Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions 2022

Understanding the Corporation Business Tax Form Instructions

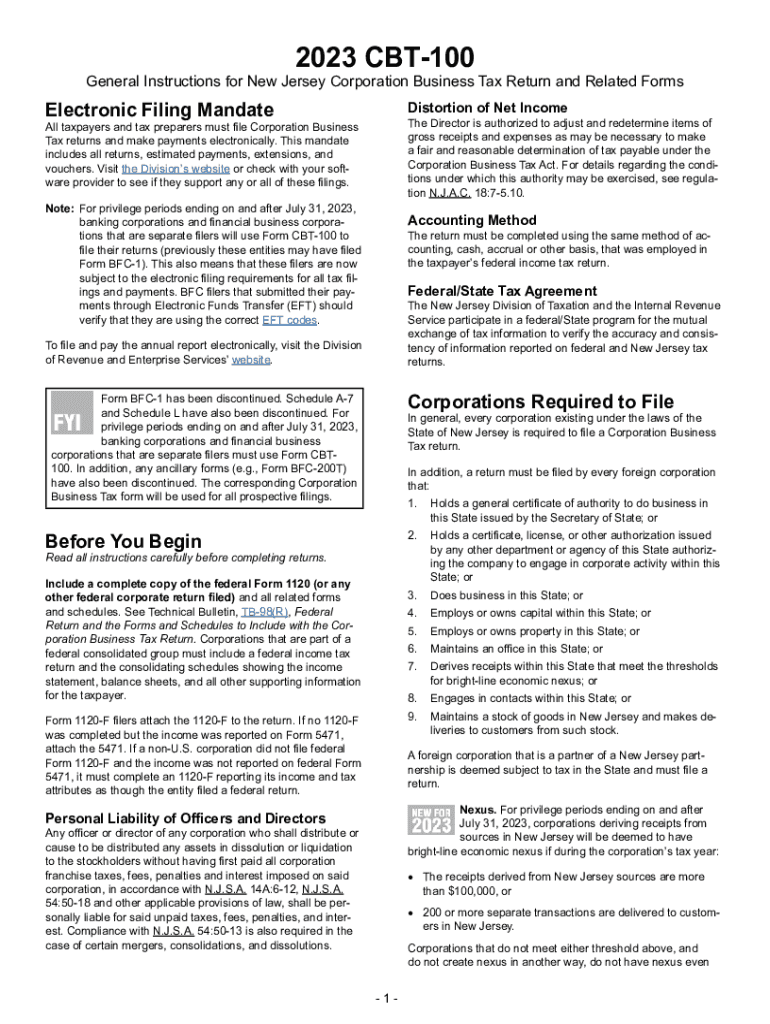

The Corporation Business Tax Form Instructions provide essential guidance for businesses in the United States to accurately complete their tax forms. This document outlines the requirements and processes for filing corporate taxes, ensuring compliance with federal and state regulations. It is crucial for corporations to understand these instructions to avoid penalties and ensure proper reporting of income, deductions, and credits.

Steps to Complete the Corporation Business Tax Form Instructions

Completing the Corporation Business Tax Form involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Review the specific instructions for the form you are completing, as requirements may vary based on the corporation's structure and revenue.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Double-check calculations and ensure that all required fields are completed.

- Submit the form by the designated deadline to avoid late penalties.

Required Documents for Filing

To complete the Corporation Business Tax Form, several documents are typically required:

- Financial statements, including profit and loss statements and balance sheets.

- Supporting documentation for deductions, such as receipts and invoices.

- Previous year’s tax return for reference and consistency.

- Any additional schedules or forms required based on the specific tax situation of the corporation.

Filing Deadlines and Important Dates

Corporations must adhere to specific deadlines for filing their tax forms to avoid penalties. Generally, the due date for corporate tax returns is the fifteenth day of the fourth month following the end of the corporation's tax year. It is important to stay informed about any changes to these deadlines, especially during tax season.

Penalties for Non-Compliance

Failure to comply with the Corporation Business Tax Form Instructions can result in various penalties, including:

- Late filing penalties, which can accumulate daily until the form is submitted.

- Interest on unpaid taxes, which accrues from the due date until payment is made.

- Potential audits by the IRS, which can lead to further scrutiny of the corporation's financial practices.

Digital vs. Paper Version of the Form

Corporations have the option to file their tax forms either digitally or via paper submission. The digital version often allows for easier calculations and faster processing times. However, some businesses may prefer the paper version for record-keeping purposes. It is essential to choose the method that best suits the corporation's needs while ensuring compliance with filing requirements.

Quick guide on how to complete corporation business tax form instructions corporation business tax form instructions 700972792

Complete Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions effortlessly

- Locate Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation business tax form instructions corporation business tax form instructions 700972792

Create this form in 5 minutes!

How to create an eSignature for the corporation business tax form instructions corporation business tax form instructions 700972792

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Corporation Business Tax Form Instructions and why are they important?

Corporation Business Tax Form Instructions provide essential guidelines for businesses on how to accurately complete and file their tax forms. Understanding these instructions is crucial to ensure compliance with tax laws and to avoid potential penalties. Properly following Corporation Business Tax Form Instructions can lead to a smoother filing process and peace of mind.

-

How can I access Corporation Business Tax Form Instructions through airSlate SignNow?

With airSlate SignNow, you can easily access Corporation Business Tax Form Instructions directly from our platform. Our solution offers helpful templates and guides that simplify the document preparation process. Accessing these instructions ensures your business can efficiently manage its tax filings.

-

Are there any costs associated with using airSlate SignNow for Corporation Business Tax Form Instructions?

airSlate SignNow offers a cost-effective solution for businesses seeking Corporation Business Tax Form Instructions. We provide various pricing plans to accommodate different business sizes and needs. Our plans are designed to provide value while ensuring you have the necessary tools for document management and eSigning.

-

What features does airSlate SignNow offer to assist with Corporation Business Tax Form Instructions?

airSlate SignNow includes features like customizable templates, document tracking, and advanced security measures to assist with Corporation Business Tax Form Instructions. Our platform allows you to fill out and sign forms electronically, minimizing the hassle of paperwork. These features ultimately streamline your taxation processes.

-

How does airSlate SignNow ensure my data is secure when handling Corporation Business Tax Form Instructions?

We prioritize security at airSlate SignNow to keep your data safe while working with Corporation Business Tax Form Instructions. Our platform employs advanced encryption technologies and compliance with security standards. You can trust that your sensitive tax information is protected at all times.

-

Can I integrate airSlate SignNow with other applications for Corporation Business Tax Form Instructions?

Yes, airSlate SignNow offers integration capabilities with various applications, making it easy to manage Corporation Business Tax Form Instructions. Our integrations allow you to streamline workflows and enhance productivity across different software. This ensures that you can maintain a unified process for your business documentation.

-

What are the benefits of using airSlate SignNow for Corporation Business Tax Form Instructions?

Using airSlate SignNow for Corporation Business Tax Form Instructions offers several benefits, including improved efficiency and reduced errors in documentation. Our eSigning solution helps eliminate the delays associated with traditional paperwork, saving your business valuable time. Additionally, our user-friendly interface makes it accessible for everyone.

Get more for Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions

- Unemployment insurance application de 1101id rev 13 6 22 form

- Application to change business or personnel address no fee form

- Info sheet bps docx form

- Application for licensure and examination in state bbs form

- Application to license a vehicle form vl17 application to license a vehicle form vl17

- How to correctly fill the online pmp application form

- Crew member training record da form 7122 apr

- 21p 534a application for dependency and indemnity compensation by a surviving spouse or child in service death only form

Find out other Corporation Business Tax Form Instructions Corporation Business Tax Form Instructions

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free