Form LOA Loan Out AffidavitAllocation Mass Gov 2022

What is the Form LOA Loan Out Affidavit Allocation Mass gov

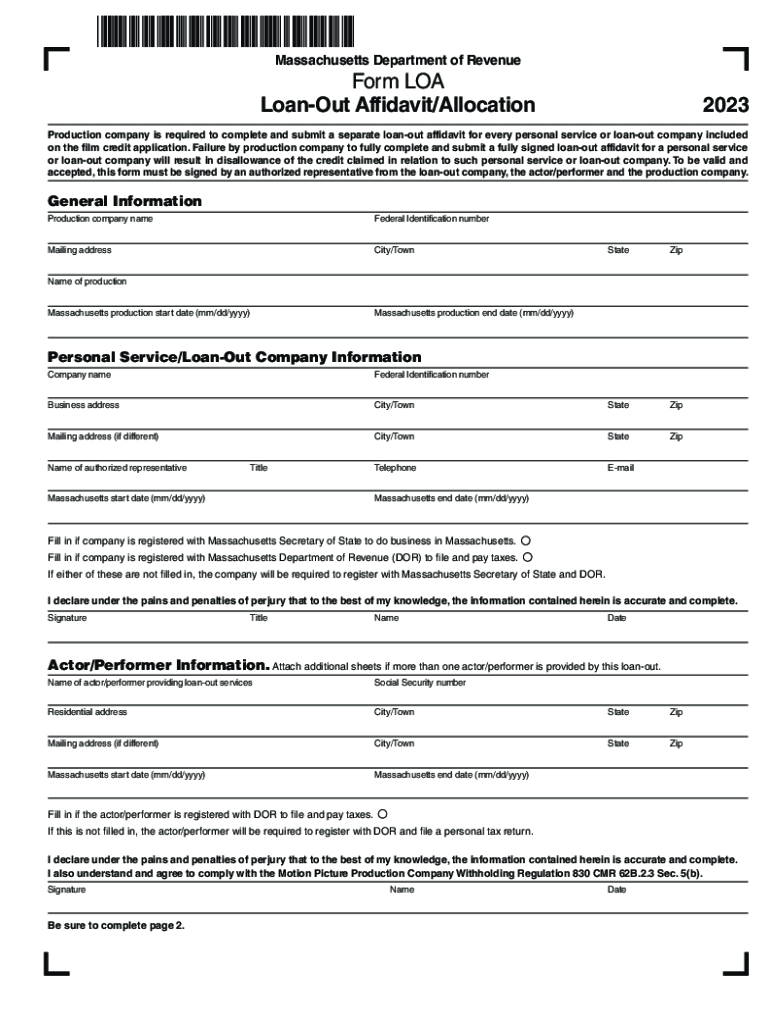

The Form LOA Loan Out Affidavit Allocation is a legal document used in Massachusetts that serves to verify the allocation of funds for loan-out arrangements. This form is essential for individuals or entities that engage in loan-out agreements, particularly within the entertainment industry. It outlines the terms and conditions under which a loan-out company operates, ensuring compliance with state regulations. The affidavit typically includes details about the parties involved, the nature of the loan-out agreement, and the financial arrangements made.

How to use the Form LOA Loan Out Affidavit Allocation Mass gov

Using the Form LOA Loan Out Affidavit Allocation requires careful attention to detail. First, ensure you have the correct version of the form, which can be obtained from the Massachusetts government website. Fill out the necessary fields, including your name, the name of the loan-out company, and the specifics of the loan-out agreement. Once completed, the form must be signed by all parties involved, affirming that the information provided is accurate and complete. It is advisable to keep a copy for your records after submission.

Steps to complete the Form LOA Loan Out Affidavit Allocation Mass gov

Completing the Form LOA Loan Out Affidavit Allocation involves several key steps:

- Obtain the latest version of the form from the Massachusetts government website.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information and the details of the loan-out company accurately.

- Provide a clear description of the loan-out agreement, including financial terms.

- Review the form for any errors or omissions before signing.

- Ensure all parties involved sign the affidavit to validate the document.

- Submit the completed form as directed, either online or via mail.

Legal use of the Form LOA Loan Out Affidavit Allocation Mass gov

The legal use of the Form LOA Loan Out Affidavit Allocation is crucial for compliance with Massachusetts laws governing loan-out agreements. This form serves as a formal declaration that the loan-out company is operating within the legal framework established by state regulations. It protects all parties involved by providing a clear record of the agreement, which can be referenced in case of disputes or audits. Proper use of this affidavit can also help in establishing credibility and transparency in business dealings.

Key elements of the Form LOA Loan Out Affidavit Allocation Mass gov

Several key elements are essential when filling out the Form LOA Loan Out Affidavit Allocation:

- Identification of Parties: Names and addresses of all parties involved in the loan-out agreement.

- Description of Services: A detailed explanation of the services provided under the loan-out arrangement.

- Financial Terms: Clear terms regarding payment, including amounts and due dates.

- Signatures: Required signatures from all parties to validate the affidavit.

- Date of Agreement: The date when the loan-out agreement takes effect.

Who Issues the Form LOA Loan Out Affidavit Allocation

The Form LOA Loan Out Affidavit Allocation is issued by the Massachusetts government, specifically through the relevant state department that oversees business regulations and compliance. This ensures that the form adheres to the legal standards set forth by state law. It is important to use the official version of the form to ensure that all legal requirements are met and to avoid any potential issues with compliance.

Quick guide on how to complete form loa loan out affidavitallocation mass gov

Complete Form LOA Loan Out AffidavitAllocation Mass gov smoothly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form LOA Loan Out AffidavitAllocation Mass gov from any device using the airSlate SignNow mobile applications for Android or iOS and enhance any document-driven workflow today.

How to edit and eSign Form LOA Loan Out AffidavitAllocation Mass gov with ease

- Obtain Form LOA Loan Out AffidavitAllocation Mass gov and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and press the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your preference. Modify and eSign Form LOA Loan Out AffidavitAllocation Mass gov and ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form loa loan out affidavitallocation mass gov

Create this form in 5 minutes!

How to create an eSignature for the form loa loan out affidavitallocation mass gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form LOA Loan Out AffidavitAllocation Mass gov?

The Form LOA Loan Out AffidavitAllocation Mass gov is a legal document used in Massachusetts for loan out agreements. It outlines the terms under which a company may lend its services or assets to another entity. Understanding its nuances is essential for compliance and proper documentation.

-

How can airSlate SignNow help with the Form LOA Loan Out AffidavitAllocation Mass gov?

airSlate SignNow provides an efficient platform for creating, signing, and managing the Form LOA Loan Out AffidavitAllocation Mass gov. Our user-friendly interface streamlines the document preparation process, making it easy to customize templates and gather electronic signatures in minutes.

-

What are the pricing options for using airSlate SignNow for the Form LOA Loan Out AffidavitAllocation Mass gov?

airSlate SignNow offers flexible pricing plans tailored to suit various business needs. Users can choose from individual, team, and business plans, ensuring that you can manage the Form LOA Loan Out AffidavitAllocation Mass gov efficiently without overspending.

-

Are there any key features that help manage the Form LOA Loan Out AffidavitAllocation Mass gov?

Yes! airSlate SignNow includes features such as document templates, automated workflows, and secure eSignature capabilities. These tools ensure that the Form LOA Loan Out AffidavitAllocation Mass gov is processed quickly and securely, improving overall efficiency.

-

Can I integrate airSlate SignNow with other applications for the Form LOA Loan Out AffidavitAllocation Mass gov?

Absolutely! airSlate SignNow offers integrations with popular apps like Google Workspace, Salesforce, and more. This capability allows you to streamline your workflow when handling the Form LOA Loan Out AffidavitAllocation Mass gov, connecting with your existing software seamlessly.

-

What benefits does using airSlate SignNow provide for the Form LOA Loan Out AffidavitAllocation Mass gov?

Using airSlate SignNow enhances productivity, reduces paperwork, and provides a more efficient way to handle the Form LOA Loan Out AffidavitAllocation Mass gov. Our platform minimizes errors and speeds up transaction times, making it easier for companies to comply with legal requirements.

-

Is my data secure while using airSlate SignNow for the Form LOA Loan Out AffidavitAllocation Mass gov?

Yes, data security is a top priority at airSlate SignNow. We implement advanced encryption and security measures to protect your sensitive information while processing the Form LOA Loan Out AffidavitAllocation Mass gov, ensuring full compliance with industry standards.

Get more for Form LOA Loan Out AffidavitAllocation Mass gov

- Inspection repairs form

- Alexian brothers assessment of self injury short form

- Inquiry access only form

- Registration and de registration of money services businesses form

- Documentation of medical evaluation form

- Dc tax from 800q instructions form

- Work at home agreement template form

- Work experience confidentiality agreement template form

Find out other Form LOA Loan Out AffidavitAllocation Mass gov

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors