F 1120X R 0116 Amended Florida Corporate Income 2016

What is the F 1120X R 0116 Amended Florida Corporate Income

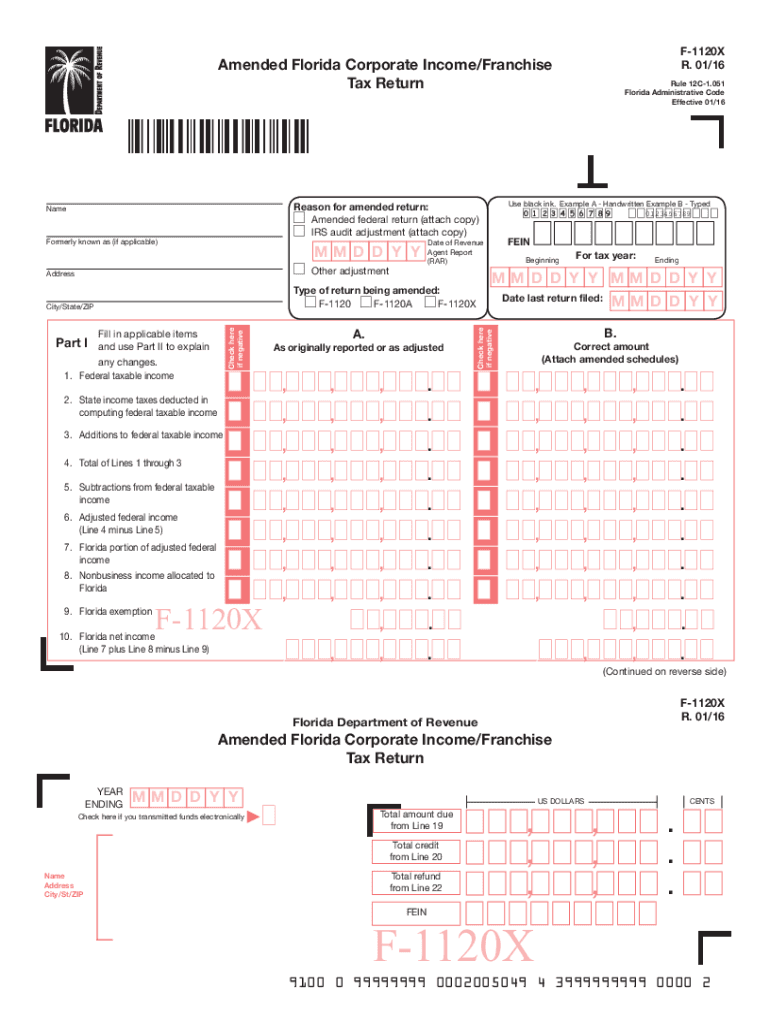

The F 1120X R 0116 Amended Florida Corporate Income is a tax form specifically designed for corporations in Florida to amend their previously filed corporate income tax returns. This form allows businesses to correct errors or make changes to their income, deductions, and credits reported on the original return. The amended return must be filed to ensure compliance with Florida tax laws and to accurately reflect the corporation's tax liability.

Steps to complete the F 1120X R 0116 Amended Florida Corporate Income

Completing the F 1120X R 0116 involves several key steps:

- Gather all relevant financial documents, including the original return and any supporting documentation for the changes being made.

- Clearly indicate the changes on the form, specifying the line numbers and amounts that are being amended.

- Provide a detailed explanation for each change, ensuring clarity and accuracy.

- Review the completed form for any errors before submission.

- Submit the form to the Florida Department of Revenue, ensuring it is sent to the correct address based on the corporation's location.

How to obtain the F 1120X R 0116 Amended Florida Corporate Income

The F 1120X R 0116 can be obtained directly from the Florida Department of Revenue's website. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, businesses may request a physical copy by contacting the Department of Revenue directly. Ensuring access to the most current version of the form is crucial for compliance.

