Form CT186 PM , Utility Services MTA Surcharge Return, CT186PM Tax Ny

Understanding Form CT186 PM, Utility Services MTA Surcharge Return

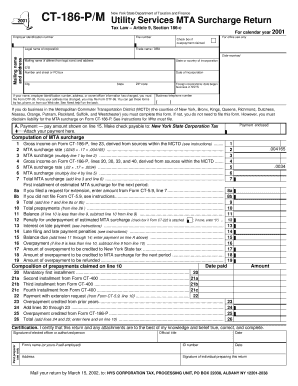

The Form CT186 PM, also known as the Utility Services MTA Surcharge Return, is a tax document utilized by businesses in New York to report and remit the Metropolitan Transportation Authority (MTA) surcharge on utility services. This form is essential for businesses that provide utility services, ensuring compliance with state tax regulations. The MTA surcharge is designed to fund public transportation projects and services within New York City and its surrounding areas.

Steps to Complete Form CT186 PM

Completing the Form CT186 PM requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your business name, address, and tax identification number.

- Calculate the total amount of utility services provided during the reporting period.

- Determine the applicable MTA surcharge rate based on the type of utility services offered.

- Complete all sections of the form, ensuring accuracy in reporting the surcharge amount.

- Review the completed form for any errors or omissions before submission.

Obtaining Form CT186 PM

Form CT186 PM can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, businesses may request a physical copy by contacting the department directly. It is important to ensure that you are using the most recent version of the form to comply with current regulations.

Legal Use of Form CT186 PM

The legal use of Form CT186 PM is critical for businesses to avoid penalties and ensure compliance with state tax laws. This form must be filed accurately and on time to report the MTA surcharge on utility services. Failure to file or incorrect filings can lead to fines or additional scrutiny from tax authorities. It is advisable for businesses to maintain thorough records of utility service transactions to support the information reported on the form.

Filing Deadlines for Form CT186 PM

Filing deadlines for Form CT186 PM are typically set by the New York State Department of Taxation and Finance. Businesses must be aware of these deadlines to avoid late fees. Generally, the form is due quarterly, with specific due dates that align with the end of each quarter. Keeping track of these dates is essential for timely compliance and to maintain good standing with tax authorities.

Form Submission Methods

Businesses can submit Form CT186 PM through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing times. For those choosing to mail the form, it is advisable to send it via certified mail to ensure it is received by the deadline. In-person submissions can be made at designated tax offices, providing an opportunity for immediate confirmation of receipt.

Quick guide on how to complete form ct186 pm utility services mta surcharge return ct186pm tax ny

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hassles. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct186 pm utility services mta surcharge return ct186pm tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT186 PM and how does it relate to utility services?

Form CT186 PM, commonly known as the Utility Services MTA Surcharge Return, is a tax return form required for businesses in New York providing utility services. Completing this form ensures compliance with state tax regulations and helps accurately report the MTA surcharge. Ensuring timely submission is crucial to avoid penalties.

-

How do I complete the Utility Services MTA Surcharge Return?

To complete the Utility Services MTA Surcharge Return, you'll need detailed information about your utility services and any applicable charges. airSlate SignNow offers an intuitive platform that streamlines the process of filling out Form CT186 PM, making it easier for businesses to submit their returns accurately.

-

What are the benefits of using airSlate SignNow for submitting Form CT186 PM?

Using airSlate SignNow for submitting Form CT186 PM, Utility Services MTA Surcharge Return, CT186PM Tax Ny, provides a user-friendly experience with digital signature capabilities. This ensures that your documents are legally binding and securely stored. Plus, our platform allows for easy tracking of submission statuses.

-

Is there a cost associated with using airSlate SignNow for the CT186PM Tax Ny?

Yes, there is a pricing structure for using airSlate SignNow to manage your documents, including Form CT186 PM and other tax forms. We offer various plans tailored to meet different business needs, providing a cost-effective solution for your document management and eSignature requirements.

-

Can airSlate SignNow integrate with other accounting software for Form CT186 PM?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing for efficient management of financial records. This integration is particularly useful when dealing with the Utility Services MTA Surcharge Return, ensuring that all data is synchronized and readily available for your tax filings.

-

How secure is the information submitted via airSlate SignNow when filing CT186PM Tax Ny?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technology to protect all information submitted through our platform, including Form CT186 PM filings. This ensures that your sensitive data remains confidential and secure throughout the submission process.

-

How can I track the status of my Utility Services MTA Surcharge Return submission?

airSlate SignNow provides real-time tracking features for your submissions, including the Utility Services MTA Surcharge Return. You can easily monitor the status of Form CT186 PM to confirm receipt and any necessary next steps, ensuring peace of mind during the filing process.

Get more for Form CT186 PM , Utility Services MTA Surcharge Return, CT186PM Tax Ny

- Da 7652 form 100057134

- Number knowledge test form

- New headway elementary 4th edition tests pdf form

- Principles of risk management and insurance 13th edition pdf download form

- Humana medical precertification request form

- Eimm5669 form

- Troubleshooting cisco ip telephony form

- Scale factor worksheet form

Find out other Form CT186 PM , Utility Services MTA Surcharge Return, CT186PM Tax Ny

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile