Form ND 1V Electronic Return Payment Voucher Nd

What is the Form ND 1V Electronic Return Payment Voucher Nd

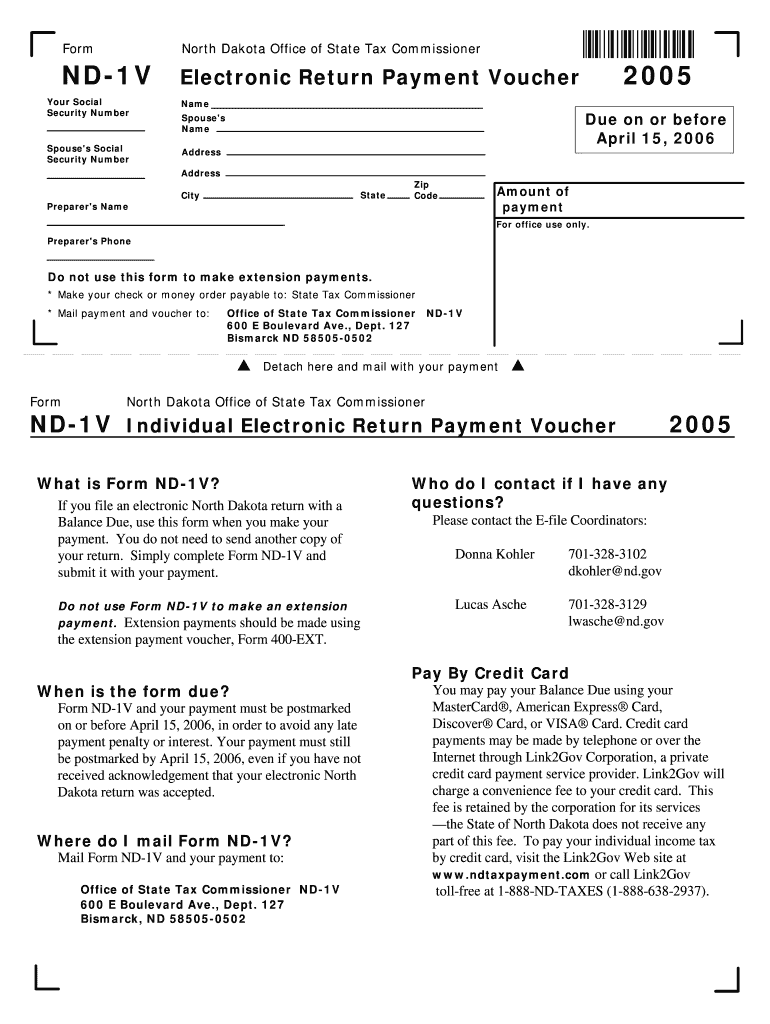

The Form ND 1V Electronic Return Payment Voucher Nd is a document used by taxpayers in the United States to facilitate electronic payments for their tax obligations. This form is specifically designed to ensure that payments are processed efficiently and accurately, providing a streamlined method for individuals and businesses to meet their tax responsibilities. The form captures essential information, including taxpayer identification details and payment amounts, making it a crucial component of the electronic filing process.

How to use the Form ND 1V Electronic Return Payment Voucher Nd

Using the Form ND 1V Electronic Return Payment Voucher Nd involves several straightforward steps. First, gather all necessary information, such as your taxpayer identification number and the amount you intend to pay. Next, complete the form by entering the required details accurately. Once the form is filled out, you can submit it electronically through the appropriate tax authority's online portal. This method ensures that your payment is processed quickly and securely, reducing the risk of delays or errors.

Steps to complete the Form ND 1V Electronic Return Payment Voucher Nd

Completing the Form ND 1V Electronic Return Payment Voucher Nd requires careful attention to detail. Follow these steps:

- Gather your taxpayer identification number and payment amount.

- Access the form through the official tax authority website or your tax software.

- Fill in your personal information, ensuring accuracy in all entries.

- Specify the payment amount and any relevant tax period.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the designated online platform.

Key elements of the Form ND 1V Electronic Return Payment Voucher Nd

The Form ND 1V Electronic Return Payment Voucher Nd includes several key elements that are essential for proper completion. These elements typically consist of:

- Taxpayer Identification Number: This unique identifier is crucial for processing your payment.

- Payment Amount: Clearly state the total amount you are submitting.

- Tax Period: Indicate the specific tax period for which the payment is being made.

- Signature: An electronic signature may be required to validate the submission.

Legal use of the Form ND 1V Electronic Return Payment Voucher Nd

The Form ND 1V Electronic Return Payment Voucher Nd is legally recognized for electronic tax payments in the United States. It complies with federal regulations governing electronic filing and payment processes. By using this form, taxpayers can ensure that they are meeting their legal obligations while benefiting from the convenience of digital submissions. It is important to retain a copy of the submitted form for your records, as it serves as proof of payment.

Filing Deadlines / Important Dates

Filing deadlines for the Form ND 1V Electronic Return Payment Voucher Nd are critical for taxpayers to observe. Typically, payments must be submitted by the due date of your tax return to avoid penalties and interest. It is advisable to check the specific deadlines set by the IRS or your state tax authority, as these dates can vary based on individual circumstances and tax regulations. Staying informed about these important dates helps ensure compliance and timely payment.

Quick guide on how to complete form nd 1v electronic return payment voucher nd

Prepare [SKS] effortlessly on any device

Managing documents online has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the right template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and possesses the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form ND 1V Electronic Return Payment Voucher Nd

Create this form in 5 minutes!

How to create an eSignature for the form nd 1v electronic return payment voucher nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form ND 1V Electronic Return Payment Voucher Nd?

The Form ND 1V Electronic Return Payment Voucher Nd is an official document used for submitting payments electronically to the North Dakota tax department. Businesses can conveniently file their return payments online using this form, ensuring compliance and efficiency in managing their tax obligations.

-

How does the Form ND 1V Electronic Return Payment Voucher Nd benefit my business?

Utilizing the Form ND 1V Electronic Return Payment Voucher Nd streamlines the payment process for businesses, reducing paperwork and saving time. Additionally, it minimizes the risk of errors and late payments, helping you maintain a good standing with tax authorities.

-

What features does airSlate SignNow offer for the Form ND 1V Electronic Return Payment Voucher Nd?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form ND 1V Electronic Return Payment Voucher Nd. Key features include secure document storage, multi-user access, and real-time tracking of signatures, enhancing the overall workflow for tax compliance.

-

Is there a cost associated with using the Form ND 1V Electronic Return Payment Voucher Nd on airSlate SignNow?

While the Form ND 1V Electronic Return Payment Voucher Nd itself is free to use, airSlate SignNow offers various pricing plans that cater to different business needs. Pricing is competitive and provides access to additional features that can enhance your document management processes.

-

Can I integrate the Form ND 1V Electronic Return Payment Voucher Nd with other software?

Yes, airSlate SignNow allows for seamless integration of the Form ND 1V Electronic Return Payment Voucher Nd with various accounting and tax software. This integration helps you manage your finances more effectively and ensures that your payment processes are synchronized across platforms.

-

What types of businesses can benefit from the Form ND 1V Electronic Return Payment Voucher Nd?

Any business that operates in North Dakota and is required to submit electronic payments can benefit from the Form ND 1V Electronic Return Payment Voucher Nd. From small startups to large corporations, this tool simplifies tax payment processes for all types of businesses.

-

How secure is the signing process for the Form ND 1V Electronic Return Payment Voucher Nd?

The signing process for the Form ND 1V Electronic Return Payment Voucher Nd on airSlate SignNow is highly secure, employing advanced encryption methods to protect your sensitive information. You can trust that your data is safe while effectively managing your tax documentation.

Get more for Form ND 1V Electronic Return Payment Voucher Nd

Find out other Form ND 1V Electronic Return Payment Voucher Nd

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe