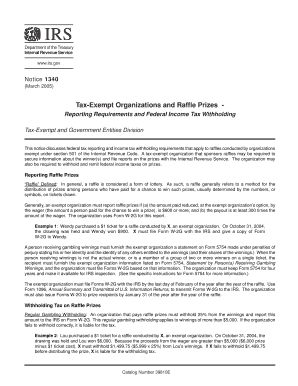

Irs Form 1340

Understanding IRS Form 1340

IRS Form 1340, also known as the IRS Notice 1340, is a crucial document used by taxpayers to address specific tax-related issues. This form is typically issued when the IRS identifies discrepancies in a taxpayer's account, such as unreported income or errors in tax calculations. Understanding the purpose and implications of this form is vital for taxpayers to ensure compliance and avoid potential penalties.

How to Obtain IRS Form 1340

To obtain IRS Form 1340, taxpayers can visit the official IRS website, where forms are available for download. Alternatively, taxpayers may receive this form directly from the IRS via mail if there are discrepancies in their tax filings. It is essential to ensure that the correct version of the form is used, as updates may occur periodically.

Steps to Complete IRS Form 1340

Completing IRS Form 1340 involves several key steps:

- Review the Notice: Carefully read the notice to understand the specific issues raised by the IRS.

- Gather Documentation: Collect all relevant financial documents, including tax returns, W-2s, and any other supporting materials.

- Fill Out the Form: Accurately complete the form, providing all required information and explanations for discrepancies.

- Double-Check Entries: Review the completed form for accuracy to prevent further issues.

- Submit the Form: Follow the instructions for submission, whether online or by mail, ensuring it is sent to the correct IRS address.

Legal Use of IRS Form 1340

IRS Form 1340 serves a legal purpose in tax compliance. It is used to formally respond to the IRS regarding discrepancies or issues identified in a taxpayer's account. Proper use of this form is essential to maintain compliance with federal tax laws and to avoid potential legal repercussions, such as fines or audits.

Key Elements of IRS Form 1340

Key elements of IRS Form 1340 include:

- Taxpayer Information: Name, address, and Social Security number or Employer Identification Number (EIN).

- Details of the Discrepancy: A clear explanation of the issue raised by the IRS.

- Supporting Documentation: Any relevant documents that support the taxpayer's position.

- Signature: The taxpayer's signature to certify the accuracy of the information provided.

Filing Deadlines and Important Dates

Filing deadlines for IRS Form 1340 can vary based on the nature of the discrepancies and the taxpayer's situation. It is crucial to respond promptly to any IRS notice to avoid additional penalties. Generally, taxpayers should aim to submit the form within thirty days of receiving the notice to ensure compliance and mitigate potential issues.

Quick guide on how to complete irs form 1340

Effortlessly Prepare Irs Form 1340 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle Irs Form 1340 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and Electronically Sign Irs Form 1340 Effortlessly

- Locate Irs Form 1340 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs Form 1340 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 1340

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS notice 1340?

An IRS notice 1340 is a communication sent by the Internal Revenue Service to inform taxpayers about their eligibility for a refund. It typically outlines the details regarding the refund process and important timelines. Understanding your IRS notice 1340 is crucial for ensuring you take the necessary actions promptly.

-

How can airSlate SignNow help with IRS notice 1340 documentation?

airSlate SignNow streamlines the documentation process when dealing with an IRS notice 1340. You can easily eSign required documents, ensuring they are filed accurately and on time. This convenient solution saves you time and minimizes the risk of errors in your responses to the IRS.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans designed to suit businesses of all sizes. With flexible subscription models, users can choose a plan that meets their needs while effectively managing documentation related to IRS notice 1340 and other requirements. Each plan provides access to essential features at an affordable rate.

-

What features does airSlate SignNow offer for handling IRS correspondence?

airSlate SignNow includes advanced features such as eSigning, document templates, and secure cloud storage for IRS correspondence like notice 1340. These features facilitate efficient document management, allowing you to quickly prepare and send required responses. The platform ensures your documentation is always organized and accessible.

-

Are there any integrations available with airSlate SignNow for IRS notice 1340?

Yes, airSlate SignNow offers various integrations with popular applications to enhance your workflow related to IRS notice 1340. You can easily connect with tools like Google Drive, Dropbox, and industry-specific software, allowing for seamless document sharing and management. These integrations improve efficiency and allow for better compliance.

-

What benefits does airSlate SignNow provide for managing IRS notice 1340?

Using airSlate SignNow to manage IRS notice 1340 brings several benefits, including increased efficiency and reduced paperwork. The platform’s user-friendly interface simplifies the eSigning process, saving you time and effort. By streamlining document handling, you can focus on more important aspects of your business.

-

How secure is the transmission of documents with airSlate SignNow?

The security of your documents is paramount at airSlate SignNow, especially when dealing with sensitive information related to IRS notice 1340. The platform uses advanced encryption technology to ensure that all documents are transmitted securely. You can confidently eSign and send documents knowing that your data is protected.

Get more for Irs Form 1340

Find out other Irs Form 1340

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast