Florida Quarterly 2015-2026

What is the Florida Quarterly Report?

The Florida Quarterly Report is a crucial document that businesses in Florida must file to report their quarterly tax obligations. This report typically includes information regarding sales tax, reemployment tax, and other employer-related taxes. It serves as a summary of the taxes collected and owed for the quarter, ensuring compliance with state regulations. Understanding this report is essential for maintaining good standing with the Florida Department of Revenue and avoiding penalties.

Steps to Complete the Florida Quarterly Report

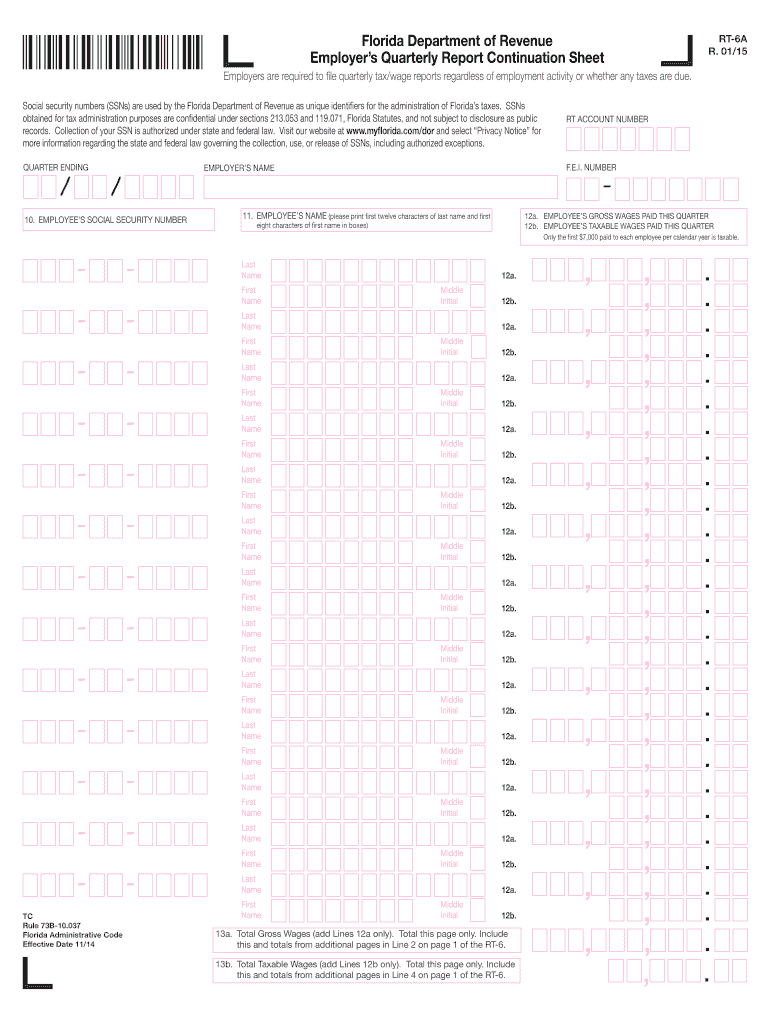

Completing the Florida Quarterly Report involves several key steps to ensure accuracy and compliance. Begin by gathering necessary financial records, including sales data and employee payroll information. Next, calculate the total sales tax collected during the quarter and any applicable reemployment taxes. Once you have the figures, fill out the Florida form RT-6A, ensuring all required fields are completed accurately. After completing the form, review it for any errors before submitting it to the Florida Department of Revenue.

Filing Deadlines / Important Dates

Timely filing of the Florida Quarterly Report is essential to avoid penalties. The due date for submitting this report is typically the last day of the month following the end of the quarter. For instance, reports for the first quarter, which ends on March 31, are due by April 30. It is crucial to mark these deadlines on your calendar to ensure compliance and avoid late fees.

Legal Use of the Florida Quarterly Report

The Florida Quarterly Report is legally binding when completed and submitted in accordance with state laws. To ensure its validity, businesses must adhere to the requirements set forth by the Florida Department of Revenue, including accurate reporting of tax liabilities. Utilizing a reliable eSignature solution, like signNow, can further enhance the legal standing of the submitted document by providing a digital certificate and ensuring compliance with eSignature laws.

Required Documents

To complete the Florida Quarterly Report, several documents are necessary. These include sales records, payroll information, and any previous tax filings. Additionally, businesses may need to gather documentation related to exemptions or deductions claimed during the quarter. Having these documents readily available will streamline the reporting process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Florida Quarterly Report can be submitted through various methods. Businesses have the option to file online through the Florida Department of Revenue's website, which is often the most efficient method. Alternatively, reports can be mailed to the appropriate department or submitted in person at designated locations. Each method has its own advantages, and businesses should choose the one that best fits their needs.

Penalties for Non-Compliance

Failing to file the Florida Quarterly Report on time can result in significant penalties. The Florida Department of Revenue may impose late fees based on the amount of tax owed, which can accumulate quickly. Additionally, businesses may face interest charges on unpaid taxes. It is essential to understand these penalties to emphasize the importance of timely and accurate reporting.

Quick guide on how to complete florida quarterly

Complete Florida Quarterly effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Florida Quarterly on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign Florida Quarterly effortlessly

- Obtain Florida Quarterly and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or downloading it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Florida Quarterly and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida quarterly

Create this form in 5 minutes!

How to create an eSignature for the florida quarterly

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the purpose of a Florida quarterly report?

A Florida quarterly report is a crucial document that businesses are required to submit to the state to maintain compliance. It provides a summary of the company's financial status over the past quarter and ensures transparency in business operations. Understanding this report is essential for effective business management in Florida.

-

How can airSlate SignNow help me with my Florida quarterly report?

airSlate SignNow simplifies the process of preparing and submitting your Florida quarterly report by enabling you to eSign documents easily. Our platform allows for secure document storage and fast access, streamlining your workflow. This ensures that you can focus on your business while maintaining compliance with state regulations.

-

Are there any costs associated with using airSlate SignNow for my Florida quarterly report?

Yes, there are various pricing plans available for airSlate SignNow that cater to different business needs. Our cost-effective solution allows businesses to manage their Florida quarterly report efficiently without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Florida quarterly reports?

airSlate SignNow provides features such as document templates, automated workflows, and secure eSigning functionalities. These tools are specifically designed to help businesses prepare accurate Florida quarterly reports effortlessly. Our user-friendly interface makes it simple to keep track of your submissions.

-

Can airSlate SignNow integrate with accounting software for Florida quarterly reports?

Yes, airSlate SignNow seamlessly integrates with several popular accounting software solutions, making it easier to generate and manage your Florida quarterly reports. These integrations help in automating data entry and reducing errors. This ensures that your reports are both accurate and compliant with state guidelines.

-

What are the benefits of using airSlate SignNow over traditional methods for Florida quarterly reports?

Using airSlate SignNow offers numerous benefits, such as enhanced speed, security, and convenience when handling Florida quarterly reports. Traditional methods can be time-consuming and prone to errors, whereas our digital solution streamlines the entire process. This allows you to focus on strategic aspects of your business.

-

Is training provided for using airSlate SignNow for Florida quarterly reports?

Absolutely! airSlate SignNow offers comprehensive training and support resources to help users navigate the platform effectively, especially when preparing Florida quarterly reports. Our tutorials and customer support teams are available to assist you in maximizing the features of our solution.

Get more for Florida Quarterly

- Trulance patient assistance application form

- Alabama special education required evaluations eligibility form

- Plumbing job application forms

- Pdfkiller form

- Pre renovation checklist form

- Lapel pin order form pdf naecb

- Dit helpt u bij het invullen van het aanvraagformulier

- Met dit formulier doet u aangifte erfbelasting voor een overlijden

Find out other Florida Quarterly

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template