Search and Pay Property Taxes Baltimore County Government Form

Understanding the Maryland Annual Report and Personal Property Return

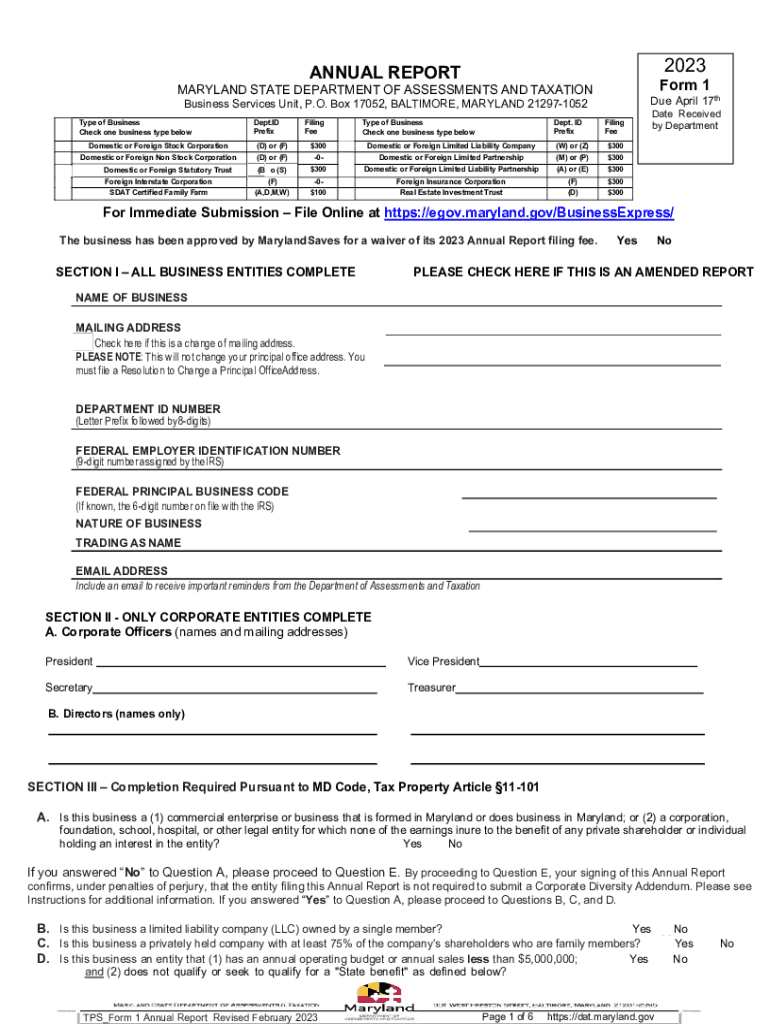

The Maryland annual report and personal property return is an essential document for businesses operating in the state. This form, often referred to as Maryland Form 1, is required for corporations, limited liability companies (LLCs), and partnerships. It provides the state with information about the business's financial status and personal property holdings. Filing this report is crucial for maintaining good standing with the Maryland State Department of Assessments and Taxation.

Steps to Complete the Maryland Annual Report Form 1

Completing the Maryland Form 1 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including balance sheets and income statements. Next, access the online filing system or obtain a paper form. Fill out the required sections, which include business identification, financial data, and personal property details. Review the completed form for any errors before submission. Finally, submit the form electronically or by mail, ensuring it is done before the filing deadline to avoid penalties.

Filing Deadlines for Maryland Form 1

Timely filing of the Maryland annual report is critical. The deadline for submission is April 15 each year for most businesses. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to file early to avoid any last-minute issues. Late submissions may incur penalties, which can affect the business's standing with the state.

Required Documents for Filing

When preparing to file the Maryland annual report, certain documents are necessary to ensure a smooth process. These include:

- Previous year’s financial statements

- Details of any changes in ownership or structure

- Personal property tax information

- Business identification number and contact information

Having these documents ready will streamline the filing process and help maintain compliance with state regulations.

Penalties for Non-Compliance

Failing to file the Maryland Form 1 by the deadline can lead to significant penalties. Businesses may incur fines and interest on any unpaid taxes. Additionally, non-compliance can result in the loss of good standing status, which may hinder future business operations, including obtaining loans or contracts. It is important for businesses to prioritize timely filing to avoid these repercussions.

Digital vs. Paper Version of the Form

Maryland offers both digital and paper versions of the annual report form. The digital version, available through the state’s online portal, allows for quicker processing and confirmation of submission. In contrast, the paper version requires mailing and may take longer to process. Businesses are encouraged to utilize the online option for efficiency and to reduce the risk of delays.

Quick guide on how to complete search and pay property taxes baltimore county government

Easily Prepare Search And Pay Property Taxes Baltimore County Government on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Search And Pay Property Taxes Baltimore County Government across any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related processes today.

How to Modify and eSign Search And Pay Property Taxes Baltimore County Government Effortlessly

- Locate Search And Pay Property Taxes Baltimore County Government and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Search And Pay Property Taxes Baltimore County Government and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the search and pay property taxes baltimore county government

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland annual report form 1?

The Maryland annual report form 1 is a mandatory filing for businesses that operate in Maryland, designed to keep the state informed of your business status. It includes essential information such as the entity's name, registered agent, and address. It is crucial for maintaining good standing with the Maryland state government.

-

How can I file my Maryland annual report form 1?

You can file your Maryland annual report form 1 online through the Maryland State Department of Assessments and Taxation website. Many businesses also opt for using services like airSlate SignNow to streamline the process, making it easier to eSign and submit documents efficiently.

-

What is the cost to file the Maryland annual report form 1?

The filing fee for the Maryland annual report form 1 varies depending on your business structure. Typically, the cost is around $300 for corporations, and $100 for limited liability companies (LLCs). Utilizing airSlate SignNow may reduce additional costs associated with document management and eSigning.

-

What are the benefits of using airSlate SignNow for my Maryland annual report form 1?

Using airSlate SignNow to handle your Maryland annual report form 1 provides a streamlined, efficient process that saves time and reduces errors. You can easily eSign documents, collaborate with team members, and securely store your filings. This helps ensure you meet deadlines and maintain compliance.

-

Is it necessary to update my Maryland annual report form 1 each year?

Yes, it is essential to update your Maryland annual report form 1 each year to reflect any changes in your business, such as new addresses, management changes, or alterations in your registered agent. Failing to update this form can lead to penalties and risk losing your business status in Maryland.

-

Can airSlate SignNow help with reminders for filing the Maryland annual report form 1?

Absolutely! airSlate SignNow can provide reminders for filing your Maryland annual report form 1, helping you stay on top of deadlines. This feature ensures that you won't miss critical filing dates, which is beneficial for maintaining good standing with the state.

-

What formats does the Maryland annual report form 1 need to be submitted in?

The Maryland annual report form 1 must be submitted electronically through the official filing site or in certain cases, via mail with original signatures. AirSlate SignNow enables you to create, eSign, and convert documents to the required formats, making it easy to comply with submission guidelines.

Get more for Search And Pay Property Taxes Baltimore County Government

- Authorization release of medical records information

- Temporary restraining order court form

- Formsnew hampshire judicial branch

- Health status report form

- F a a form 5100 109 project evaluation review and development analysis faa form 5100 109 faa

- Ia renewal activity record ia renewal form

- Ac43 9c form

- Subject guide for developing and form

Find out other Search And Pay Property Taxes Baltimore County Government

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT