Additionally, the form must be submitted within the designated filing period to avoid penalties. Understanding the legal implications of the OK-512 is essential for taxpayers to maintain compliance and avoid potential legal issues.

Required Documents for the Oklahoma Income Tax Declaration OK-512

When preparing to file the Oklahoma Income Tax Declaration OK-512, certain documents are required to ensure accurate reporting. Key documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any additional income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Previous year’s tax return for reference

Having these documents readily available can streamline the process and help ensure that all income and deductions are accurately reported.

Filing Deadlines for the Oklahoma Income Tax Declaration OK-512

Filing deadlines for the Oklahoma Income Tax Declaration OK-512 are crucial for compliance. Typically, the form must be submitted by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes to deadlines that may occur due to state legislation or other factors. Timely submission is essential to avoid penalties and interest on any taxes owed.

Form Submission Methods for the Oklahoma Income Tax Declaration OK-512

The Oklahoma Income Tax Declaration OK-512 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Oklahoma Tax Commission’s website

- Mailing a printed copy of the form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Quick guide on how to complete oklahoma income tax declaration okgov

Complete Oklahoma Income Tax Declaration OK gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Handle Oklahoma Income Tax Declaration OK gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign Oklahoma Income Tax Declaration OK gov with ease

- Locate Oklahoma Income Tax Declaration OK gov and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize essential parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form: via email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of misplaced or lost documents, tedious form searches, and errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Oklahoma Income Tax Declaration OK gov while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma income tax declaration okgov

Create this form in 5 minutes!

People also ask

-

What is the ok 512 plan offered by airSlate SignNow?

The ok 512 plan from airSlate SignNow provides a comprehensive eSigning solution tailored for businesses of all sizes. This plan includes features like document templates, secure storage, and customizable workflows, making it ideal for streamlining your document management process.

-

How much does the ok 512 plan cost?

The pricing for the ok 512 plan is competitive and designed to fit various budgets. airSlate SignNow offers flexible payment options, and you can check their website for the most up-to-date pricing information and any promotional offers.

-

What features are included in the ok 512 plan?

The ok 512 plan includes essential features such as unlimited eSignatures, document tracking, team collaboration tools, and advanced security measures. This allows businesses to manage, send, and sign documents efficiently while maintaining compliance.

-

Can I integrate the ok 512 plan with other tools?

Yes, the ok 512 plan supports integration with various popular applications like Google Drive, Salesforce, and more. This ensures that you can seamlessly incorporate airSlate SignNow into your existing workflows to enhance productivity.

-

What are the benefits of using the ok 512 plan for my business?

Utilizing the ok 512 plan can signNowly improve your business operations by reducing turnaround times for document approvals. Additionally, it enhances security and user experience, allowing you to focus on more critical tasks while ensuring document integrity.

-

Is it easy to use the ok 512 plan?

Absolutely! The ok 512 plan is designed with user-friendliness in mind, making it easy for anyone to send and sign documents digitally. The intuitive interface ensures that both your team and clients can navigate the platform with minimal training.

-

How can I get started with the ok 512 plan?

To get started with the ok 512 plan, simply visit the airSlate SignNow website and sign up for an account. You can choose the ok 512 plan that best meets your needs and begin leveraging its powerful eSigning capabilities immediately.

Get more for Oklahoma Income Tax Declaration OK gov

Find out other Oklahoma Income Tax Declaration OK gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors