Sales and Use Tax West Virginia Tax Division Form

Understanding the AR1000ES Form

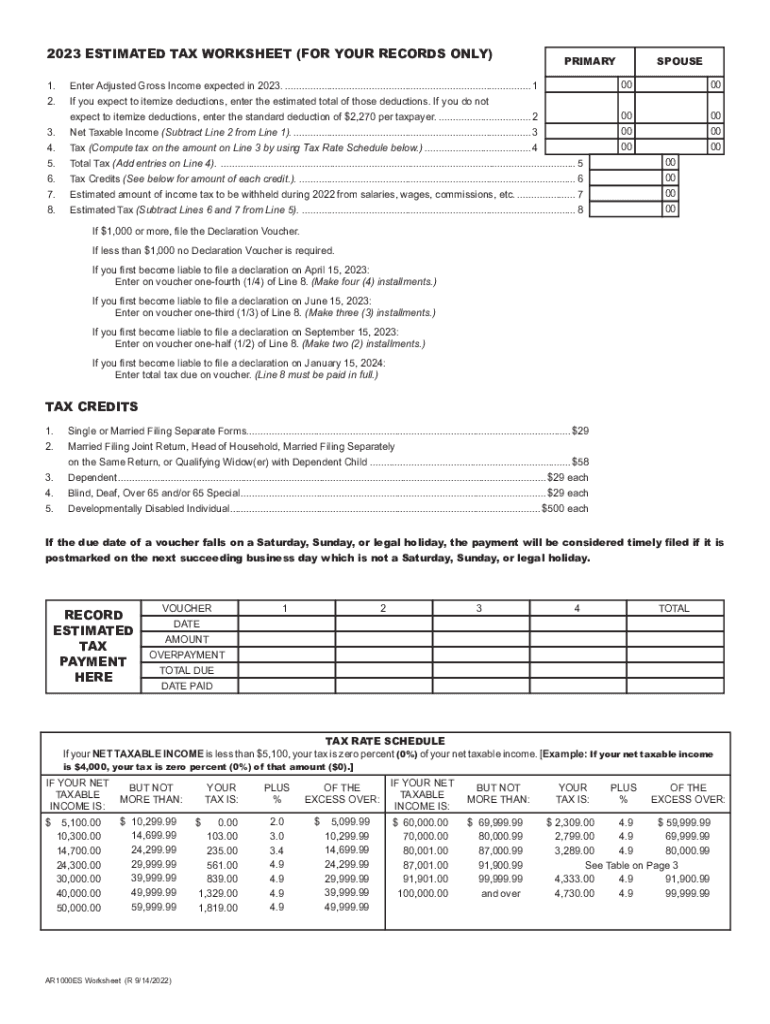

The AR1000ES form is used by residents of Arkansas to report estimated tax payments to the Arkansas Department of Finance and Administration (DFA). This form is essential for individuals who expect to owe tax of $1,000 or more when filing their annual tax return. It helps taxpayers manage their tax obligations throughout the year instead of making a lump sum payment at tax time.

Steps to Complete the AR1000ES Form

Completing the AR1000ES form involves several key steps:

- Gather your financial information, including income sources and deductions.

- Calculate your estimated tax liability using last year's tax return as a reference.

- Fill out the AR1000ES form with your estimated income and tax amounts.

- Submit the form along with your payment to the Arkansas DFA.

It is advisable to keep a copy of the completed form for your records.

Filing Deadlines for the AR1000ES Form

The AR1000ES form must be submitted quarterly. The deadlines for each quarter are as follows:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Timely submission of the AR1000ES form is crucial to avoid penalties and interest on late payments.

Required Documents for Filing the AR1000ES Form

To complete the AR1000ES form, you will need the following documents:

- Your previous year's tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

Having these documents on hand will streamline the process and ensure accuracy in your estimated tax calculations.

Penalties for Non-Compliance with the AR1000ES Form

Failing to file the AR1000ES form or making insufficient estimated tax payments can result in penalties. The Arkansas DFA may impose a penalty of five percent of the unpaid tax for each month the payment is late, up to a maximum of 25 percent. Additionally, interest may accrue on any unpaid amounts, further increasing your tax liability.

Who Issues the AR1000ES Form

The AR1000ES form is issued by the Arkansas Department of Finance and Administration (DFA). This state agency is responsible for tax collection and administration in Arkansas, ensuring compliance with state tax laws.

Digital vs. Paper Version of the AR1000ES Form

Taxpayers have the option to file the AR1000ES form either digitally or via paper. The digital version can be submitted through the Arkansas DFA's online portal, which offers a convenient way to manage your tax obligations. The paper version can be mailed to the appropriate address provided by the DFA. Choosing the digital option may expedite processing times and reduce the risk of errors.

Quick guide on how to complete sales and use tax west virginia tax division

Complete Sales And Use Tax West Virginia Tax Division effortlessly on any device

Managing documents online has become widely embraced by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to generate, modify, and eSign your documents swiftly without delays. Handle Sales And Use Tax West Virginia Tax Division on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Sales And Use Tax West Virginia Tax Division with ease

- Find Sales And Use Tax West Virginia Tax Division and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Alter and eSign Sales And Use Tax West Virginia Tax Division and ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax west virginia tax division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar1000es and how can it benefit my business?

The ar1000es is a powerful eSigning solution offered by airSlate SignNow that streamlines the document signing process. It allows businesses to send, manage, and eSign documents effortlessly, saving time and reducing operational costs. With user-friendly features, the ar1000es ensures a smooth experience for both senders and signers.

-

How much does the ar1000es cost?

The pricing for the ar1000es varies based on your business needs and the number of users. airSlate SignNow offers several pricing tiers to accommodate businesses of all sizes, ensuring a cost-effective solution. You can visit our website for detailed pricing information and select the plan that suits you best.

-

What features are included with the ar1000es?

The ar1000es includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. It also supports multiple file formats and offers integration with popular tools to enhance your workflow. These features make the ar1000es an ideal choice for businesses looking to optimize their document management processes.

-

Is the ar1000es easy to integrate with other software?

Yes, the ar1000es is designed for seamless integration with various software applications including CRM systems, cloud storage services, and collaborative tools. This flexibility allows businesses to incorporate the ar1000es into their existing workflows without disruption. Integration enhances productivity and ensures a smooth transition for users.

-

Can I use the ar1000es for international document signing?

Absolutely! The ar1000es supports international document signing, making it suitable for businesses operating globally. With legally binding eSignatures recognized in many countries, the ar1000es ensures compliance and security for international transactions. This feature allows your business to expand its signNow without any geographical limitations.

-

What security measures does the ar1000es provide?

The ar1000es prioritizes data security with advanced encryption, secure cloud storage, and compliance with regulations like GDPR and eIDAS. These measures ensure that your documents and signatures are protected against unauthorized access. Trust the ar1000es to safeguard your sensitive information while providing a reliable eSigning solution.

-

How can the ar1000es improve my team's efficiency?

The ar1000es enhances your team's efficiency by automating the document signing process and reducing the time spent on manual tasks. Its intuitive interface allows users to send and sign documents quickly, leading to faster turnaround times. By minimizing delays, the ar1000es empowers your team to focus on more strategic initiatives.

Get more for Sales And Use Tax West Virginia Tax Division

- Affidavit of direct payments mohave county superior court form

- Connecticare enrollment form

- White earth enrollment application white earth nation form

- City of vancouver schedule e 1 form

- Bmillwoodb school christmas wreath fundraiser order form millwood ednet ns

- Torrens cover sheet complete with ease form

- Lamda graded examinations planning form lamda mmind

- Non solicitation for independent contractors agreement template form

Find out other Sales And Use Tax West Virginia Tax Division

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement