Revenue Clearance Certificate Washington State 2014

What is the Revenue Clearance Certificate Washington State

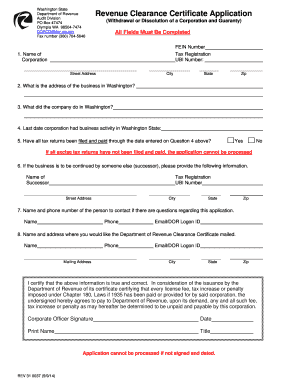

The Revenue Clearance Certificate in Washington State is an official document issued by the Department of Revenue. It serves as proof that a business has satisfied all tax obligations and is in good standing with the state. This certificate is often required when a business is applying for loans, selling assets, or undergoing changes in ownership. It confirms that there are no outstanding tax liabilities, which can help facilitate smoother business transactions.

How to obtain the Revenue Clearance Certificate Washington State

To obtain a Revenue Clearance Certificate in Washington State, businesses must first ensure that all taxes have been paid and that they are in compliance with state tax laws. The application can be submitted online through the Department of Revenue's website. Businesses may need to provide their Unified Business Identifier (UBI) number and other identifying information. Once the application is processed, the certificate will be issued if all conditions are met.

Steps to complete the Revenue Clearance Certificate Washington State

Completing the Revenue Clearance Certificate involves several key steps:

- Verify that all taxes are paid and up to date.

- Gather necessary documentation, including your UBI number.

- Access the application form on the Department of Revenue's website.

- Fill out the form with accurate information.

- Submit the application and await confirmation.

Key elements of the Revenue Clearance Certificate Washington State

The Revenue Clearance Certificate includes several important elements:

- Business Name: The legal name of the business requesting the certificate.

- UBI Number: A unique identifier assigned to the business by the state.

- Tax Compliance Status: A statement indicating that all tax obligations have been met.

- Issue Date: The date on which the certificate is issued.

Legal use of the Revenue Clearance Certificate Washington State

The Revenue Clearance Certificate is legally recognized as proof of tax compliance in Washington State. It can be used in various business transactions, such as applying for loans, selling a business, or transferring ownership. The certificate assures potential buyers or lenders that the business has no outstanding tax liabilities, which can enhance credibility and trustworthiness in business dealings.

Required Documents

When applying for a Revenue Clearance Certificate, businesses may need to provide specific documents, including:

- Proof of tax payments.

- Business registration documents.

- Identification information, such as the UBI number.

Quick guide on how to complete revenue clearance certificate washington state

Complete Revenue Clearance Certificate Washington State seamlessly on any gadget

Web-based document handling has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents quickly without delays. Manage Revenue Clearance Certificate Washington State on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Revenue Clearance Certificate Washington State effortlessly

- Find Revenue Clearance Certificate Washington State and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or mask sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and select the Done button to save your changes.

- Choose your preferred method of sending your form, be it via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign Revenue Clearance Certificate Washington State while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenue clearance certificate washington state

Create this form in 5 minutes!

How to create an eSignature for the revenue clearance certificate washington state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a revenue certificate and how can it benefit my business?

A revenue certificate is a legally recognized document that certifies the financial standing or revenue history of a business. It can help enhance your credibility when applying for loans or contracts, ensuring potential partners see your business as financially sound and reliable.

-

How much does airSlate SignNow charge for revenue certificate processing?

airSlate SignNow offers competitive pricing for document management services, including revenue certificate processing. You can choose from various subscription plans that cater to businesses of all sizes, ensuring you find an option that fits your budget while providing the features you need.

-

Can I use airSlate SignNow to create a revenue certificate?

Yes, airSlate SignNow enables you to create professional revenue certificates easily. With our user-friendly interface, you can customize templates to match your brand requirements, streamlining the certificate creation process.

-

What features does airSlate SignNow offer for managing revenue certificates?

airSlate SignNow provides several features for managing revenue certificates, including secure eSigning, template customization, and real-time tracking of document status. These features help ensure your revenue certificates are processed efficiently and securely.

-

Is airSlate SignNow secure for handling sensitive revenue certificate information?

Absolutely! airSlate SignNow prioritizes security for all documents, including revenue certificates. We utilize advanced encryption methods and compliance with data protection regulations, ensuring your sensitive financial information remains safe.

-

Can I integrate airSlate SignNow with other software for managing revenue certificates?

Yes, airSlate SignNow offers seamless integration with various third-party applications, making it easier to manage your revenue certificates alongside your existing tools. This flexibility helps streamline your workflow and enhances productivity.

-

How does eSigning a revenue certificate work with airSlate SignNow?

With airSlate SignNow, eSigning a revenue certificate is simple and intuitive. Users can upload the document, add necessary fields for signatures, and send it for signing, allowing for a quick turnaround without the need for printing or mailing.

Get more for Revenue Clearance Certificate Washington State

- Well septic rider page form

- Wisconsin form f01812

- Allooss allograft bone tracking report ace surgical supply form

- South dakota notice of dishonored check civil keywords bad check bounced check form

- What is a edrs number form

- Notarized authorization letter form

- Beneficiary agreement template form

- Certificate of appropriateness 782528473 form

Find out other Revenue Clearance Certificate Washington State

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship