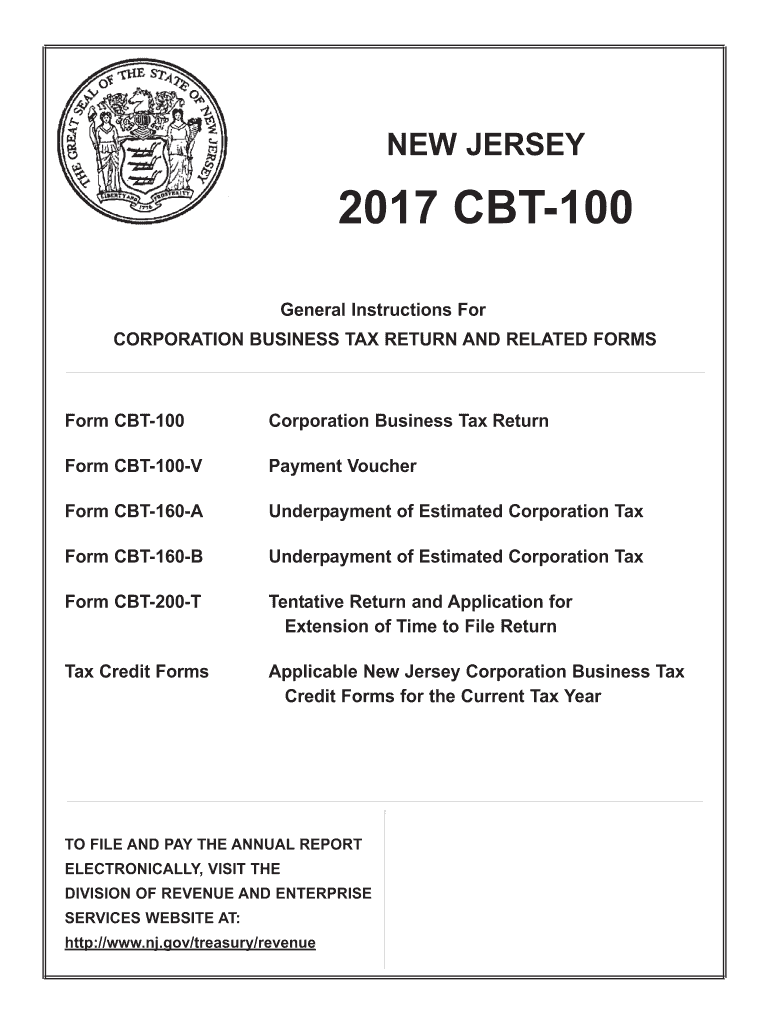

CBT 100 New Jersey Corporation Business Tax Return State of NJ 2017

What is the CBT 100 New Jersey Corporation Business Tax Return State Of NJ

The CBT 100 New Jersey Corporation Business Tax Return is a tax form specifically designed for corporations operating within the state of New Jersey. This form is essential for reporting the income, deductions, and tax liability of corporations to the New Jersey Division of Taxation. It is crucial for ensuring compliance with state tax laws and regulations. Corporations must accurately complete this form to determine their tax obligations and contribute to state revenue.

Steps to complete the CBT 100 New Jersey Corporation Business Tax Return State Of NJ

Completing the CBT 100 requires several steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements and balance sheets. Next, follow these steps:

- Fill out the identification section of the form, including the corporation's name, address, and federal employer identification number (FEIN).

- Report total income, including gross receipts and other income sources.

- Detail allowable deductions, such as business expenses and losses.

- Calculate the taxable income by subtracting deductions from total income.

- Apply the appropriate tax rate to determine the tax liability.

- Complete any additional schedules required for specific deductions or credits.

- Review the form for accuracy before submission.

Legal use of the CBT 100 New Jersey Corporation Business Tax Return State Of NJ

The CBT 100 form is recognized as a legal document when completed and submitted according to New Jersey tax laws. To ensure its legal standing, the form must be signed by an authorized officer of the corporation. Electronic signatures are acceptable, provided they comply with the standards set forth by the ESIGN Act and UETA. It is essential to maintain accurate records of the submitted form and any supporting documents for future reference and compliance verification.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the CBT 100 to avoid penalties. The due date for filing the CBT 100 is generally the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. It is advisable to check for any changes in deadlines or extensions that may apply, particularly during tax season.

Required Documents

To complete the CBT 100, several documents are necessary to provide accurate financial information. These include:

- Income statements, detailing gross receipts and revenue.

- Balance sheets, showing assets, liabilities, and equity.

- Records of business expenses and deductions.

- Previous tax returns, if applicable, for reference.

- Any additional schedules or forms required for specific deductions.