Legal use of the F 1120X R 0116 Amended Florida Corporate Income

The legal use of the F 1120X R 0116 is essential for maintaining compliance with Florida tax regulations. Corporations are required to file this form when they need to amend their tax returns to correct inaccuracies. Failure to do so can result in penalties or additional tax liabilities. It is important for businesses to understand their legal obligations regarding tax filings and amendments.

Filing Deadlines / Important Dates

Filing deadlines for the F 1120X R 0116 are critical for compliance. Generally, the amended return must be filed within three years from the original return's due date or within two years from the date the tax was paid, whichever is later. Staying informed about these deadlines helps corporations avoid penalties and ensures timely processing of amendments.

Form Submission Methods (Online / Mail / In-Person)

The F 1120X R 0116 can be submitted through various methods. Corporations may choose to file the form by mail, sending it to the designated address provided by the Florida Department of Revenue. Currently, electronic filing options may not be available for this specific form, so businesses should verify the submission methods accepted by the Department of Revenue to ensure proper filing.

Quick guide on how to complete f 1120x r 0116 amended florida corporate income

Complete F 1120X R 0116 Amended Florida Corporate Income effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage F 1120X R 0116 Amended Florida Corporate Income on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and electronically sign F 1120X R 0116 Amended Florida Corporate Income effortlessly

- Find F 1120X R 0116 Amended Florida Corporate Income and click on Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign F 1120X R 0116 Amended Florida Corporate Income to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f 1120x r 0116 amended florida corporate income

Create this form in 5 minutes!

How to create an eSignature for the f 1120x r 0116 amended florida corporate income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the F 1120X R 0116 Amended Florida Corporate Income form?

The F 1120X R 0116 Amended Florida Corporate Income form is used by corporations to amend their previously filed Florida corporate income tax returns. This form allows businesses to rectify errors, update income or deductions, and ensure compliance with Florida tax regulations.

-

How does airSlate SignNow simplify the process of eSigning the F 1120X R 0116 Amended Florida Corporate Income form?

airSlate SignNow provides an intuitive eSigning solution that enables users to quickly and securely sign the F 1120X R 0116 Amended Florida Corporate Income form. Its user-friendly interface allows for easy navigation, ensuring that important documents are eSigned without unnecessary delays.

-

What are the pricing options for airSlate SignNow when filing the F 1120X R 0116 Amended Florida Corporate Income form?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Depending on the features you require and the volume of documents to eSign, you can choose a plan that helps efficiently manage F 1120X R 0116 Amended Florida Corporate Income filings at a competitive cost.

-

Can airSlate SignNow help with automated reminders for filing the F 1120X R 0116 Amended Florida Corporate Income form?

Yes, airSlate SignNow allows users to set up automated reminders for important deadlines, including those for the F 1120X R 0116 Amended Florida Corporate Income form. This feature ensures that you never miss a filing date, helping your business stay compliant with Florida corporate tax requirements.

-

Which integrations does airSlate SignNow offer to streamline the filing of the F 1120X R 0116 Amended Florida Corporate Income form?

airSlate SignNow integrates with various tools and platforms, such as Google Drive, Dropbox, and CRM systems, to streamline documentation processes. These integrations enhance your workflow and ensure that all necessary documents related to the F 1120X R 0116 Amended Florida Corporate Income filing are easily accessible.

-

What benefits does using airSlate SignNow for the F 1120X R 0116 Amended Florida Corporate Income form provide?

Using airSlate SignNow for the F 1120X R 0116 Amended Florida Corporate Income form provides several benefits, including enhanced security, compliance tracking, and cost-effectiveness. The platform not only simplifies the signing process but also ensures that your documents are protected and organized.

-

Is there customer support available for questions regarding the F 1120X R 0116 Amended Florida Corporate Income form?

Absolutely! airSlate SignNow offers robust customer support to assist you with any questions regarding the F 1120X R 0116 Amended Florida Corporate Income form. Their team is equipped to help resolve any queries efficiently, ensuring you have the support needed throughout the filing process.

Get more for F 1120X R 0116 Amended Florida Corporate Income

Find out other F 1120X R 0116 Amended Florida Corporate Income

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now