New York State Department of Taxation and Finance Allocation of Estimated Tax Payments to Beneficiaries for Jan Tax Ny Form

Understanding the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

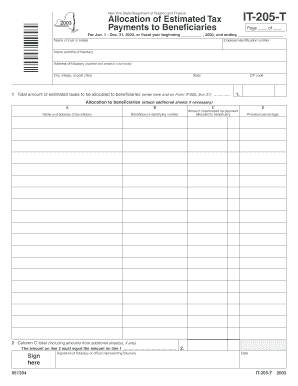

The New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny is a crucial document for individuals receiving estimated tax payments. This form outlines how estimated tax payments are allocated to beneficiaries, ensuring that the correct amounts are credited to the appropriate accounts. It is essential for tax compliance and accurate financial planning.

Steps to Complete the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

Completing the allocation form involves several key steps:

- Gather necessary information, including beneficiary details and payment amounts.

- Fill out the form accurately, ensuring all fields are completed.

- Review the information for accuracy to avoid potential issues.

- Submit the form by the specified deadline to ensure timely processing.

Key Elements of the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

Important components of the form include:

- Beneficiary names and identification numbers.

- Details of estimated tax payments being allocated.

- Signature of the individual responsible for the submission.

- Date of submission and any relevant tax year information.

Legal Use of the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

This form is legally recognized for the allocation of estimated tax payments. Proper completion and submission are necessary to ensure compliance with New York State tax laws. Failure to use the form correctly may result in penalties or misallocation of funds.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the allocation of estimated tax payments. Typically, these deadlines align with the state tax filing calendar. Missing these deadlines can lead to complications in the allocation process.

Examples of Using the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

Examples of when to use this form include:

- When a beneficiary receives a distribution from an estate or trust that includes estimated tax payments.

- In situations where multiple beneficiaries are involved, and clear allocation is needed to avoid disputes.

Who Issues the Form

The New York State Department Of Taxation And Finance is responsible for issuing this form. They provide guidelines and resources to assist taxpayers in understanding and completing the allocation process effectively.

Quick guide on how to complete new york state department of taxation and finance allocation of estimated tax payments to beneficiaries for jan tax ny

Accomplish [SKS] seamlessly on any gadget

Virtual document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Steps to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the resources we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure outstanding communication at every phase of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance allocation of estimated tax payments to beneficiaries for jan tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments to Beneficiaries for Jan Tax NY?

The New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax NY refers to the process of distributing estimated tax payments among eligible beneficiaries. This ensures that all individuals meet their tax obligations accurately and efficiently.

-

How can airSlate SignNow help with the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments?

airSlate SignNow streamlines document management related to the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax NY. With eSigning capabilities, businesses can efficiently handle necessary documentation to comply with tax requirements.

-

What pricing options does airSlate SignNow offer for businesses managing tax documents?

airSlate SignNow provides various pricing plans designed for businesses of all sizes. Depending on the features you require, you can choose a plan that suits your needs while ensuring compliance with the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax NY.

-

Are there any integrations available with airSlate SignNow for managing tax documents?

Yes, airSlate SignNow offers seamless integrations with popular platforms such as Google Drive and Dropbox. These integrations enhance your document workflow especially when dealing with the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax NY.

-

What features of airSlate SignNow support the allocation of tax payments?

Key features of airSlate SignNow include customizable templates, automated reminders, and secure storage. These tools are particularly useful for ensuring accurate documentation when dealing with the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax NY.

-

How does airSlate SignNow enhance the efficiency of tax payment allocations?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document processing. The automation of the signing process related to the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax NY helps ensure timely compliance.

-

Can airSlate SignNow assist in tracking tax payment deadlines?

Absolutely! airSlate SignNow includes reminder notifications that keep businesses informed about important tax payment deadlines. This feature is vital for those working with the New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax NY.

Get more for New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

Find out other New York State Department Of Taxation And Finance Allocation Of Estimated Tax Payments To Beneficiaries For Jan Tax Ny

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation