Florida Department of Revenue Employers Quarterly 2015

Understanding the Florida Department of Revenue Employers Quarterly

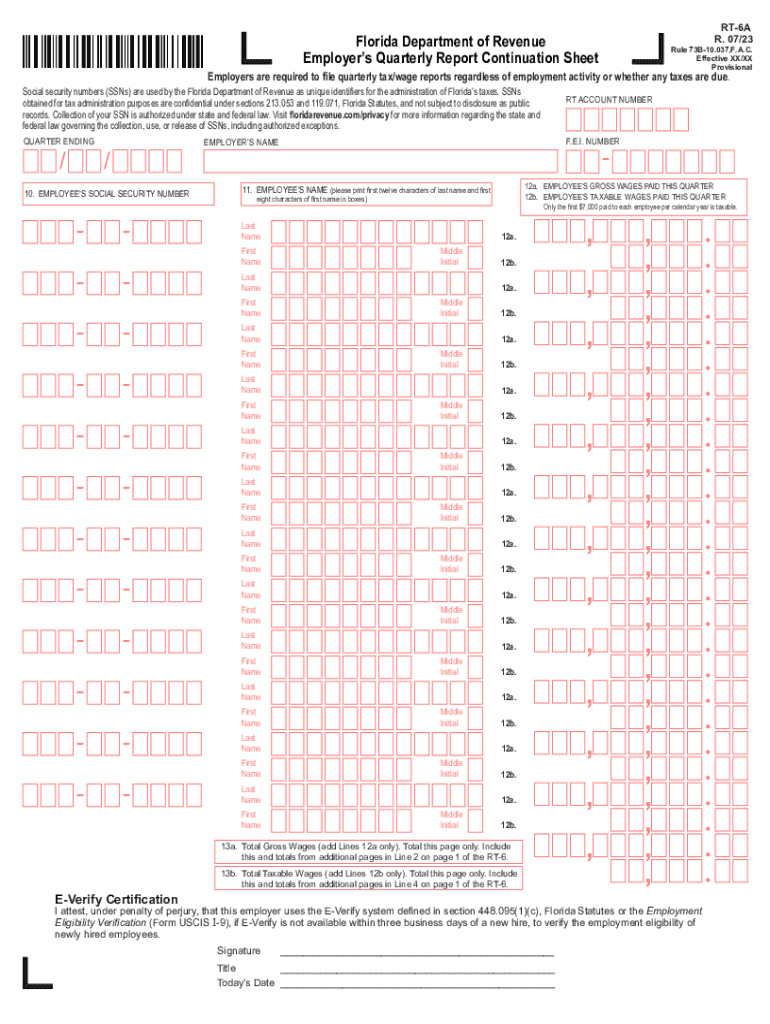

The Florida Department of Revenue Employers Quarterly is a crucial form for businesses in Florida. It is used to report and pay re-employment taxes for employees. This form helps ensure compliance with state tax laws and contributes to the funding of unemployment benefits. Employers must file this form quarterly, detailing wages paid and taxes owed to avoid penalties.

Steps to Complete the Florida Department of Revenue Employers Quarterly

Completing the Florida Department of Revenue Employers Quarterly involves several key steps:

- Gather necessary information, including employee wages and tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total taxes owed based on reported wages.

- Review the form for accuracy to prevent errors that could lead to penalties.

- Submit the form by the due date, either online or via mail.

Filing Deadlines and Important Dates

Employers must adhere to specific deadlines for filing the Florida Department of Revenue Employers Quarterly. The due date for submission is the last day of the month following the end of each quarter. This means:

- First quarter: Due by April 30

- Second quarter: Due by July 31

- Third quarter: Due by October 31

- Fourth quarter: Due by January 31

Form Submission Methods

Employers have several options for submitting the Florida Department of Revenue Employers Quarterly. These methods include:

- Online submission through the Florida Department of Revenue's website.

- Mailing a paper form to the designated address.

- In-person submission at local Department of Revenue offices.

Required Documents

To complete the Florida Department of Revenue Employers Quarterly, employers must have certain documents ready. These include:

- Employee wage records for the reporting period.

- Previous quarterly tax filings for reference.

- Any notices or correspondence from the Florida Department of Revenue.

Penalties for Non-Compliance

Failure to file the Florida Department of Revenue Employers Quarterly on time can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes.

- Potential legal action for continued non-compliance.

Quick guide on how to complete florida department of revenue employers quarterly

Effortlessly prepare Florida Department Of Revenue Employers Quarterly on any device

Digital document management has become increasingly common among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Florida Department Of Revenue Employers Quarterly on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Florida Department Of Revenue Employers Quarterly with ease

- Obtain Florida Department Of Revenue Employers Quarterly and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form—by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Florida Department Of Revenue Employers Quarterly to maintain effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida department of revenue employers quarterly

Create this form in 5 minutes!

How to create an eSignature for the florida department of revenue employers quarterly

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it handle Florida information?

airSlate SignNow is a user-friendly eSignature solution that enables businesses to send and sign documents electronically. With robust security measures in place, it ensures that all Florida information remains confidential and is stored securely. Users can easily manage and track documents, making it ideal for organizations operating in Florida.

-

How much does airSlate SignNow cost for Florida businesses?

airSlate SignNow offers flexible pricing plans tailored to accommodate various business needs in Florida. The pricing is competitive, providing great value for services like document signing, templates, and workflows. For Florida information, you can find detailed pricing options on our website, ensuring transparency and clarity.

-

What features does airSlate SignNow provide for managing Florida information?

airSlate SignNow includes features such as customizable templates, team collaboration tools, and audit trails. These features allow Florida businesses to manage their information effectively, ensuring compliance and traceability. The platform also supports a wide range of document formats for greater flexibility.

-

Can I integrate airSlate SignNow with other software for managing Florida information?

Yes, airSlate SignNow offers seamless integrations with various software applications, enabling businesses in Florida to streamline their document workflows. Whether you use CRM systems, cloud storage, or accounting software, you can easily connect them to manage Florida information more efficiently. Check our integration list for specific options.

-

How is the security of Florida information ensured with airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption methods to protect all Florida information during transmission and storage. Additionally, features like multi-factor authentication and access controls allow businesses to enhance the security of sensitive documents.

-

What benefits does airSlate SignNow offer for Florida businesses?

airSlate SignNow provides numerous benefits for Florida businesses, including increased efficiency, reduced paper usage, and enhanced customer convenience. By allowing users to eSign documents quickly, businesses can accelerate their processes and improve client satisfaction, which is crucial in today's fast-paced environment.

-

Is airSlate SignNow compliant with Florida regulations regarding document signing?

Absolutely! airSlate SignNow is fully compliant with Florida regulations concerning electronic signatures, ensuring that all signed documents are legally binding. This compliance gives peace of mind to Florida businesses when handling essential information and contracts. You can trust airSlate SignNow to meet the legal requirements for your documents.

Get more for Florida Department Of Revenue Employers Quarterly

Find out other Florida Department Of Revenue Employers Quarterly

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed