Washington State Department of Revenue Audit Divis 2019-2026

Required Documents for Revenue Clearance Certificate Application

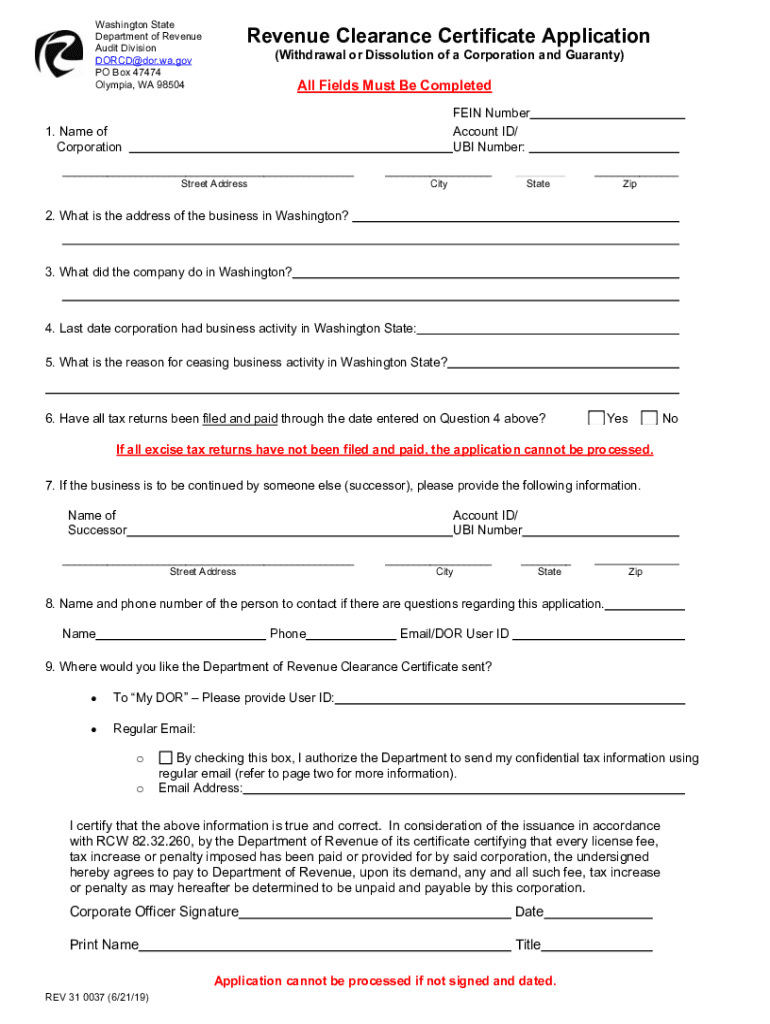

When applying for a revenue clearance certificate, it is essential to gather the necessary documents to ensure a smooth application process. The following documents are typically required:

- Identification: A government-issued photo ID, such as a driver's license or passport.

- Tax Returns: Copies of your most recent tax returns, usually for the last two years.

- Income Statements: Documentation of income, which may include W-2s or 1099 forms.

- Business Records: If applicable, provide business financial statements and records.

- Previous Clearance Certificates: Any prior revenue clearance certificates, if available.

Having these documents ready can help expedite the processing of your application and avoid delays.

Application Process & Approval Time

The application process for a revenue clearance certificate involves several steps. First, you need to complete the application form, which can typically be found on the Washington State Department of Revenue website. After filling out the form, submit it along with the required documents.

Once submitted, the approval time can vary. Generally, applicants can expect to receive their certificate within two to four weeks, depending on the volume of applications being processed. It is advisable to apply well in advance of any deadlines to ensure timely receipt of the certificate.

Eligibility Criteria for Revenue Clearance Certificate

To qualify for a revenue clearance certificate, applicants must meet specific eligibility criteria. These criteria often include:

- Tax Compliance: All tax obligations must be current, with no outstanding balances owed to the state.

- Business Status: For businesses, the entity must be in good standing with the Washington Secretary of State.

- No Pending Audits: There should be no ongoing audits or disputes with the Department of Revenue.

Meeting these criteria is crucial for a successful application and to avoid potential delays.

Form Submission Methods

Applicants can submit their revenue clearance certificate application through various methods. The options typically include:

- Online Submission: Many applicants prefer the convenience of submitting their application online through the Washington State Department of Revenue's website.

- Mail: Applications can also be mailed to the appropriate department. Ensure that you send it to the correct address to avoid processing delays.

- In-Person Submission: For those who prefer direct interaction, submitting the application in person at a local Department of Revenue office is an option.

Choosing the right submission method can depend on personal preference and urgency.

Penalties for Non-Compliance

Failure to obtain a revenue clearance certificate when required can lead to significant penalties. These may include:

- Fines: Monetary penalties may be imposed for non-compliance with state revenue regulations.

- Legal Action: In severe cases, the state may take legal action to recover owed taxes.

- Business Restrictions: Businesses may face restrictions on operations until compliance is achieved.

Understanding these potential consequences highlights the importance of timely application and compliance with revenue requirements.

Quick guide on how to complete washington state department of revenue audit divis

Easily prepare Washington State Department Of Revenue Audit Divis on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Washington State Department Of Revenue Audit Divis on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and electronically sign Washington State Department Of Revenue Audit Divis effortlessly

- Locate Washington State Department Of Revenue Audit Divis and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Washington State Department Of Revenue Audit Divis and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct washington state department of revenue audit divis

Create this form in 5 minutes!

How to create an eSignature for the washington state department of revenue audit divis

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a revenue clearance certificate application?

A revenue clearance certificate application is a formal request submitted to the relevant tax authority to signNow that a business has settled all its tax dues. This certificate is often needed for various legal and financial transactions. Understanding the application process for a revenue clearance certificate can help streamline your business operations.

-

How can airSlate SignNow help with my revenue clearance certificate application?

airSlate SignNow offers a user-friendly platform for efficiently managing your revenue clearance certificate application. You can easily send, receive, and eSign your documents, ensuring that your application process is fast and hassle-free. Our solution improves your workflow, enabling you to focus on other important tasks.

-

What features does airSlate SignNow offer for handling applications?

With airSlate SignNow, you have access to key features such as customizable templates, real-time tracking, and secure storage, all designed to simplify your revenue clearance certificate application. These tools not only save time but also enhance the accuracy of your submitted documents. The platform ensures that your application is compliant and professional.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides a free trial for new users, allowing you to experience the platform's features before committing to a subscription. During this trial, you can effectively manage your revenue clearance certificate application and explore the benefits of our eSignature solution at no cost. This is an excellent way to determine if our service meets your needs.

-

What is the pricing structure for airSlate SignNow?

The pricing for airSlate SignNow is competitive, with various plans designed to fit different business needs. Each plan includes features to streamline the revenue clearance certificate application process, with costs dependent on the number of users and additional features required. We recommend evaluating the options to select the best plan for your organization.

-

Can airSlate SignNow integrate with other applications?

Absolutely! airSlate SignNow offers integration capabilities with popular applications and tools to enhance your workflow, including CRM systems and document management software. This means you can easily connect your existing tools to facilitate your revenue clearance certificate application process without any disruptions.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow to eSign documents provides numerous benefits, including faster turnaround times and enhanced security. This ensures that your revenue clearance certificate application is processed without unnecessary delays. Additionally, the platform is compliant with eSignature laws, so you can be confident in the legality of your signed documents.

Get more for Washington State Department Of Revenue Audit Divis

- Saq c v3 1 pci security standards council pcissc form

- Aashto t245 pdf form

- Spartanburg county request for absentee ballot application spartanburgcounty form

- Njdep form wqm 005

- Wayne township fmla form

- Adobe gmd 1 form

- White wolf character sheet form

- Application for student employment university of southern california www rcf usc form

Find out other Washington State Department Of Revenue Audit Divis

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease