Tuition Tax Credit Parentguardian Claim Form

What is the Tuition Tax Credit Parentguardian Claim Form

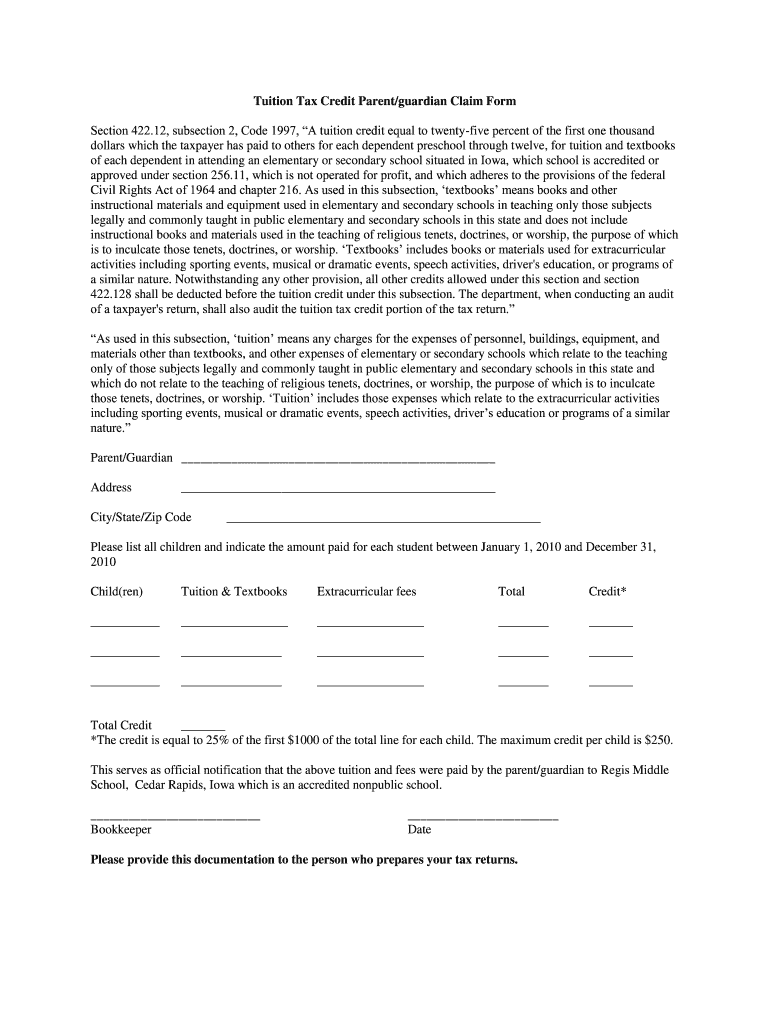

The Tuition Tax Credit Parentguardian Claim Form is a specific document used by parents or guardians to claim educational tax credits for their dependents. This form is essential for individuals seeking to benefit from tax deductions related to tuition expenses incurred for qualifying educational institutions. The credits aimed at reducing the overall tax burden can significantly assist families in managing the costs of education.

How to use the Tuition Tax Credit Parentguardian Claim Form

Using the Tuition Tax Credit Parentguardian Claim Form involves several straightforward steps. First, gather all necessary documentation, including receipts for tuition payments and the dependent's information. Next, accurately fill out the form, ensuring that all required fields are completed. Finally, submit the form according to the specified submission methods, which may include online filing, mailing, or in-person delivery to the appropriate tax authority.

Steps to complete the Tuition Tax Credit Parentguardian Claim Form

Completing the Tuition Tax Credit Parentguardian Claim Form requires careful attention to detail. Follow these steps:

- Collect documentation, such as tuition payment receipts and your dependent's identification.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the dependent, including their name, age, and the educational institution attended.

- Enter the amount of tuition paid during the tax year.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Tuition Tax Credit using the Parentguardian Claim Form, specific eligibility criteria must be met. Generally, the student must be enrolled in an eligible educational institution, and the tuition expenses claimed must be for qualified courses. Additionally, the taxpayer must meet income limits set by the IRS to ensure eligibility for the tax credits. It's important to review these criteria carefully to ensure compliance.

Required Documents

When filling out the Tuition Tax Credit Parentguardian Claim Form, certain documents are necessary to support your claim. These typically include:

- Tuition payment receipts or statements from the educational institution.

- Your Social Security number and that of your dependent.

- Proof of enrollment for the dependent, such as a student ID or enrollment letter.

- Any prior tax returns if applicable for reference.

Filing Deadlines / Important Dates

Filing deadlines for the Tuition Tax Credit Parentguardian Claim Form align with the general tax filing schedule. Typically, the deadline for submitting your tax return, including this form, is April fifteenth of each year. It's crucial to be aware of any state-specific deadlines that may apply, as they can differ from federal deadlines. Keeping track of these dates ensures that you do not miss out on potential tax benefits.

Quick guide on how to complete tuition tax credit parentguardian claim form

Complete Tuition Tax Credit Parentguardian Claim Form effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Tuition Tax Credit Parentguardian Claim Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Tuition Tax Credit Parentguardian Claim Form with minimal effort

- Locate Tuition Tax Credit Parentguardian Claim Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you choose. Adjust and eSign Tuition Tax Credit Parentguardian Claim Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tuition tax credit parentguardian claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tuition Tax Credit Parentguardian Claim Form?

The Tuition Tax Credit Parentguardian Claim Form is a document that allows parents or guardians to claim educational expenses for tax benefits. This form is essential for eligible individuals seeking to optimize their tax liabilities by utilizing available tuition credits.

-

How do I complete the Tuition Tax Credit Parentguardian Claim Form using airSlate SignNow?

Completing the Tuition Tax Credit Parentguardian Claim Form is straightforward with airSlate SignNow. Simply upload your document, fill in the necessary details, and eSign it easily using our user-friendly interface. Our solution guides you through each step.

-

Is there a cost associated with using the Tuition Tax Credit Parentguardian Claim Form on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing your Tuition Tax Credit Parentguardian Claim Form. Pricing plans are designed for businesses of all sizes, ensuring that you have access to affordable eSigning services that meet your budgetary needs.

-

What are the benefits of using airSlate SignNow for my Tuition Tax Credit Parentguardian Claim Form?

Using airSlate SignNow for your Tuition Tax Credit Parentguardian Claim Form offers numerous advantages, including quick and secure eSigning, easy document management, and time-saving workflows. Our platform simplifies the entire process, allowing you to focus on what matters most.

-

Can I integrate airSlate SignNow with other software for managing the Tuition Tax Credit Parentguardian Claim Form?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage the Tuition Tax Credit Parentguardian Claim Form efficiently. This interoperability allows you to synchronize your data, improving overall productivity and document handling.

-

What features does airSlate SignNow offer to enhance the eSigning experience for the Tuition Tax Credit Parentguardian Claim Form?

airSlate SignNow includes several features designed to enhance your eSigning experience for the Tuition Tax Credit Parentguardian Claim Form, such as templates, mobile access, and real-time tracking. These tools ensure that signing and sharing your forms is effortless and reliable.

-

How secure is my data when using the Tuition Tax Credit Parentguardian Claim Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When using the Tuition Tax Credit Parentguardian Claim Form, your data is protected by robust encryption protocols, ensuring that your personal and financial information remains confidential and secure throughout the eSigning process.

Get more for Tuition Tax Credit Parentguardian Claim Form

Find out other Tuition Tax Credit Parentguardian Claim Form

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word