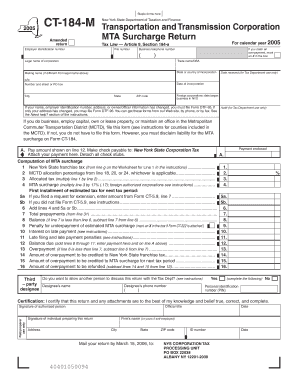

Transportation and Transmission Corporation MTA Surcharge Return Tax Ny Form

What is the Transportation And Transmission Corporation MTA Surcharge Return Tax Ny

The Transportation And Transmission Corporation MTA Surcharge Return Tax in New York is a specific tax levied on transportation services that utilize the Metropolitan Transportation Authority (MTA) infrastructure. This tax is designed to fund public transportation initiatives and maintain the operational efficiency of the MTA. Businesses that engage in transportation services within the jurisdiction of the MTA are required to file this return, ensuring compliance with state regulations and contributing to the overall public transit system.

Steps to complete the Transportation And Transmission Corporation MTA Surcharge Return Tax Ny

Completing the Transportation And Transmission Corporation MTA Surcharge Return Tax involves several key steps:

- Gather necessary financial records and documentation related to transportation services provided.

- Determine the applicable surcharge rate based on the type of transportation service and the revenue generated.

- Fill out the required forms accurately, ensuring all information is complete and correct.

- Review the completed return for any errors or omissions before submission.

- Submit the return by the designated deadline, either online or via mail, as per MTA guidelines.

Required Documents

To successfully file the Transportation And Transmission Corporation MTA Surcharge Return Tax, businesses must prepare specific documents, including:

- Financial statements detailing revenue from transportation services.

- Invoices and receipts that substantiate the reported income.

- Any previous tax returns related to MTA surcharges.

- Documentation of any exemptions or deductions claimed.

Filing Deadlines / Important Dates

Timely filing of the Transportation And Transmission Corporation MTA Surcharge Return Tax is crucial. Important dates include:

- The annual filing deadline, typically set for the end of the fiscal year.

- Quarterly estimated payment deadlines for businesses that expect to owe a certain amount.

- Any extensions that may be available for filing, along with their specific due dates.

Penalties for Non-Compliance

Failure to comply with the requirements of the Transportation And Transmission Corporation MTA Surcharge Return Tax can result in significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest charges on late payments.

- Potential legal action for continued non-compliance.

Who Issues the Form

The Transportation And Transmission Corporation MTA Surcharge Return Tax form is issued by the Metropolitan Transportation Authority. This agency is responsible for overseeing the collection of surcharges and ensuring that businesses comply with tax regulations related to transportation services within its jurisdiction.

Quick guide on how to complete transportation and transmission corporation mta surcharge return tax ny

Effortlessly complete [SKS] on any device

Managing documents online has become increasingly popular among companies and individuals. It presents an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Transportation And Transmission Corporation MTA Surcharge Return Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the transportation and transmission corporation mta surcharge return tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Transportation And Transmission Corporation MTA Surcharge Return Tax Ny?

The Transportation And Transmission Corporation MTA Surcharge Return Tax Ny is a tax applied to businesses operating within the Metropolitan Transportation Authority service area. It helps fund transportation infrastructure and services in New York. Understanding this tax is crucial for compliance and financial planning.

-

How does airSlate SignNow simplify the MTA Surcharge Return Tax Ny filing process?

airSlate SignNow streamlines the MTA Surcharge Return Tax Ny filing process by allowing businesses to easily eSign and manage their tax documents. With its intuitive interface, users can quickly prepare and submit their returns without complications. This makes the typically tedious tax filing process much more efficient.

-

What are the pricing plans for using airSlate SignNow in relation to the MTA Surcharge Return Tax Ny?

airSlate SignNow offers flexible pricing plans suited for businesses of all sizes. Depending on your needs related to the MTA Surcharge Return Tax Ny, you can choose a plan that ensures you have all the necessary features for managing your tax documents affordably. Review our plans to find the one that fits best with your business requirements.

-

What features does airSlate SignNow offer for handling MTA Surcharge Return Tax Ny documentation?

airSlate SignNow provides features like document templates, real-time collaboration, and secure eSigning, specifically designed to assist with the MTA Surcharge Return Tax Ny documentation. These tools allow businesses to complete their tax forms efficiently, ensuring they meet deadline requirements effortlessly. The platform also integrates seamlessly with existing business systems.

-

Can I integrate airSlate SignNow with my accounting software for MTA Surcharge Return Tax Ny?

Yes, airSlate SignNow can be integrated with a variety of accounting software solutions, enhancing your workflow related to the MTA Surcharge Return Tax Ny. This integration simplifies data exchange, making it easier to transfer financial information and manage documents all within one platform. Check our website for a list of compatible software.

-

What benefits does airSlate SignNow offer for businesses dealing with MTA Surcharge Return Tax Ny documentation?

Using airSlate SignNow brings numerous benefits for businesses managing MTA Surcharge Return Tax Ny documentation, including speed, efficiency, and security. The platform reduces the time spent on paperwork, ensuring that you can focus on growing your business. Additionally, by using eSignatures, you enhance the security of your tax-related documents.

-

Is there support available for businesses using airSlate SignNow for MTA Surcharge Return Tax Ny?

Absolutely! airSlate SignNow offers comprehensive support to all users, especially for those dealing with MTA Surcharge Return Tax Ny. Our customer service team is available to assist with any questions or challenges you may face, ensuring you can navigate the document signing and filing process smoothly.

Get more for Transportation And Transmission Corporation MTA Surcharge Return Tax Ny

Find out other Transportation And Transmission Corporation MTA Surcharge Return Tax Ny

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe