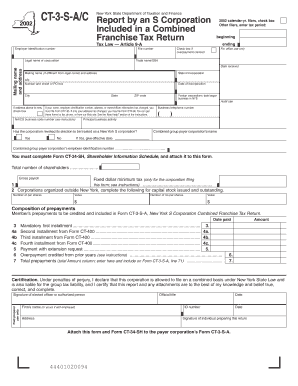

CT 3 S AC Employer Identification Number New York State Department of Taxation and Finance Report by an S Corporation Included I Form

Understanding the CT-3-S AC Employer Identification Number

The CT-3-S AC Employer Identification Number is a critical component for S Corporations in New York State. This number is assigned by the New York State Department of Taxation and Finance and is essential for reporting income and tax obligations. It ensures that the corporation is recognized for tax purposes and is necessary for filing the combined franchise tax return under Tax Law Article 9-A. Having this identification number helps streamline the tax process and maintain compliance with state regulations.

Steps to Complete the CT-3-S AC Report

Completing the CT-3-S AC report involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with the required information, including the Employer Identification Number and details about the corporation's income and deductions. Be sure to check the box if claiming an overpayment. Finally, review the completed form for accuracy before submission to the New York State Department of Taxation and Finance.

Obtaining the CT-3-S AC Employer Identification Number

To obtain the CT-3-S AC Employer Identification Number, S Corporations must apply through the New York State Department of Taxation and Finance. This process typically involves submitting specific forms and documentation that verify the corporation's status and tax obligations. It is advisable to prepare all necessary information in advance to expedite the application process. Once approved, the corporation will receive its unique identification number, which must be used for all tax-related filings.

Key Elements of the CT-3-S AC Report

The CT-3-S AC report includes several key elements that must be accurately completed. These elements consist of the corporation's name, address, Employer Identification Number, and financial data, such as total income and allowable deductions. Additionally, the form requires details about any overpayment claims, which must be clearly indicated by checking the appropriate box. Understanding these key components is essential for ensuring a successful filing.

Legal Use of the CT-3-S AC Report

The CT-3-S AC report serves a legal purpose in documenting the tax obligations of S Corporations in New York State. It is essential for compliance with state tax laws and regulations. By accurately completing and submitting this report, corporations fulfill their legal responsibilities and avoid potential penalties. It is important to keep a copy of the submitted report for record-keeping and future reference.

Filing Deadlines and Important Dates

Filing deadlines for the CT-3-S AC report are crucial for compliance. S Corporations must be aware of the specific dates set by the New York State Department of Taxation and Finance to avoid late penalties. Typically, the report is due on the fifteenth day of the third month following the end of the tax year. Marking these important dates on a calendar can help ensure timely submission and maintain good standing with state tax authorities.

Quick guide on how to complete ct 3 s ac employer identification number new york state department of taxation and finance report by an s corporation included

Easily Prepare [SKS] on Any Device

Online document management has gained immense traction among businesses and individuals. It serves as a fantastic eco-friendly option compared to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Access [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and electronically sign [SKS] while ensuring exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 3 S AC Employer Identification Number New York State Department Of Taxation And Finance Report By An S Corporation Included I

Create this form in 5 minutes!

How to create an eSignature for the ct 3 s ac employer identification number new york state department of taxation and finance report by an s corporation included

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 3 S AC Employer Identification Number?

The CT 3 S AC Employer Identification Number is a unique identification number assigned by the New York State Department of Taxation and Finance for S Corporations reporting in a Combined Franchise Tax Return. This number is essential for tax filing and ensuring compliance with Tax Law Article 9 A.

-

What purpose does the Report By An S Corporation Included In A Combined Franchise Tax Return serve?

The Report By An S Corporation Included In A Combined Franchise Tax Return outlines the tax obligations of S Corporations in New York. This report helps the state assess the combined tax liabilities of associated entities under Tax Law Article 9 A.

-

How can I check my CT 3 S AC Employer Identification Number?

You can check your CT 3 S AC Employer Identification Number through the New York State Department of Taxation and Finance's online portal. Simply navigate to the appropriate section and provide the required details for verification.

-

What benefits does airSlate SignNow provide for S Corporations?

airSlate SignNow offers S Corporations a streamlined way to send and eSign important documents, including those related to the CT 3 S AC Employer Identification Number. This enhances efficiency, ensures compliance, and offers a secure solution for managing sensitive corporate documents.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses looking to manage their documentation needs. By utilizing this platform, companies can save time and reduce costs associated with traditional paper methods, including those related to tax reporting like the CT 3 S AC Employer Identification Number.

-

Does airSlate SignNow integrate with accounting software for tax reporting?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage tax-related documents effortlessly. This is particularly beneficial when dealing with the CT 3 S AC Employer Identification Number and associated reports.

-

Can I claim an overpayment using the CT 3 S AC Employer Identification Number?

Yes, if you have an overpayment, you can claim it on your tax return by using the CT 3 S AC Employer Identification Number. It's crucial to check the appropriate box designated for overpayment claims on your return to ensure proper processing.

Get more for CT 3 S AC Employer Identification Number New York State Department Of Taxation And Finance Report By An S Corporation Included I

- Forn have form

- Editable certificate of appreciation template word form

- Homeless verification letter form

- Discrepancy letter sample form

- Letter of surety treasury and surety bond and surety bonding capacity form

- Madurai kamaraj university migration certificate online payment form

- Esa forms to download

- General health questionnaire 12 pdf download form

Find out other CT 3 S AC Employer Identification Number New York State Department Of Taxation And Finance Report By An S Corporation Included I

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement