and Printable Pa 1500 Form 2019-2026

What is the rev 1500 form?

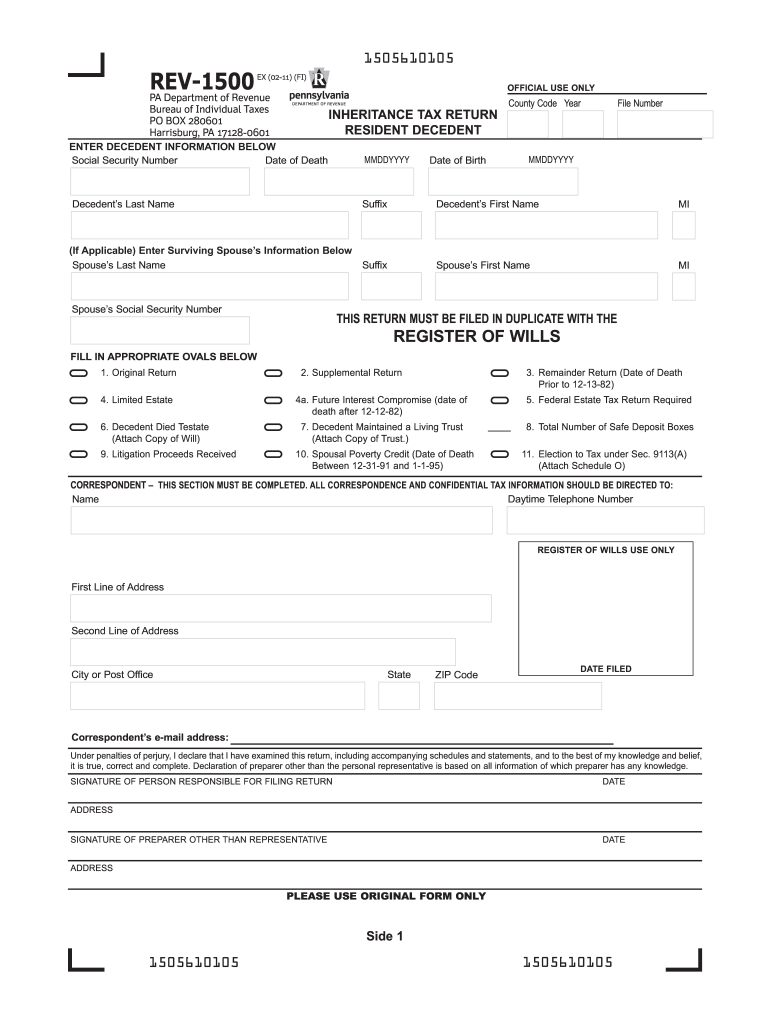

The rev 1500 form, also known as the Pennsylvania Inheritance Tax Return, is a crucial document used to report and calculate inheritance tax owed on the transfer of property and assets after an individual's death. This form is essential for the estate's executor or administrator to ensure compliance with Pennsylvania state tax laws. The rev 1500 form must be filed with the Pennsylvania Department of Revenue to settle any tax obligations related to the inheritance received by beneficiaries.

Steps to complete the rev 1500 form

Completing the rev 1500 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the decedent's assets, including real estate, bank accounts, and personal property. Next, accurately fill out the form, providing details such as the decedent's name, date of death, and a comprehensive list of assets. It's important to report any debts or expenses that may affect the taxable value of the estate. After completing the form, review it for accuracy before submission.

Legal use of the rev 1500 form

The rev 1500 form serves as a legally binding document that must be filed to fulfill the requirements of Pennsylvania inheritance tax law. Proper completion and submission of this form ensure that the estate is compliant with state regulations. Failure to file the rev 1500 form can result in penalties, interest on unpaid taxes, and potential legal issues for the estate's executor. Therefore, understanding the legal implications of this form is critical for all parties involved.

How to obtain the rev 1500 form

The rev 1500 form can be obtained through the Pennsylvania Department of Revenue's official website or by visiting local government offices. It is available in both printable and digital formats, allowing for easy access and completion. Additionally, many tax preparation services may provide the form as part of their offerings, ensuring that users have the necessary resources to complete their inheritance tax return accurately.

Form Submission Methods

The rev 1500 form can be submitted through various methods to accommodate different preferences. Individuals may choose to file the form online through the Pennsylvania Department of Revenue's e-filing system, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed directly to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Filing the rev 1500 form within the designated deadlines is crucial to avoid penalties. Generally, the form must be submitted within nine months of the decedent's date of death. If the form is filed late, interest and penalties may accrue on the unpaid tax amount. It's advisable to be aware of any specific dates that may affect the filing process, such as extensions or changes in tax law that could impact the inheritance tax obligations.

Quick guide on how to complete and printable pa 1500 2011 form

Effortlessly Complete And Printable Pa 1500 Form on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to swiftly create, edit, and electronically sign your documents without delays. Manage And Printable Pa 1500 Form on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related operation today.

How to Edit and Electronically Sign And Printable Pa 1500 Form with Ease

- Obtain And Printable Pa 1500 Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Identify key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and electronically sign And Printable Pa 1500 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct and printable pa 1500 2011 form

Create this form in 5 minutes!

How to create an eSignature for the and printable pa 1500 2011 form

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the rev 1500 form and why is it important?

The rev 1500 form is a standardized document used by healthcare providers to bill for services rendered. It is important because it ensures that claims are processed efficiently and accurately, allowing for faster reimbursement from insurers.

-

How can airSlate SignNow help me with the rev 1500 form?

airSlate SignNow simplifies the completion and signing of the rev 1500 form by providing a user-friendly platform for electronic signatures. With airSlate SignNow, you can easily fill out the form, send it for signatures, and track its status, all in one place.

-

Is there a cost associated with using airSlate SignNow for the rev 1500 form?

Yes, airSlate SignNow offers various pricing plans based on your needs. These plans provide access to essential features for managing the rev 1500 form and include options for businesses of all sizes, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for the rev 1500 form?

airSlate SignNow offers features such as document templates, real-time tracking, and customizable workflows specifically for the rev 1500 form. These tools streamline the billing process, making it easier to manage and send out forms quickly.

-

Can I integrate airSlate SignNow with other software for the rev 1500 form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing for efficient management of the rev 1500 form alongside your existing systems. This ensures that you can maintain a smooth workflow and keep all your documentation in sync.

-

What are the benefits of using airSlate SignNow for the rev 1500 form?

Using airSlate SignNow for the rev 1500 form enhances efficiency and reduces errors, as electronic signatures eliminate the need for physical paperwork. Additionally, it saves time by allowing you to manage your documents from anywhere, leading to faster reimbursement cycles.

-

How secure is my information when using airSlate SignNow for the rev 1500 form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols to protect your data when handling the rev 1500 form, ensuring that sensitive information remains confidential and secure throughout the signing process.

Get more for And Printable Pa 1500 Form

- Brew day sheet excel form

- Contents of lease agreement form

- Bank of ceylon nrfc metropolitan branch form

- Lifeline inspection checklist 441649050 form

- Mass volume and density practice problems review worksheet form

- Starbucks employee handbook pdf form

- Professional disclosure statement counseling example 426153381 form

- Automatic withdrawal authorization form renaissance montessori

Find out other And Printable Pa 1500 Form

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History