Form Submission Methods (Online / Mail / In-Person)

The CBT 100 can be submitted through various methods to accommodate different preferences. Corporations may choose to file the form online through the New Jersey Division of Taxation's electronic filing system. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is essential to choose the one that best suits the corporation's needs.

Quick guide on how to complete cbt 100 new jersey corporation business tax return state of nj

Complete CBT 100 New Jersey Corporation Business Tax Return State Of NJ effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the needed form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage CBT 100 New Jersey Corporation Business Tax Return State Of NJ on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign CBT 100 New Jersey Corporation Business Tax Return State Of NJ effortlessly

- Find CBT 100 New Jersey Corporation Business Tax Return State Of NJ and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to store your modifications.

- Choose how you'd like to share your form, via email, SMS, or invitation link, or download it onto your computer.

Bid farewell to lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Edit and eSign CBT 100 New Jersey Corporation Business Tax Return State Of NJ and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cbt 100 new jersey corporation business tax return state of nj

Create this form in 5 minutes!

How to create an eSignature for the cbt 100 new jersey corporation business tax return state of nj

How to generate an eSignature for the Cbt 100 New Jersey Corporation Business Tax Return State Of Nj online

How to make an electronic signature for the Cbt 100 New Jersey Corporation Business Tax Return State Of Nj in Google Chrome

How to generate an electronic signature for signing the Cbt 100 New Jersey Corporation Business Tax Return State Of Nj in Gmail

How to make an electronic signature for the Cbt 100 New Jersey Corporation Business Tax Return State Of Nj right from your smart phone

How to create an electronic signature for the Cbt 100 New Jersey Corporation Business Tax Return State Of Nj on iOS devices

How to create an electronic signature for the Cbt 100 New Jersey Corporation Business Tax Return State Of Nj on Android

People also ask

-

What is the CBT 100 New Jersey Corporation Business Tax Return State Of NJ?

The CBT 100 New Jersey Corporation Business Tax Return State Of NJ is a tax form that corporations operating in New Jersey must file annually. This form reports a corporation's income, losses, and deductions to determine the tax due to the state. Understanding how to complete this return accurately is crucial for compliance and to avoid penalties.

-

Why is it important to file the CBT 100 New Jersey Corporation Business Tax Return State Of NJ on time?

Filing the CBT 100 New Jersey Corporation Business Tax Return State Of NJ on time is essential to avoid late fees and interest penalties. Timely submission ensures that your corporation remains in good standing with the state and prevents potential audits. Plus, it contributes to your reputation as a responsible business.

-

What features does airSlate SignNow offer to help with the CBT 100 New Jersey Corporation Business Tax Return State Of NJ?

AirSlate SignNow offers an easy-to-use platform that allows businesses to send, eSign, and manage documents electronically, including tax forms like the CBT 100 New Jersey Corporation Business Tax Return State Of NJ. The platform streamlines the signing process, reducing the time and effort needed to complete essential filings.

-

What are the benefits of using airSlate SignNow for handling the CBT 100 New Jersey Corporation Business Tax Return State Of NJ?

Utilizing airSlate SignNow for the CBT 100 New Jersey Corporation Business Tax Return State Of NJ enhances efficiency and accuracy in document management. The platform minimizes errors by enabling electronic signatures, thereby accelerating the filing process. Additionally, it provides a secure way to store and share sensitive tax documents.

-

Are there any integrations available with airSlate SignNow for managing the CBT 100 New Jersey Corporation Business Tax Return State Of NJ?

Yes, airSlate SignNow offers various integrations with popular accounting and tax software. This allows for seamless data transfer when preparing the CBT 100 New Jersey Corporation Business Tax Return State Of NJ. By integrating your systems, you can streamline your workflow and reduce the chances of manual errors.

-

How does airSlate SignNow ensure my documents for the CBT 100 New Jersey Corporation Business Tax Return State Of NJ are secure?

AirSlate SignNow prioritizes the security of your documents through advanced encryption and secure cloud storage. This ensures that your sensitive information related to the CBT 100 New Jersey Corporation Business Tax Return State Of NJ is protected from unauthorized access. You can trust that your data remains confidential and safe.

-

What is the pricing structure for airSlate SignNow's services related to the CBT 100 New Jersey Corporation Business Tax Return State Of NJ?

AirSlate SignNow offers a flexible pricing structure based on the features and scale your business needs for handling documents like the CBT 100 New Jersey Corporation Business Tax Return State Of NJ. Their competitive pricing makes it an accessible solution for businesses of all sizes, ensuring you receive value while managing your tax documentation.

Get more for CBT 100 New Jersey Corporation Business Tax Return State Of NJ

Find out other CBT 100 New Jersey Corporation Business Tax Return State Of NJ

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney