Do Not Send to the Oklahoma Tax Commission 2017

What is the Do Not Send To The Oklahoma Tax Commission

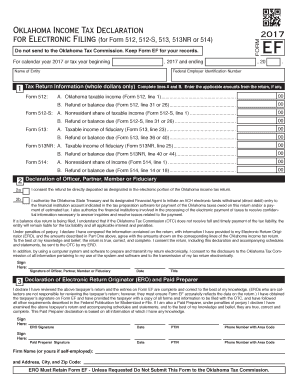

The "Do Not Send To The Oklahoma Tax Commission" form serves as a directive for taxpayers regarding specific documentation that should not be submitted to the Oklahoma Tax Commission. This form is crucial for ensuring that individuals and businesses understand the proper channels for submitting their tax-related documents. By adhering to this guideline, taxpayers can avoid unnecessary delays or complications in their tax filings.

How to use the Do Not Send To The Oklahoma Tax Commission

Using the "Do Not Send To The Oklahoma Tax Commission" form involves several steps. First, ensure that you have the correct version of the form, as outdated versions may lead to confusion. Next, complete the form with accurate information, including your name, address, and any relevant identification numbers. After filling it out, retain a copy for your records while following the instructions on where to send the appropriate documents instead.

Steps to complete the Do Not Send To The Oklahoma Tax Commission

Completing the "Do Not Send To The Oklahoma Tax Commission" form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from a reliable source.

- Fill in your personal information accurately, including your name and contact details.

- Review the instructions to ensure you understand what documents should be submitted elsewhere.

- Sign and date the form where indicated.

- Keep a copy for your records before sending any required documents to the appropriate agency.

Legal use of the Do Not Send To The Oklahoma Tax Commission

The legal use of the "Do Not Send To The Oklahoma Tax Commission" form is grounded in compliance with state tax regulations. This form helps taxpayers navigate the complexities of tax submissions and ensures that they do not inadvertently submit documents that could lead to penalties or legal issues. It is essential to understand the legal implications of misdirecting tax documents, as this can affect both individual and business tax standings.

Key elements of the Do Not Send To The Oklahoma Tax Commission

Several key elements define the "Do Not Send To The Oklahoma Tax Commission" form:

- Identification Information: Personal details of the taxpayer, including name and address.

- Document Instructions: Clear guidance on which documents should not be sent to the Oklahoma Tax Commission.

- Signature Requirement: A signature is often required to validate the form.

- Date of Submission: The date when the form is completed and signed.

State-specific rules for the Do Not Send To The Oklahoma Tax Commission

State-specific rules regarding the "Do Not Send To The Oklahoma Tax Commission" form can vary. It is crucial for taxpayers in Oklahoma to familiarize themselves with local tax laws and guidelines. These rules dictate how and when to use the form, as well as any additional documentation that may be required. Understanding these regulations can help prevent errors and ensure compliance with state tax obligations.

Quick guide on how to complete do not send to the oklahoma tax commission

Complete Do Not Send To The Oklahoma Tax Commission effortlessly on any gadget

Online document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Do Not Send To The Oklahoma Tax Commission on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Do Not Send To The Oklahoma Tax Commission with ease

- Obtain Do Not Send To The Oklahoma Tax Commission and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device of your choice. Modify and eSign Do Not Send To The Oklahoma Tax Commission and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not send to the oklahoma tax commission

Create this form in 5 minutes!

People also ask

-

What does 'Do Not Send To The Oklahoma Tax Commission' mean?

The phrase 'Do Not Send To The Oklahoma Tax Commission' signifies that certain documents or forms should not be submitted to the commission for processing. It's important to understand which documents are affected to avoid delays or penalties in your tax filing process. With airSlate SignNow, you can easily manage and eSign necessary documents while making sure they're directed correctly.

-

How can airSlate SignNow help with documents that 'Do Not Send To The Oklahoma Tax Commission'?

airSlate SignNow allows you to efficiently organize and eSign documents that should not be sent to the Oklahoma Tax Commission. Our platform ensures compliance by providing clear instructions and workflows for handling sensitive documents. This reduces the risk of miscommunication and enhances your document management process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides numerous features, including customizable templates, secure eSignature options, and real-time document tracking. These functionalities help ensure that documents marked 'Do Not Send To The Oklahoma Tax Commission' are handled correctly. Our user-friendly interface makes it easy for teams to collaborate while maintaining compliance.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial, allowing users to explore its features and determine how it can help manage documents like those labeled 'Do Not Send To The Oklahoma Tax Commission.' During the trial, you can experience the ease of use and effectiveness of our platform before committing to a subscription plan.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet individual and business needs. Whether you're a small business dealing with documents that 'Do Not Send To The Oklahoma Tax Commission' or a larger enterprise, there is a plan that can accommodate your requirements. Visit our pricing page to find the best option for your needs.

-

Can I integrate airSlate SignNow with other software systems?

Yes, airSlate SignNow seamlessly integrates with a variety of other software systems, including CRM and accounting tools. This allows for efficient workflows and ensures that documents, including those that should 'Do Not Send To The Oklahoma Tax Commission,' are processed according to your business needs. Check our integration options for more details.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow provides numerous benefits including increased efficiency, reduced paperwork, and enhanced compliance for documents you shouldn't send to the Oklahoma Tax Commission. Our software streamlines the document signing process, ensures security, and facilitates easy collaboration among teams, thus saving time and resources.

Get more for Do Not Send To The Oklahoma Tax Commission

Find out other Do Not Send To The Oklahoma Tax Commission

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online