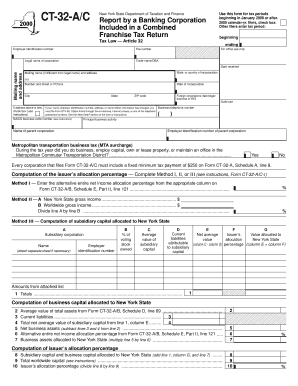

Filers, Check Box Other Filers Enter Tax Period Beginning Ending for Office Use Only Legal Name of Corporation Trade NameDBA Mai Form

Understanding the Filers Tax Form

The Filers tax form is essential for businesses in the United States to report their income and tax obligations accurately. This form includes various fields, such as the legal name of the corporation, trade name (DBA), and mailing address. These details ensure that the tax authorities can identify the entity filing the form and process the information correctly. The form also includes sections for entering the tax period, which specifies the beginning and ending dates for the reporting period. This information is crucial for compliance and accurate tax assessment.

Steps to Complete the Filers Tax Form

Completing the Filers tax form involves several key steps:

- Gather necessary information: Collect all relevant details, including the legal name of the corporation, trade name, and mailing address.

- Identify the tax period: Clearly define the beginning and ending dates for the tax period you are reporting.

- Fill out the form: Accurately enter all required information in the designated fields, ensuring clarity and correctness.

- Review for accuracy: Double-check all entries to avoid mistakes that could lead to penalties or delays.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the Filers Tax Form

The Filers tax form serves a legal purpose, allowing corporations to comply with federal and state tax regulations. Accurate completion of this form is necessary to avoid legal issues, such as fines or audits. It is essential for businesses to understand the legal implications of the information provided, as inaccuracies can lead to significant consequences. Maintaining proper records and ensuring compliance with tax laws is crucial for the longevity and integrity of any business.

State-Specific Rules for the Filers Tax Form

Each state may have unique rules regarding the Filers tax form. It is important for businesses to be aware of these regulations to ensure compliance. For example, some states may require additional documentation or specific filing formats. Understanding state-specific guidelines helps businesses avoid penalties and ensures that they meet all legal obligations. Consulting with a tax professional or legal advisor can provide clarity on these requirements.

Filing Deadlines and Important Dates

Filing deadlines for the Filers tax form vary depending on the tax period and the type of business entity. It is crucial for businesses to be aware of these deadlines to avoid late fees and penalties. Typically, the deadline falls on the fifteenth day of the fourth month following the end of the tax year. However, extensions may be available under certain circumstances. Keeping a calendar of important dates related to tax filings can help businesses stay organized and compliant.

Required Documents for Filing

When completing the Filers tax form, several documents may be required to support the information provided. These documents can include:

- Financial statements: Providing accurate financial records helps substantiate reported income.

- Previous tax returns: These can offer a reference point for current filings.

- Identification numbers: Such as the Employer Identification Number (EIN) or Social Security Number (SSN) for sole proprietors.

Having these documents ready can streamline the filing process and ensure compliance with tax regulations.

Quick guide on how to complete filers check box other filers enter tax period beginning ending for office use only legal name of corporation trade namedba 130073

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any documentation process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or black out sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the filers check box other filers enter tax period beginning ending for office use only legal name of corporation trade namedba 130073

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Filers in New York?

airSlate SignNow is a powerful tool that allows Filers to efficiently manage their document signing and eSignature needs. By utilizing features like Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation Trade NameDBA Mailing Name And Address, users can streamline their tax documentation processes in New York.

-

How can airSlate SignNow help with tax filing in New York?

With airSlate SignNow, Filers can easily navigate the complexities of tax documentation, ensuring that all necessary fields, such as Legal Name Of Corporation and Mailing Name And Address, are accurately filled out. This makes the preparation and submission process more efficient for those needing to Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only.

-

What pricing options does airSlate SignNow offer for users in New York?

airSlate SignNow provides flexible pricing plans designed to accommodate various business needs, including those of Filers in New York. Each plan includes features like eSigning and document management, ensuring that all fields such as Trade NameDBA, Mailing Name if Different From Legal Name And Address, and Tax NY are covered.

-

Can airSlate SignNow integrate with other tax software?

Absolutely! airSlate SignNow offers integrations with various tax software solutions to enhance the experience for Filers. This means you can easily incorporate the functionalities of entering Tax Period Beginning Ending For Office Use Only alongside your existing tools for seamless document management.

-

What are the key features of airSlate SignNow for Filers in New York?

Key features of airSlate SignNow include customizable templates, secure eSignatures, and thorough document tracking. For Filers, these features are essential when dealing with complex forms like Legal Name Of Corporation and ensuring all necessary information is collected correctly, such as Mailing Name And Address.

-

Is airSlate SignNow user-friendly for new Filers?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for new Filers. The platform provides guided support for completing forms like Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation, reducing errors and improving overall efficiency.

-

What benefits does airSlate SignNow offer to businesses in New York?

airSlate SignNow benefits New York businesses by speeding up document turnaround and enhancing compliance with state regulations. For Filers, this means easier management of documents, allowing completion of forms like Mailing Name if Different From Legal Name And Address accurately and efficiently.

Get more for Filers, Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation Trade NameDBA Mai

Find out other Filers, Check Box Other Filers Enter Tax Period Beginning Ending For Office Use Only Legal Name Of Corporation Trade NameDBA Mai

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament