Form M 990T 62 Exempt Trust and Unincorporated 2021

What is the Form M 990T 62 Exempt Trust And Unincorporated

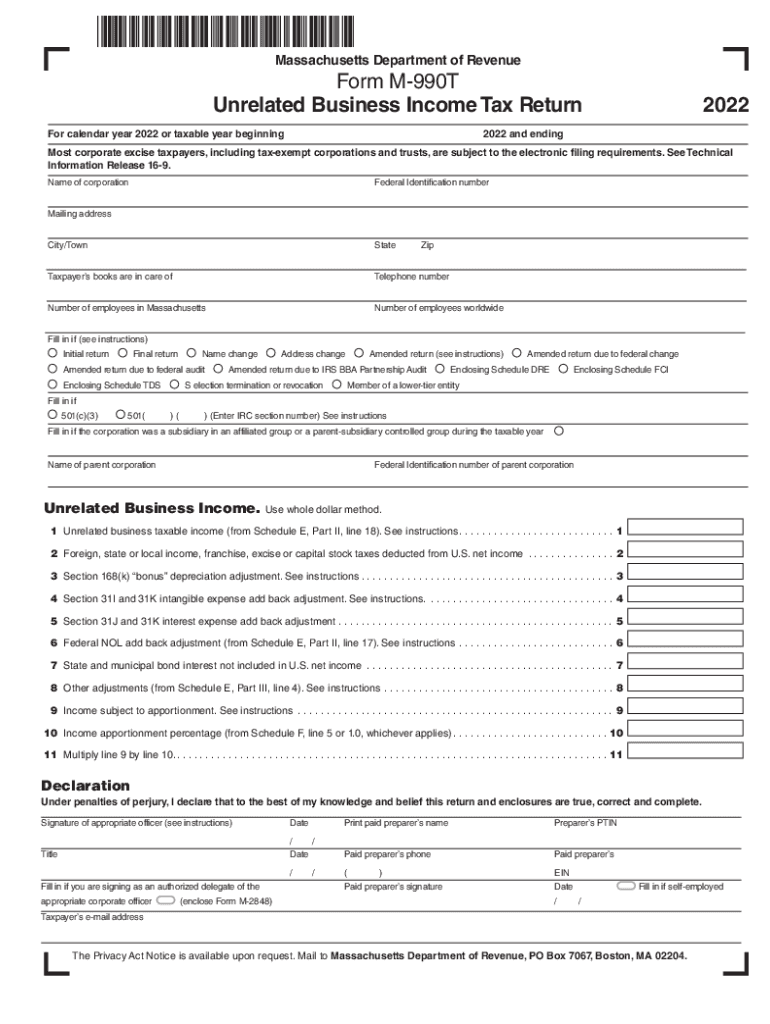

The Form M 990T 62 is a tax form specifically designed for exempt trusts and unincorporated entities. It is used to report unrelated business income and calculate the tax owed on that income. This form is essential for organizations that are exempt from federal income tax but still engage in business activities that generate taxable income. By filing this form, these entities ensure compliance with IRS regulations while accurately reporting their financial activities.

How to use the Form M 990T 62 Exempt Trust And Unincorporated

Using the Form M 990T 62 involves several steps to ensure accurate completion and submission. First, gather all necessary financial records related to the unrelated business income. This includes income statements, expense reports, and any relevant documentation that supports the figures reported. Next, complete the form by entering the required information, such as the entity's name, address, and tax identification number. After filling out the form, review it for accuracy before submitting it to the IRS, either electronically or by mail.

Steps to complete the Form M 990T 62 Exempt Trust And Unincorporated

Completing the Form M 990T 62 requires careful attention to detail. Follow these steps:

- Gather financial documentation related to unrelated business income.

- Enter the entity's identifying information at the top of the form.

- Report total unrelated business income and allowable deductions in the appropriate sections.

- Calculate the taxable income and the tax owed based on the IRS guidelines.

- Review all entries for accuracy and completeness.

- Submit the form by the specified deadline, ensuring it is sent to the correct IRS address.

Key elements of the Form M 990T 62 Exempt Trust And Unincorporated

Several key elements are crucial when completing the Form M 990T 62. These include:

- Identification Information: The entity's name, address, and tax identification number.

- Income Reporting: Total unrelated business income must be reported accurately.

- Deductions: Allowable deductions that can reduce taxable income.

- Tax Calculation: The method used to calculate the tax owed based on taxable income.

- Signature: The form must be signed by an authorized individual to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form M 990T 62 are critical for compliance. Generally, the form is due on the 15th day of the fifth month after the end of the entity's tax year. For entities following a calendar year, this means the deadline is May 15. If the deadline falls on a weekend or holiday, it is typically extended to the next business day. It is important to keep track of these dates to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to file the Form M 990T 62 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the length of the delay and the amount of tax owed. Additionally, non-compliance can lead to further scrutiny of the entity’s financial activities, which may result in additional audits or legal actions. It is essential for exempt trusts and unincorporated entities to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete form m 990t 62 exempt trust and unincorporated

Effortlessly Prepare Form M 990T 62 Exempt Trust And Unincorporated on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Form M 990T 62 Exempt Trust And Unincorporated from any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven procedure today.

How to Modify and Electronically Sign Form M 990T 62 Exempt Trust And Unincorporated with Ease

- Find Form M 990T 62 Exempt Trust And Unincorporated and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Choose your preferred method of sending your form—by email, SMS, or via an invitation link—or download it directly to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form M 990T 62 Exempt Trust And Unincorporated and maintain excellent communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form m 990t 62 exempt trust and unincorporated

Create this form in 5 minutes!

How to create an eSignature for the form m 990t 62 exempt trust and unincorporated

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form M 990T 62 Exempt Trust And Unincorporated?

Form M 990T 62 Exempt Trust And Unincorporated is a tax form required for certain exempt trusts and unincorporated organizations in the United States. This form helps ensure compliance with tax obligations while allowing organizations to maintain their exempt status. Completing this form accurately is crucial for managing tax liabilities effectively.

-

How can airSlate SignNow help with Form M 990T 62 Exempt Trust And Unincorporated?

airSlate SignNow simplifies the process of completing and eSigning the Form M 990T 62 Exempt Trust And Unincorporated. Our platform allows users to create, send, and securely sign documents online, ensuring that all necessary information is filled out correctly. This streamlines compliance and reduces the chances of errors in submission.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different needs, including tiers for small businesses and larger organizations. Each plan provides access to features that enable efficient handling of documents like Form M 990T 62 Exempt Trust And Unincorporated. You can choose a plan that fits your budget and business requirements.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes comprehensive features such as eSigning, template creation, and document tracking. These tools make it easier to manage important documents like Form M 990T 62 Exempt Trust And Unincorporated. Additionally, you can collaborate with team members in real-time to expedite the completion process.

-

Is airSlate SignNow secure for sensitive documents like tax forms?

Yes, airSlate SignNow prioritizes security and compliance, making it safe for handling sensitive documents such as Form M 990T 62 Exempt Trust And Unincorporated. Our platform utilizes encryption and robust security measures to protect your data. You can trust us to safeguard your information throughout the document management process.

-

Can I integrate airSlate SignNow with other software?

Absolutely, airSlate SignNow offers numerous integrations with popular applications that enhance your workflow. Whether you use CRM systems or accounting software, you can seamlessly integrate to manage Form M 990T 62 Exempt Trust And Unincorporated and other documents. This connectivity helps streamline operations and improves efficiency.

-

What benefits does airSlate SignNow provide for small businesses?

For small businesses, airSlate SignNow offers cost-effective solutions that simplify document management. By using our platform for tasks like completing the Form M 990T 62 Exempt Trust And Unincorporated, businesses save time and reduce errors. This efficiency ultimately contributes to better resource management and increased productivity.

Get more for Form M 990T 62 Exempt Trust And Unincorporated

- Swpr6 plan for post lcsw supervised experience in new york state form

- The missouri supreme court form

- Sebb metlife enrollment form pdf washington state health

- Abi 46x1112 criminal history information release form

- Preparticipation examination form

- Pasture lease agreement ces ncsu form

- Spay amp neuter voucher program application form

- Florida elementary charter school form

Find out other Form M 990T 62 Exempt Trust And Unincorporated

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors