Citi Announces Agreement to Sell Its Consumer 2023-2026

Understanding Form 15G for Tax Purposes

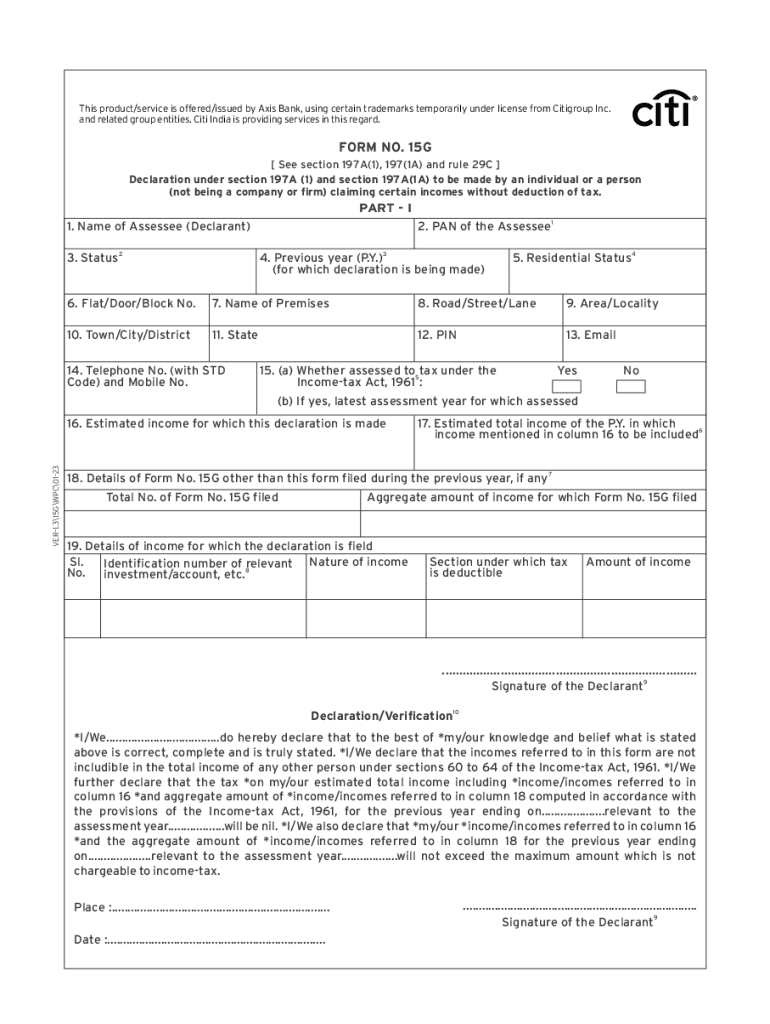

Form 15G is a declaration used in India to ensure that certain individuals do not have tax deducted at source (TDS) on their income. This form is particularly relevant for individuals whose total income is below the taxable limit. By submitting Form 15G, taxpayers can request that no TDS be deducted from their interest income, provided they meet specific eligibility criteria.

Eligibility Criteria for Using Form 15G

To qualify for submitting Form 15G, individuals must meet the following criteria:

- The total income for the financial year must be below the taxable limit.

- The individual must be a resident of India.

- Form 15G is applicable for interest income from savings accounts, fixed deposits, and other sources.

Steps to Complete Form 15G

Filling out Form 15G involves several straightforward steps:

- Obtain a copy of Form 15G, which can be downloaded in PDF format.

- Fill in personal details such as name, address, and PAN (Permanent Account Number).

- Provide details of the income for which the declaration is being made.

- Sign and date the form before submission.

Submission Methods for Form 15G

Form 15G can be submitted through various methods:

- Online submission through the bank's website or financial institution's portal.

- Physical submission at the bank branch where the account is held.

IRS Guidelines on Form 15G

While Form 15G is primarily used in India, understanding its implications in the context of U.S. tax regulations can be beneficial. The IRS provides guidelines on tax forms and declarations, emphasizing the importance of accurate reporting of income and compliance with tax laws. Taxpayers should ensure that they are aware of any relevant U.S. tax obligations when submitting similar forms.

Common Scenarios for Using Form 15G

Individuals often use Form 15G in various situations, such as:

- When receiving interest from fixed deposits that do not exceed the taxable threshold.

- For interest income from savings accounts where the total income is below the taxable limit.

Penalties for Non-Compliance with Form 15G

Failing to submit Form 15G when eligible can lead to TDS deductions that may not be necessary. Taxpayers who do not comply with the guidelines may face penalties, including:

- Unnecessary tax deductions from interest income.

- Potential complications in tax filings if income exceeds the threshold without proper declarations.

Quick guide on how to complete citi announces agreement to sell its consumer

Complete Citi Announces Agreement To Sell Its Consumer effortlessly on any device

Digital document management has gained traction with organizations and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly without interruptions. Manage Citi Announces Agreement To Sell Its Consumer on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign Citi Announces Agreement To Sell Its Consumer without hassle

- Find Citi Announces Agreement To Sell Its Consumer and then select Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Mark important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Citi Announces Agreement To Sell Its Consumer and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct citi announces agreement to sell its consumer

Create this form in 5 minutes!

How to create an eSignature for the citi announces agreement to sell its consumer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'certain tax 15g' form and why is it important?

The 'certain tax 15g' form is a declaration that allows individuals to avoid TDS (Tax Deducted at Source) on their income if their total income is below the taxable limit. It's important because it ensures that taxpayers only pay taxes according to their actual income levels, thus facilitating better cash flow.

-

How can airSlate SignNow help with signing 'certain tax 15g' documents?

airSlate SignNow provides a streamlined solution for electronically signing documents, including the 'certain tax 15g' form. With just a few clicks, you can securely eSign and send these documents, saving time and eliminating the need for physical signatures.

-

Is there a cost associated with using airSlate SignNow for 'certain tax 15g' forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans ensure that you have access to essential features for handling 'certain tax 15g' and other documents effectively, making it a cost-effective solution for businesses.

-

Are there any specific features in airSlate SignNow for handling tax-related documents like 'certain tax 15g'?

Absolutely! airSlate SignNow includes features like customizable templates, document tracking, and automated reminders that are particularly useful for handling tax-related documents such as 'certain tax 15g'. These features enhance efficiency and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other software for managing 'certain tax 15g' forms?

Yes, airSlate SignNow seamlessly integrates with various software solutions commonly used for financial management, making it easier to manage 'certain tax 15g' forms. Integrations with platforms such as Google Drive and Dropbox enable smooth workflows and document sharing.

-

What benefits can I expect from using airSlate SignNow for the 'certain tax 15g' process?

By using airSlate SignNow for the 'certain tax 15g' process, businesses can enjoy faster turnaround times, improved compliance, and reduced administrative burdens. The platform also enhances user experience, making it easy to manage and sign sensitive documents securely.

-

Is airSlate SignNow secure for submitting sensitive documents like 'certain tax 15g'?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with data protection regulations. This ensures that any 'certain tax 15g' documents submitted through our platform remain secure and confidential throughout the signing process.

Get more for Citi Announces Agreement To Sell Its Consumer

- Official asa pick up player form boise parks amp recreation

- Mississippi department of public safety driver records request summit form

- Certificate of religious exemption from school new mexico immunizenm form

- 6376t health care encounter form 080908 co fresno ca

- Hics 260 patient evacuation tracking form emsa ca

- Noise mitigation plan form

- Gsr property map form

- 01 121veriuniv oklahoma state department of education form

Find out other Citi Announces Agreement To Sell Its Consumer

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now